3 Smart meter stocks with strong orderbook of up to ₹32,000 Cr to keep on your radar

The smart meter sector is witnessing a significant surge in demand, driven by the Indian government’s push for modernization and energy efficiency. Companies like Genus Power Infrastructures, HPL Electric and Power, and Adani Energy Solutions are at the forefront, boasting robust order books that collectively amount to Rs. 32,000 crore. Here are a few smart […] The post 3 Smart meter stocks with strong orderbook of up to ₹32,000 Cr to keep on your radar appeared first on Trade Brains.

The smart meter sector is witnessing a significant surge in demand, driven by the Indian government’s push for modernization and energy efficiency. Companies like Genus Power Infrastructures, HPL Electric and Power, and Adani Energy Solutions are at the forefront, boasting robust order books that collectively amount to Rs. 32,000 crore.

Here are a few smart meter stocks with a strong order book worth up to Rs. 32000 Cr

1. Genus Power Infrastructures Limited

With a market capitalization of Rs. 11,959.78 crores, Genus Power Infrastructures Limited’s share price closed at Rs. 393.60 per share, up by 2.37 percent from its previous close of Rs. 384.50.

Genus Power Infrastructures maintains a robust order book of INR 31,776 crores as of September 30, 2024, with concessions spanning 8-10 years. The company order covers 60% of the smart meter market.

Genus Power Infrastructures Limited’s revenue has increased from Rs. 259 crore in Q2 FY24 to Rs. 487 crore in Q2 FY25, which has grown by 88.03 percent. The net profit of Genus Power Infrastructures Limited has increased by 69.39 percent from Rs. 49 crore in Q2 FY24 to Rs. 83 crore in Q2 FY25.

Genus Power Infrastructures Limited was established in 1992 and is part of the Kailash Group. The company specializes in manufacturing metering solutions and providing turnkey engineering services. The company focuses on smart metering technologies, including electricity, gas, and water meters, alongside undertaking power transmission and distribution projects.

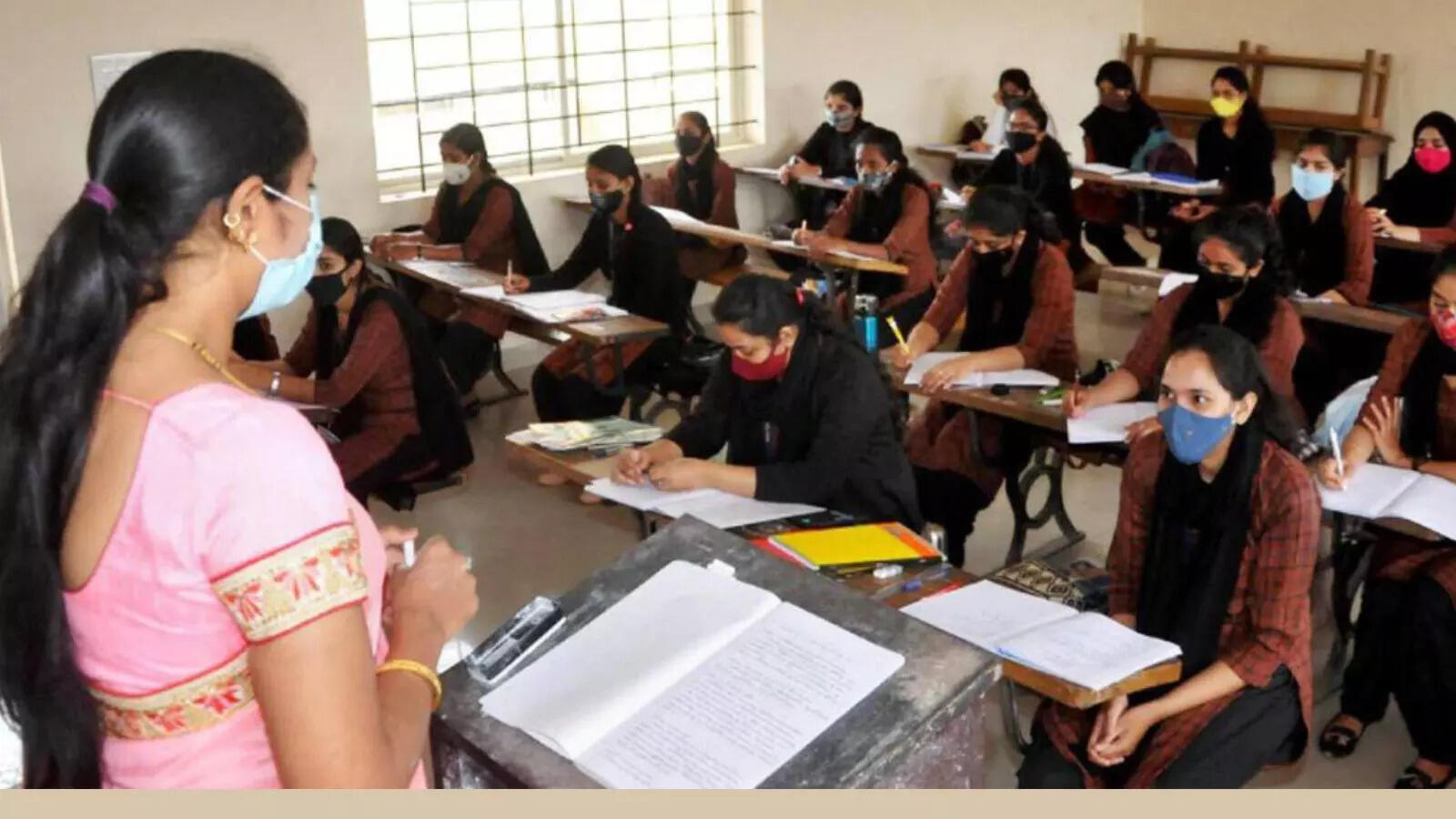

2. HPL Electric and Power Limited

With a market capitalization of Rs. 3,375.78 crores, HPL Electric and Power Limited’s share price closed at Rs. 525 per share, down by 1.44 percent from its previous close of Rs. 532.65

The company boasts a robust order book exceeding Rs. 3,500 crore as of November 9, 2024, ensuring short- to medium-term revenue visibility. Metering, Systems & Services dominate the order book at over 95%, with smart meters contributing more than 99%. Additionally, metering tenders worth Rs. 10,000 crore provide promising growth opportunities.

HPL Electric and Power Limited’s revenue has increased from Rs. 350 crore in Q2 FY24 to Rs. 422 crore in Q2 FY25, which has grown by 20.57 percent. The net profit of HPL Electric and Power Limited has dropped by 100 percent from Rs. 11 crore in Q2 FY24 to Rs. 22 crore in Q2 FY25.

HPL Electric and Power Limited was established in 1992 and is a prominent Indian manufacturer specializing in low-voltage electrical equipment. Based in Sonipat, the company produces a wide range of products including metering solutions, switchgears, lighting equipment, and wires and cables, serving both domestic and international markets.

Also read…

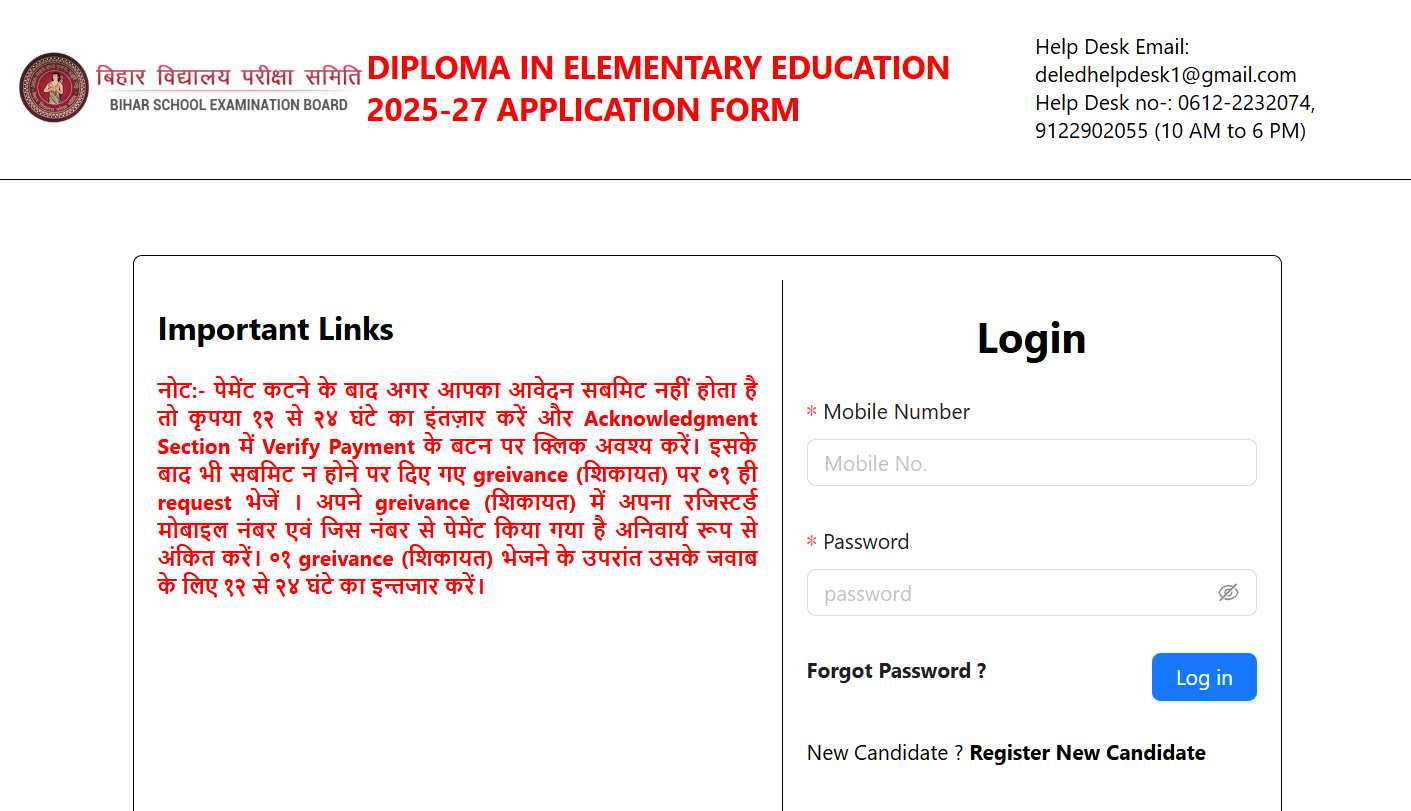

3. Adani Energy Solutions Limited

With a market capitalization of Rs. 87,651.59 crores, Adani Energy Solutions Limited’s share price closed at Rs. 729.65 per share, down by 2.91 percent from its previous close of Rs. 751.50.

The company has secured smart meter projects worth Rs. 27,000 crores across states like Maharashtra, Bihar, and Andhra Pradesh. Deployment will begin aggressively within 12–18 months, supported by partnerships with Esyasoft, Airtel, and others. A capex of Rs. 1,000-2,000 crores is planned for FY2025 to drive installation efforts.

Adani Energy Solutions Limited’s revenue has increased from Rs. 3,674 crore in Q2 FY24 to Rs. 6,184 crore in Q2 FY25, which has grown by 68.32 percent. The net profit of Adani Energy Solutions Limited has dropped by 172.18 percent from Rs. 284 crore in Q2 FY24 to Rs. 773 crore in Q2 FY25.

Adani Energy Solutions Limited was established in 2015 and is headquartered in Ahmedabad and is a leading power transmission company in India. It operates over 12,200 circuit kilometers, focusing on smart energy solutions and serving millions of consumers, particularly in Mumbai.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post 3 Smart meter stocks with strong orderbook of up to ₹32,000 Cr to keep on your radar appeared first on Trade Brains.

What's Your Reaction?