Bank stock crashes after FII sold stake worth over ₹500 Cr via bulk deal

The shares of the fastest-growing private-sector bank plummeted by 4 percent after a foreign institutional investor offloaded 50,86,943 equity shares via a bulk deal, for Rs 501.94 crore. Price Movement With a market capitalization of Rs 74,687.86 crore, the shares of IndusInd Bank Ltd were trading at Rs 958.00 per share, decreasing 3.13 percent as […] The post Bank stock crashes after FII sold stake worth over ₹500 Cr via bulk deal appeared first on Trade Brains.

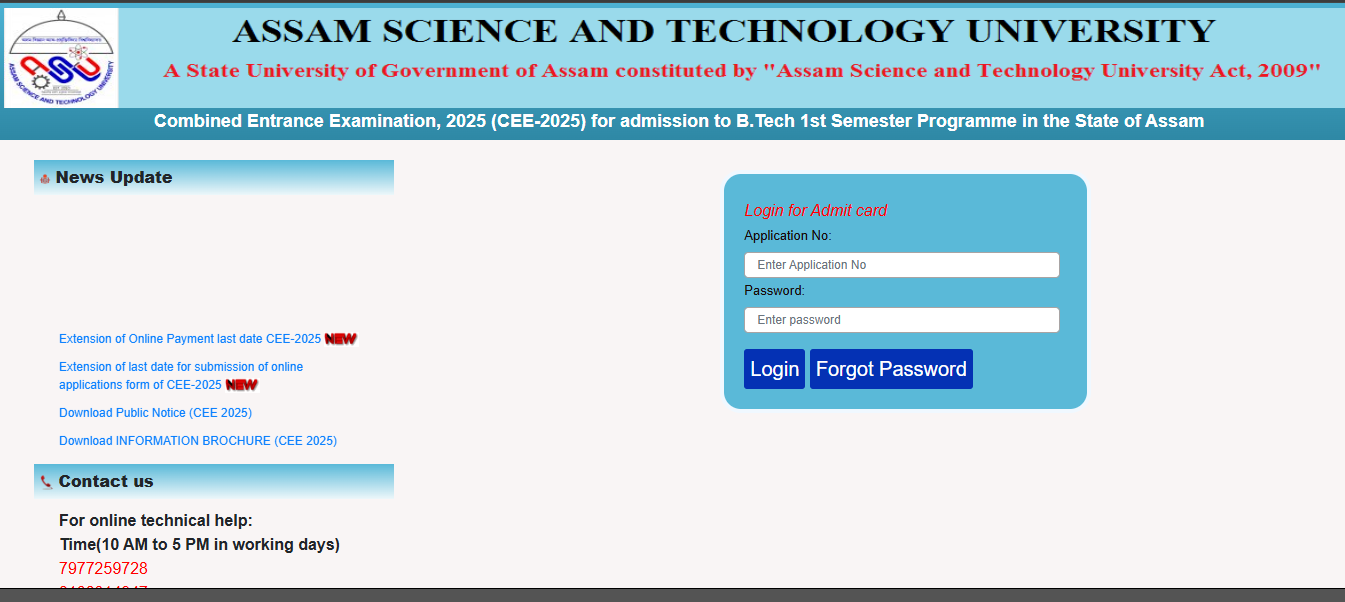

The shares of the fastest-growing private-sector bank plummeted by 4 percent after a foreign institutional investor offloaded 50,86,943 equity shares via a bulk deal, for Rs 501.94 crore.

Price Movement

With a market capitalization of Rs 74,687.86 crore, the shares of IndusInd Bank Ltd were trading at Rs 958.00 per share, decreasing 3.13 percent as compared to the previous closing price of Rs 988.95 apiece.

Reason for Rise

The shares of IndusInd Bank Ltd have seen bearish movement after a foreign institutional investor, Integrated Core Strategies (Asia) Pte, offloaded 50,86,943 equity shares, which is equivalent to 0.65 percent stake at the average price of Rs 986.74 per share via bulk deal. This transaction is valued at Rs 501.94 crore.

Financial performance

Examining the company’s financial condition, its revenue zoomed by 11 percent from Rs 11,572 crore in Q3FY24 to Rs 12,801 crore in Q3FY25, and during the same time frame, net profit plummeted by 39 percent from Rs 2,298 crore to Rs 1,401 crore.

Also read: Midcap stocks in focus after Motilal Oswal acquires stakes worth over ₹617 Cr in these companies

Business Segment Insights

The company reported 14 percent YoY retail deposit growth, with LCR retail deposits rising to 46.1 percent. Loans grew 12 percent YoY, driven by vehicle, microfinance, and corporate segments. New initiatives saw strong growth in NRI banking, merchant, and home loans. Asset quality remained stable despite higher microfinance slippages.

Digital Initiatives

The company is scaling its direct digital model, originating over 70,000 clients monthly. It launched the INDIE app, showing strong early adoption, and introduced INDIE for Business, attracting 10,000+ users within a month, reinforcing its commitment to digital expansion and customer engagement.

Challenges and Outlook

The company maintains a cautious outlook on the microfinance segment, expecting elevated slippages in Q4. It prioritizes asset quality and capital adequacy amid regulatory changes while remaining optimistic about growth in core domains and recovering retail loan shares.

Company Snapshot

IndusInd Bank Limited (the Bank) is engaged in providing financial services. The Bank offers a wide range of products and services for individuals and corporates, including microfinance, personal loans, personal and commercial vehicle loans, credit cards, and small to medium enterprise (SME) loans.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Bank stock crashes after FII sold stake worth over ₹500 Cr via bulk deal appeared first on Trade Brains.

What's Your Reaction?