Data center stock jumps 5% after reporting 31% YoY increase in PAT

Synopsis: Anant Raj shares jumped 5% after reporting strong Q3 FY26 results, with 20% revenue growth and 31% YoY PAT growth, supported by real estate project milestones and data centre expansion plans. The shares of this company, which is primarily engaged in the development and construction of IT parks, hospitality projects, SEZs, office complexes, shopping […] The post Data center stock jumps 5% after reporting 31% YoY increase in PAT appeared first on Trade Brains.

Synopsis: Anant Raj shares jumped 5% after reporting strong Q3 FY26 results, with 20% revenue growth and 31% YoY PAT growth, supported by real estate project milestones and data centre expansion plans.

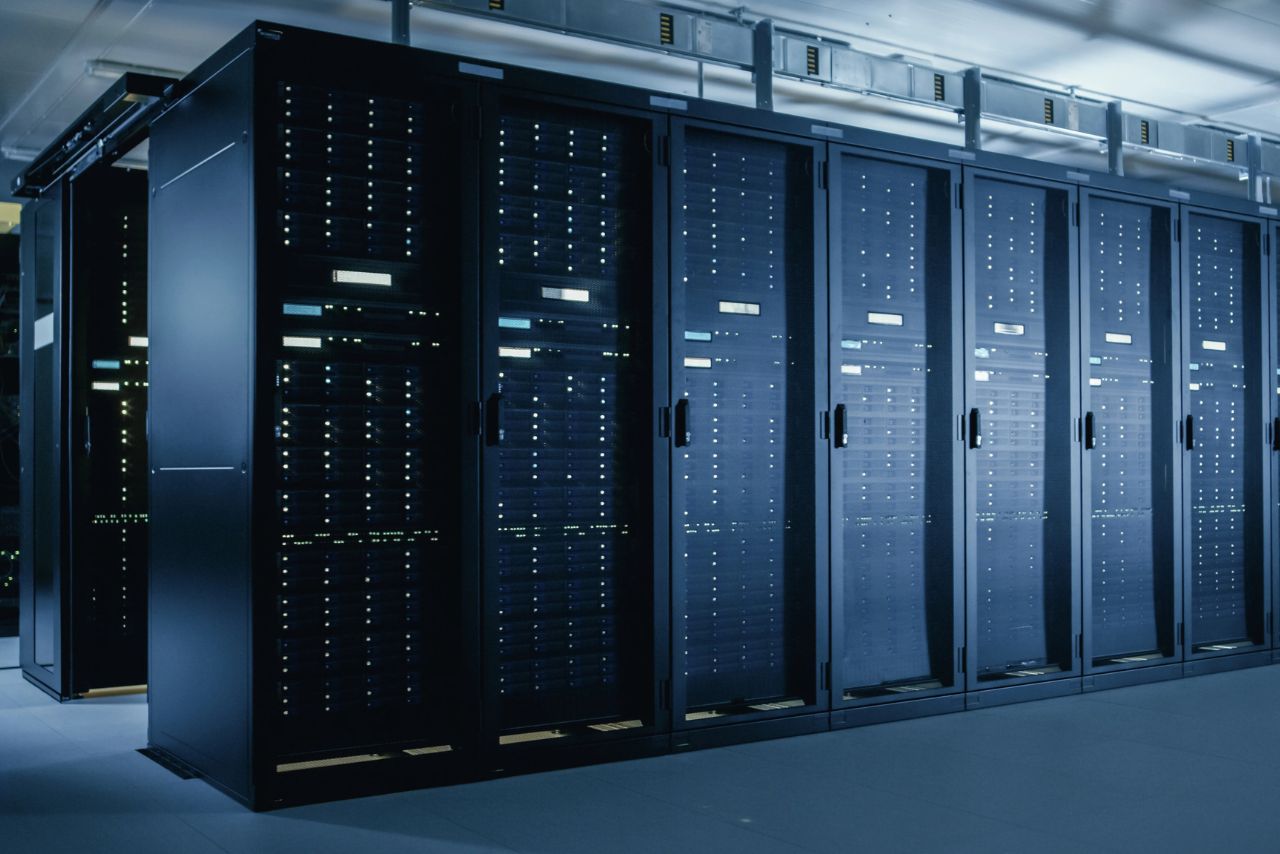

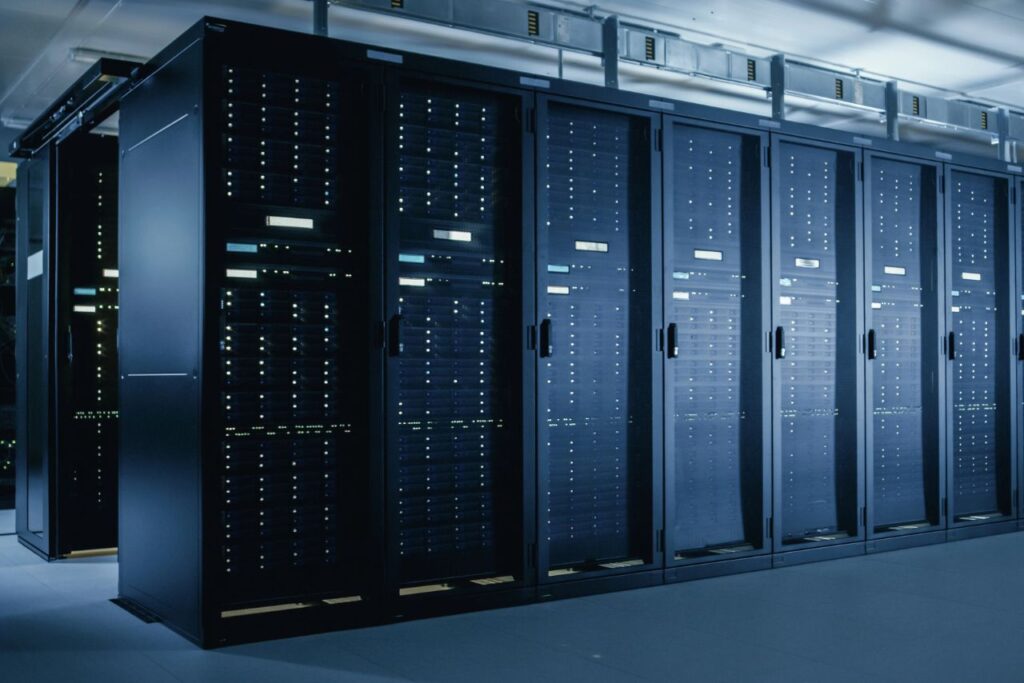

The shares of this company, which is primarily engaged in the development and construction of IT parks, hospitality projects, SEZs, office complexes, shopping malls and residential projects in the several states of India and mainly functions in the real estate and data centre business, had its shares in the news following the robust Q3 results with 31% PAT growth and growth in several other operations.

With the market cap of Rs 19,149 crore, the shares of Anant Raj Ltd gained about 5% and made a high at Rs 547.30, compared to its previous day closing price of Rs 521.15, and are trading at a PE of 36.5, whereas its industry PE is at 30.7. The shares have given a return of more than 1,200% over the last 5 years.

Q3 FY26 Result highlights

The revenue from operations for the company stood at Rs 642 crore when compared to Rs 535 crore in Q3 FY25, up by about 20 per cent on a YoY basis and on a QoQ basis up by 2 per cent from Rs 631 crore in Q2 FY26.

When it comes to profitability, the company has gone from an Rs 110 crore profit in Q3 FY25 to an Rs 144 crore profit in Q3 FY26, up 31% YoY, and from Rs 138 crore in Q2 FY26, up about 4.3% QoQ.

The updates on the realty side of Anant Raj are showing high visibility on growth plans in the medium term with several high-ticket projects lined up on key milestones soon. The rollout of “The Estate One”, an upscale high-rise residential project with approximately 1.09 million sq. ft. of saleable area, planned to be launched in Q4 FY26 in Gurugram, holds high merit for the company to benefit from high-end housing demand.

Project Navya, a 50:50 JV with Birla Estate, soon to start with Phase 2 deliveries in Q4 FY26, has already received an occupancy certificate. The upcoming approval for an additional 9.12 acres in Phase V of Anant Raj Estate further reinforces the company’s future land bank in the fast-developing Golf Course Extension Road micro-market in Gurugram.

This is a strategic move that improves the future township potential and scalability for residential development in the company. This is a move that will ensure a healthy project pipeline and help to reinforce the company as a major player in the Gurugram premium real estate market.

Apart from the realty business, Anant Raj’s move into data centres and cloud solutions represents a significant diversification push into an exciting and rapidly growing digital infrastructure opportunity area. With the enhancement of its Ashok Cloud operations in both Manesar and Panchkula, which is expected to become operational in Q4 FY26, and its further agreement with the Andhra Pradesh Government for 50 MW of IT load in a memorandum of understanding, the company’s planned capacity in the data centre business now expands to 357 MW of IT load, 117 MW of which would become operational in FY28.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Data center stock jumps 5% after reporting 31% YoY increase in PAT appeared first on Trade Brains.

What's Your Reaction?