Defence stock jumps 3% after signing ₹6,084 Cr contract with Ministry of Defence

The shares of the industrial explosives manufacturer gained up to 3 percent after the company inked a prestigious contract with the Ministry of Defence for Rs 6,084. Price movement With a market capitalization of Rs 81,739.67 crore, the shares of Solar Industries India Ltd were trading at Rs 9,033.00 per share, increasing around 0.96 percent […] The post Defence stock jumps 3% after signing ₹6,084 Cr contract with Ministry of Defence appeared first on Trade Brains.

The shares of the industrial explosives manufacturer gained up to 3 percent after the company inked a prestigious contract with the Ministry of Defence for Rs 6,084.

Price movement

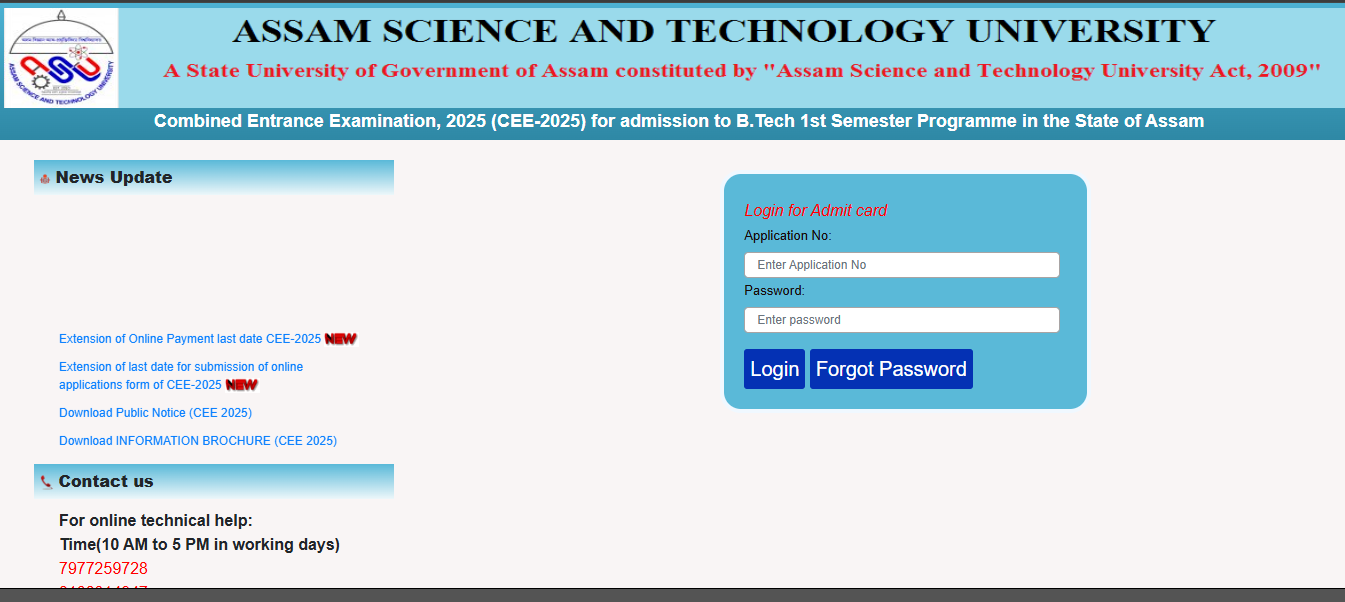

With a market capitalization of Rs 81,739.67 crore, the shares of Solar Industries India Ltd were trading at Rs 9,033.00 per share, increasing around 0.96 percent as compared to the previous closing price of Rs 9,120.15 apiece.

Reason for rise

The shares of Solar Industries India Ltd have seen positive movement after its wholly owned subsidiary Economic Explosive Limited (EEL), inked a prestigious contract with the Ministry of Defence for the procurement of Area Denial Munition (ADM) Type-1 (DPICM) and High Explosive Pre Fragmented (HEPF) Mk-1 (Enhanced) rockets respectively for PINAKA Multiple Launcher Rocket System (MLRS) worth Rs 6,084 crore, the biggest contract in the history of Solar Group.

Additionally, DRDO has nominated Economic Explosives Limited (EEL) as the production agency for all variations of the Pinaka Rocket System. This contract will boost defence product revenue, create new opportunities, and strengthen EEL’s position in Indigenous defense manufacturing.

Financial performance

Looking forward to the company’s financial performance, revenue increased by 19 percent from Rs 1,429 crore in Q3FY24 to Rs 1,973 crore in Q3Y25. During the same period, net profit increased 52 percent from Rs 222 crore to Rs 338 crore.

Defence Segment Growth

Defence revenue surged 204% YoY from Rs. 106 crores to Rs. 322 crores. The company targets Rs.1,500 crores in defense sales for FY25, comprising 20 percent of total sales. Recent orders include Rs. 887 crores from Singareni Collieries and Rs.1,110 crores in defense, pushing the order book past Rs.5,700 crores.

Also read…..

Capex Guidance

The company has revised its FY ’25 Capex guidance upward from Rs.800 crores to Rs.1,200 crores, reflecting strong order inflow and growth opportunities. This significant increase highlights its commitment to expanding capacity and capitalizing on emerging market demands.

Market Overview

Market dynamics saw subdued demand in H1 due to elections and heavy monsoons affecting mining and infrastructure. However, strong international business and defense segment performance offset these challenges, driving overall growth despite initial headwinds.

International Business

International business generated Rs. 799 crores, strengthening operations in South Africa via Problast. Nigeria and Turkey showed a positive turnaround with improved performance and margins.

Margin Guidance and Future Outlook

Management is optimistic about sustaining EBITDA margins above 25 percent, driven by operational efficiencies and growth in defense and international segments. Upcoming Pinaka orders and export potential, along with strong government focus on infrastructure and rising power demand, are expected to support long-term growth.

Company snapshot

Solar Industries India Limited is an India-based integrated global explosives company. The Company is primarily involved in the manufacturing of a complete range of industrial explosives and explosive-initiating devices. Its segment is Explosives and its accessories.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Defence stock jumps 3% after signing ₹6,084 Cr contract with Ministry of Defence appeared first on Trade Brains.

What's Your Reaction?