FMCG stock is in focus after Cag-Tech likely to acquire 4.99% stake in the company

Synopsis: The company gained investor traction after it reported buying of shares by Cag-tech ltd, amounting to Rs. 1.3 billion in cash consideration. The shares of this company which is primarily engaged in the business of manufacturing and trading of edible oils and food products are in focus after Cag-tech’s bulk deal. With the market […] The post FMCG stock is in focus after Cag-Tech likely to acquire 4.99% stake in the company appeared first on Trade Brains.

Synopsis: The company gained investor traction after it reported buying of shares by Cag-tech ltd, amounting to Rs. 1.3 billion in cash consideration.

The shares of this company which is primarily engaged in the business of manufacturing and trading of edible oils and food products are in focus after Cag-tech’s bulk deal.

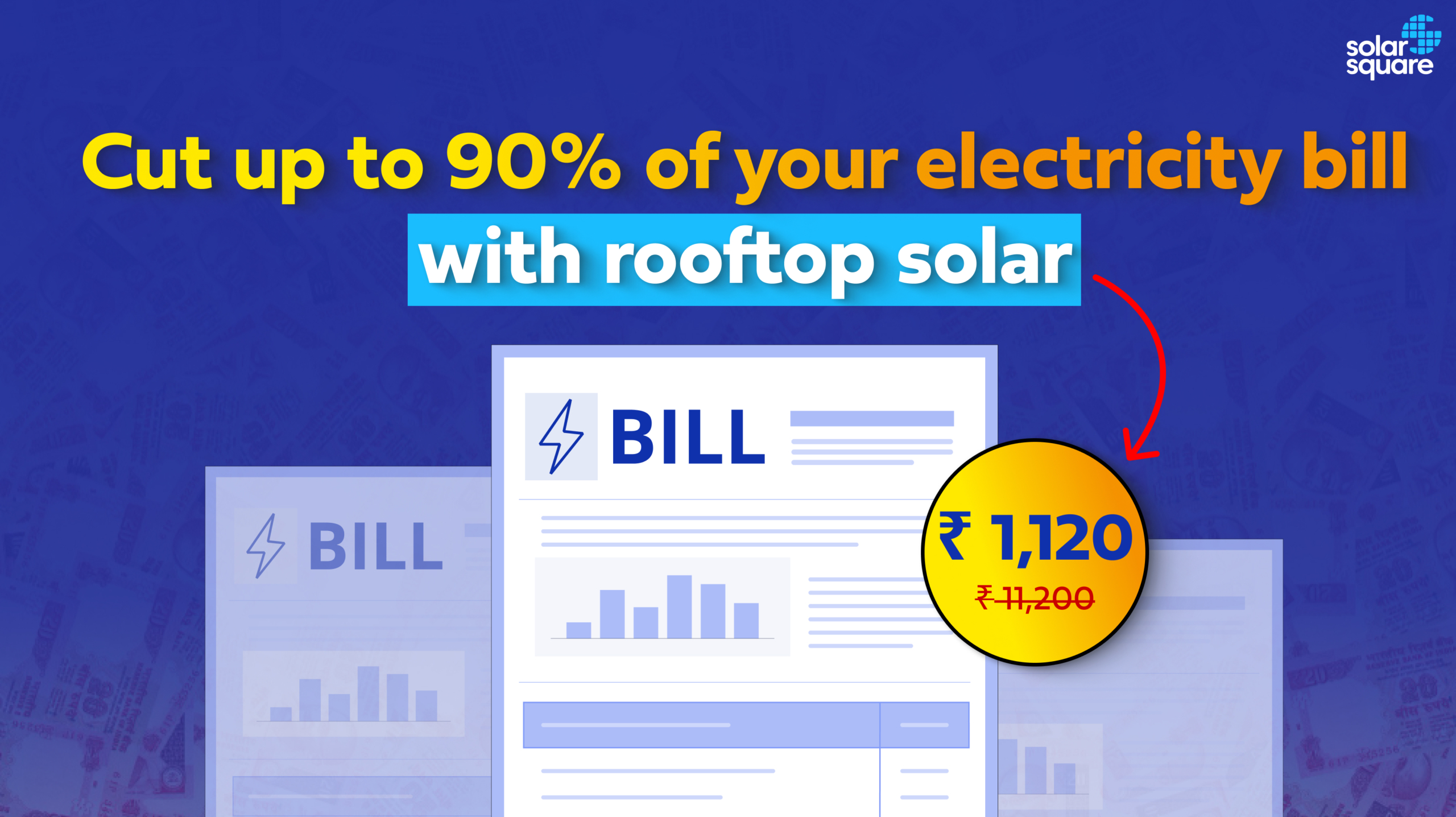

With the market capitalization of Rs. 2,684.02 crore, Sundrop Brands Ltd’s share on Thursday made a day high of Rs. 715.25 per share, down by 0.09 percent from its previous day’s close price of Rs. 715.90 per share. It has delivered a negative return of 5.92 percent over a period of five years.

Corporate Action

DMPL India limited is selling its 4.99 percent stake of Sundrop Brand Limited through a purchase agreement with Cag-Tech (Mauritius) Limited for Rs. 1.3 billion, i.e. a cash consideration valued at Rs. 715 per share.

The acquisition deal is subject to a few conditions: Delivery of a section 281 Income Tax Act (India) report, Delivery of a tax opinion issued by a major accounting firm, evidence of respective corporate authorisations and Regulatory pre-clearance under Indian insider-trading rules & approvals by SGX.

About the company

Sundrop Brands Limited (formerly known as Agro Tech Foods Limited) is a public Limited company, engaged in the business of manufacturing, marketing and selling of a wide range of Food Products and Edible Oils. The food categories in which the Company competes includes Ready to Cook Snacks , Ready to Eat snacks, Spreads & Dips, Breakfast Cereals and Chocolate Confectionery.

This purchase agreement will change the Shareholding Pattern of the company, which stood as 33.92 percent held by promoters, 60 percent by public and the rest by institutions like DIIs and FIIs.

Financial highlights, revenue from operations grew by 86 percent to Rs. 383 crore in Q2 FY26 from Rs. 206 crore in Q2 FY25. Accompanied by a decline in EBDIT by 36 percent to Rs. 3.92 crore YoY and losses of Rs. 2.09 crore in Q2 FY26.

Written by Gourav Pratap Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post FMCG stock is in focus after Cag-Tech likely to acquire 4.99% stake in the company appeared first on Trade Brains.

What's Your Reaction?