FMCG stocks in India are reviving after muted 2025, setting up a selective recovery in 2026

Synopsis: India’s FMCG sector is recovering from a slowdown in the last year, supported by improving consumer sentiment, easing inflation, policy support, and a pickup in urban and rural demand. India’s FMCG sector remains one of the strongest consumption-driven growth stories globally, supported by rising incomes, favourable demographics, rapid premiumisation, and deeper digital and distribution […] The post FMCG stocks in India are reviving after muted 2025, setting up a selective recovery in 2026 appeared first on Trade Brains.

Synopsis: India’s FMCG sector is recovering from a slowdown in the last year, supported by improving consumer sentiment, easing inflation, policy support, and a pickup in urban and rural demand.

India’s FMCG sector remains one of the strongest consumption-driven growth stories globally, supported by rising incomes, favourable demographics, rapid premiumisation, and deeper digital and distribution penetration. The overall FMCG market, valued at US$ 245.4 billion in 2024, is projected to expand sharply to US$ 615.8 billion by 2027, implying a strong 27.9% CAGR over 2021–27.

Growth is broad-based across key segments. Personal and household care continues to benefit from higher hygiene awareness and premium consumption, with the beauty and personal care market at US$ 16.8 billion, growing at around 11% CAGR, led by skincare and premium products. India’s food processing market reached US$ 307.2 billion in 2022 and is projected to expand to US$ 470 billion by 2028, translating into a 9-10% CAGR.

The alcoholic beverages industry is seeing steady 8-10% revenue growth, supported by premiumisation and urban demand recovery, with revenues expected to reach US$ 61.97 billion by FY26. Meanwhile, non-alcoholic beverages are expanding at a faster pace, with the market at US$ 28 billion in 2024, growing at 15% CAGR, led by ready-to-drink products that account for nearly 70% of the segment and are growing at a faster CAGR of 18%. Overall, sustained consumption growth, premiumisation, and evolving consumer preferences position the Indian FMCG industry for durable, multi-year expansion.

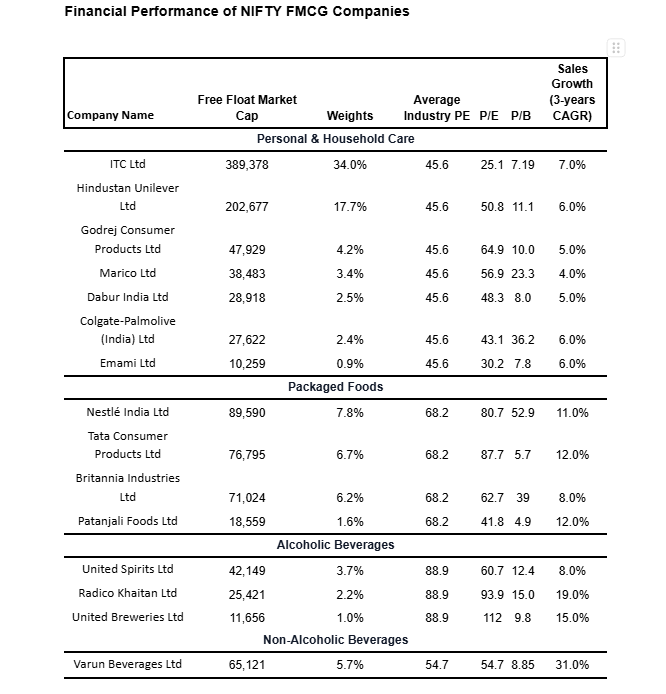

Financial Performance of NIFTY FMCG Companies

Nifty FMCG Index Stocks Constituents

- ITC Ltd offers a diverse portfolio of fast-moving consumer goods (FMCG), including food products like Aashirvaad atta, Sunfeast biscuits, and Bingo! snacks, alongside personal care items under brands such as Fiama and Engage, cigarettes, and stationery via Classmate. The company also operates in hotels, agribusiness (wheat and coffee trading), paperboards, and IT services through ITC Infotech. Notably, the regulatory environment for cigarettes remains stringent, with a 40% GST and an excise duty of Rs 2,050-Rs 8,500 per 1,000 sticks, linked to cigarette length, effective from 1 February 2026.

- Hindustan Unilever Ltd provides a wide range of FMCG products focused on personal care (soaps like Lifebuoy and shampoos like Dove), home care (detergents like Surf Excel), and foods (Knorr soups and Brooke Bond tea). Its offerings emphasise hygiene, nutrition, and household essentials for daily consumer needs.

- Nestlé India Ltd offers packaged foods and beverages, including Maggi noodles, Nescafe coffee, KitKat chocolates, Cerelac infant nutrition, and dairy like Everyday milk, catering to convenience foods and nutrition.

- Tata Consumer Products Ltd provides teas (Tata Tea, Tetley), coffee (Tata Coffee), packaged foods (Samara noodles), salt (Tata Salt), and beverages, blending traditional Indian staples with premium wellness options.

- Britannia Industries Ltd specialises in biscuits (Good Day, Marie Gold), bread, cakes, and dairy products and is known for baked goods that emphasise nutrition, taste, and everyday snacking.

- Varun Beverages Ltd is the primary bottler for PepsiCo products in India, offering carbonated soft drinks (Pepsi, 7UP, and Mirinda), juices (Tropicana), and snacks (Lay’s, Kurkure) through its franchise network.

- Godrej Consumer Products Ltd specialises in personal and home care products, including soaps (Cinthol), hair colours (Nye), household insecticides (Goodknight), and beauty items under brands like Godrej No.1. It targets affordable hygiene and wellness solutions primarily in emerging markets.

- United Spirits Ltd produces a range of alcoholic beverages, including whisky (McDowell’s No.1, Royal Challenge), vodka (Smirnoff), rum (Bagpiper), and premium brands like Johnnie Walker and Black Dog.

- Marico Ltd focuses on hair care (Parachute coconut oil, Saffola shampoo), skin care, and wellness products (Saffola edible oils, Livon serums), with a strong presence in natural and Ayurvedic formulations for personal grooming.

- Dabur India Ltd delivers Ayurvedic and natural health care products such as Chyawanprash, Hajmola digestive aids, Real juices, and Fem personal care items, emphasising herbal wellness and oral care (Red toothpaste).

- Colgate-Palmolive (India) Ltd primarily offers oral care products like Colgate toothpastes and toothbrushes, alongside personal care items including soaps and home care solutions, dominating the toothbrush and toothpaste segments.

- Radico Khaitan Ltd manufactures Indian Made Foreign Liquor (IMFL) like 8PM whisky, Contessa rum, and Rampur single malt, alongside grain alcohol and premium spirits for domestic and export markets.

- Patanjali Foods Ltd offers edible oils (Nutrela), wheat flour, juices, and dairy under the Patanjali Ayurved umbrella, focusing on natural, affordable staples rooted in Ayurvedic principles.

- United Breweries Ltd brews beers such as Kingfisher (lager, strong), Heineken, and craft options, dominating the Indian beer market with a focus on premium and mass-market alcoholic beverages.

- Emami Ltd produces Ayurvedic personal care products such as Navratna cool oil, Zandu balms, and skincare under brands like Fair and Handsome (now Emami 7 Oils), focusing on affordable herbal remedies for hair, skin, and pain relief.

Macroeconomic Factors Impacting FMCG in 2025

GST Success Stories in FMCG

GST reforms, particularly GST 2.0 implemented from September 2025, have significantly benefited India’s FMCG industry by slashing rates on essentials from 18% to 5%, spurring consumption-led growth with a projected Rs 1 lakh crore net gain in spending, lower prices, and 20-30% volume increases in mass categories. In Personal & Household Care, the GST cut from 18% to 5% prompted P&G and Unilever to pass full benefits via price drops, boosting festive sales volumes.

Packaged Foods saw GST reduced to 5% on snacks, chocolates, sauces, juices, and coffee, with 22-58% of consumers confirming full/partial price benefits and rural demand surging. Alcoholic Beverages gained indirectly through Extra Neutral Alcohol (ENA) exemption from November 2024 and 5% rates on transport/job work, eliminating tax-on-tax burdens, simplifying logistics, and improving cost efficiency. Non-alcoholic beverages: introducing a high 40% GST rate for sugary, carbonated, and caffeinated drinks while reducing rates for healthier alternatives to 5%.

Real GDP Growth Rate

India has shown a cyclical recovery in real GDP growth, rising from 6.4% in Q3 FY25 to a peak of 8.2% in Q2 FY26, driven by improving economic momentum. Further, RBI projected real GDP growth to moderate to around 7.0% in Q3 FY26 and 6.5% in Q4 FY26, reflecting base effects and normalising momentum. Growth is then projected to stabilise in the first half of FY27 at 6.7% in Q1 FY27 and 6.8% in Q2 FY27, supported by resilient domestic demand and steady investment activity.

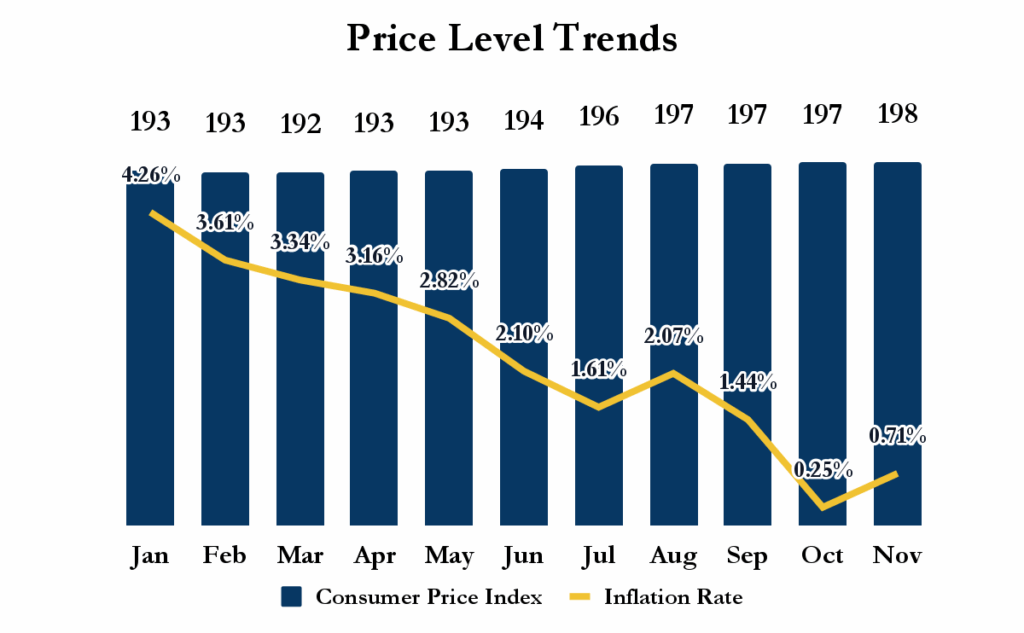

Inflation trend

The Consumer Price Index (CPI) data shows a clear declining inflation trend through 2025, with the CPI rising from 193.4 in January to 197.9 in November. Correspondingly, the inflation rate eased sharply from 4.26% in January to 0.71% in November, reflecting cooling price pressures across the economy, likely supported by stable commodity prices, currency stability, and moderate demand growth.

RBI Rate cut expected to Boost Consumption

The repo rate trajectory reflects a neutral monetary policy stance, with calibrated rate cuts from 6.50% in January to 5.25% by December. RBI has balanced growth support with inflation control, easing rates gradually and maintaining stability around 5.50% for most of the year to avoid disrupting macroeconomic conditions.

Rupee Depreciation Threatens Import Costs

The Indian rupee depreciated around 4.55% against the USD in 2025, starting near 85.58 INR/USD in January and hitting a record high of 90.95 INR/USD by mid-December. This was driven by limited intervention from the RBI in forex markets, a delayed trade deal between India and the US that continued to dampen market sentiments, persistent foreign fund outflows, and a relatively strong US dollar, which put continuous pressure on the currency.

A weaker rupee raises the cost of imported inputs for FMCG companies because key raw materials and commodity derivatives are bought in dollars. FMCG firms may see input costs increase by about 5-7% as palm oil is their raw material cost. Analysts suggest that a sustained decline in the rupee could lead to a 6-8% rise in raw material costs, squeezing profit margins if companies cannot fully pass these costs onto consumers.

Consumer Sentiments

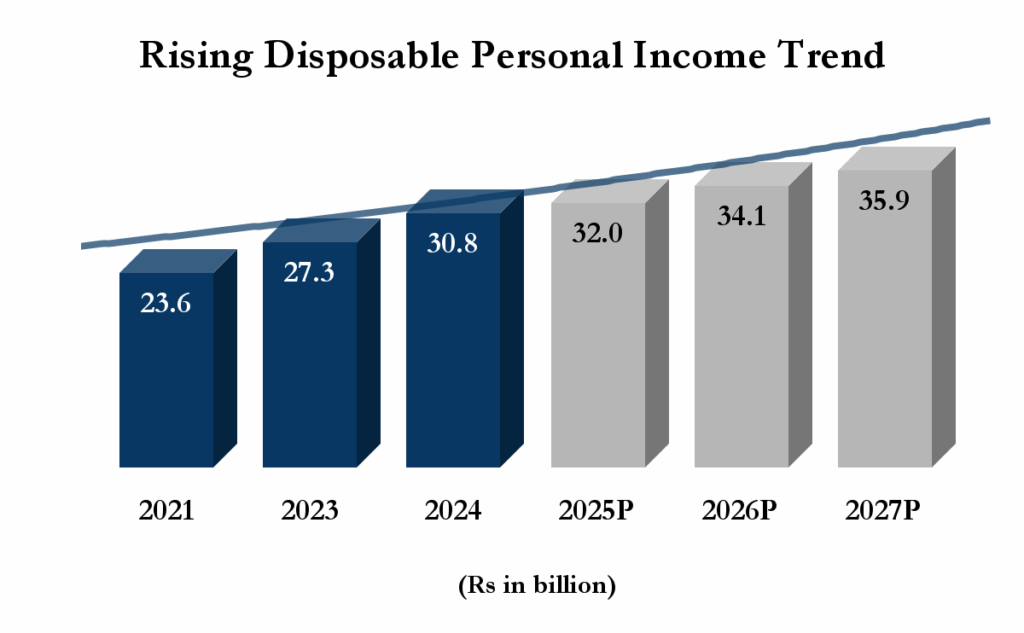

The consumer confidence index shows a steady improvement through 2025, rising from 93.7 in January to 98.4 by November. This gradual uptick indicates strengthening consumer sentiment, supported by stable inflation, improving income expectations, and resilient domestic demand.

Disposable personal income has shown a strong upward trend, increasing from 23.6 in 2021 to 30.8 in 2024, reflecting rising wages and economic recovery. It is projected to grow further to 32.0 in 2025, 34.1 in 2026, and 35.9 in 2027, indicating sustained improvement in household purchasing power.

Performance Comparison: Nifty 50 vs Nifty FMCG vs Nifty India Consumption Index

The performance comparison shows mixed trends across indices, highlighting selective strength within consumption themes despite near-term FMCG weakness. Over 1 month, the Nifty 50 gained 0.84%, while Nifty FMCG declined 0.50% and Nifty India Consumption fell 1.12%, reflecting FMCG’s underperformance against modest gains in the broader market.

Over 6 months, consumption stocks outperformed, with Nifty India Consumption rising 6.06%, compared to Nifty 50’s 4.83% and Nifty FMCG’s 1.76%. Over the 1-year horizon, the Nifty 50 delivered 10.20%, Nifty India Consumption rose 8.96%, and Nifty FMCG slipped 1.10%, underscoring the relative strength of broader consumption themes while FMCG lagged. The Indian FMCG sector underperformed YTD 2025 due to high inflation squeezing margins, an urban demand slowdown shifting consumers to cheaper packs, and elevated valuations (Nifty FMCG at 40.71x vs. Nifty 50’s 22.81x) triggering corrections.

Analyst Opinion

India’s FMCG sector is expected to sustain high single-digit volume growth in 2026, driven by stronger urban demand and improving rural consumption. Stabilising input costs and easing commodity inflation is supporting margin expansion, while prudent pricing, product mix optimisation, and cost management should bolster profitability. With GDP growth projected at 6.7-6.8% in H1 FY27, steady demand across essential and discretionary categories underpins cautious optimism for a selective recovery and stronger earnings momentum.

Overall, the FMCG sector is recovering from the muted 2025 performance. India’s FMCG and beverage sector is heading into FY26-FY27 with a positive growth outlook. Overall, industry sentiment remains constructive with growth visibility across categories.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post FMCG stocks in India are reviving after muted 2025, setting up a selective recovery in 2026 appeared first on Trade Brains.

What's Your Reaction?