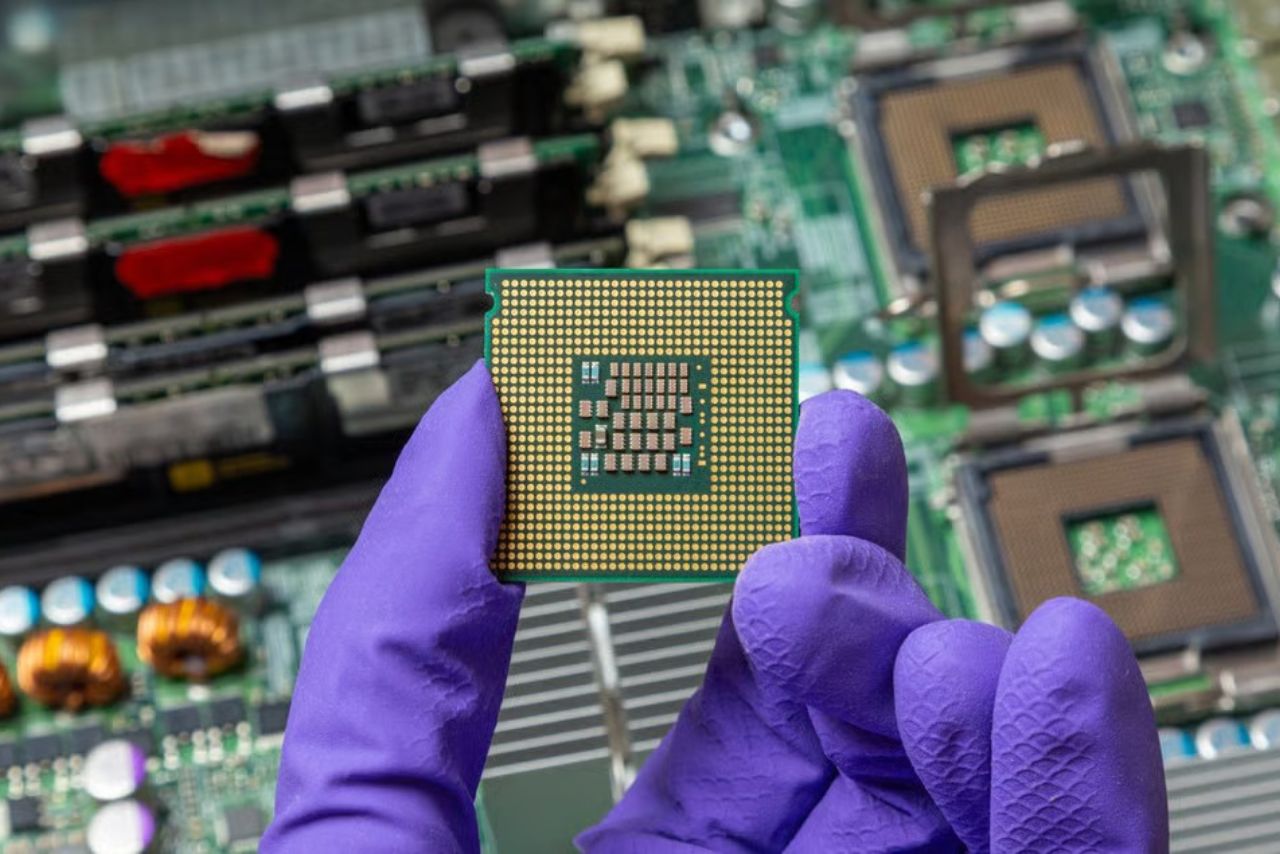

French Semiconductor Firm Plans to Buy 100,000 Bitcoin by 2030 After $200M Raise

Synopsis– French semiconductor company Sequans Communications has announced one of the boldest treasury strategies in the corporate world. The chipmaker has filed for a $200 million at-the-market (ATM) equity offering to expand its Bitcoin reserves, with a long-term goal of accumulating 100,000 BTC by 2030. Currently, Sequans holds 3,171 BTC worth about $349 million, making […] The post French Semiconductor Firm Plans to Buy 100,000 Bitcoin by 2030 After $200M Raise appeared first on Trade Brains.

Synopsis– French semiconductor company Sequans Communications has announced one of the boldest treasury strategies in the corporate world. The chipmaker has filed for a $200 million at-the-market (ATM) equity offering to expand its Bitcoin reserves, with a long-term goal of accumulating 100,000 BTC by 2030.

Currently, Sequans holds 3,171 BTC worth about $349 million, making it the second-largest corporate Bitcoin holder in Europe. The company’s decision highlights the rapid growth of Bitcoin adoption among listed firms that see cryptocurrency as both an inflation hedge and a long-term value store.

$200 Million Equity Plan

Sequans confirmed on Monday that the ATM equity program will allow the company to issue American Depositary Shares (ADSs) at its discretion. Each ADS represents ten ordinary shares and is traded in U.S. dollars on major stock exchanges. CEO Georges Karam explained that the proceeds will “optimise its treasury, increase Bitcoin per share, and deliver long-term value to investors.” The company stressed that the timing and size of each issuance will depend on market conditions.

At the current Bitcoin price of about $110,000, Sequans’ raise could secure 1,814 BTC. This purchase would raise its total holdings to nearly 5,000 BTC, bringing it close to Semler Scientific’s corporate Bitcoin treasury.

Building a Digital Reserve

Sequans’ Bitcoin journey began in June when it unveiled its strategy of using cryptocurrency as a core treasury asset. That move aligned with tech giants like MicroStrategy and Tesla, which have also embedded Bitcoin into their balance sheets. The company is now placing Bitcoin at the centre of its financial planning. Management intends to layer acquisitions over time, using equity raises, cash from operations, and intellectual property monetisation to reach its ambitious 100,000 BTC goal.

The phased plan stretches to 2030. In the near term, Sequans will rely on equity offerings, such as the $200 million program, to establish a stronger foundation. From 2026, the company wants to speed up purchases with Bitcoin-backed credit instruments while protecting shareholders against heavy dilution. By 2027, it aims to optimise the mix of financing, turning Bitcoin into a more stable reserve asset.

Bitcoin Pullback Opens a Buying Window

Sequans’ timing comes amid a temporary pullback in Bitcoin’s price. The cryptocurrency, which hit an all-time high of $124,517 on August 14, has since fallen 11.6% to about $110,000. Other corporate treasury holders are also “buying the dip”. MicroStrategy scooped up 3,081 BTC this week, bringing its total to over 632,000 BTC. Meanwhile, Japan’s Metaplanet started its week with an additional 103 BTC purchase.

This broader trend underscores growing confidence in Bitcoin as a resilient asset class, even during volatile downturns. However, there is risk. Equity-funded acquisitions tie company value to Bitcoin’s price swings, increasing liquidity and valuation pressure if markets turn sharply.

Competing With Ether Treasury Adoption

While Bitcoin remains the most widely held corporate cryptocurrency, Ethereum is rapidly gaining adoption. Companies like BitMine Immersion Technologies, SharpLink, and The Ether Machine have built multibillion-dollar ETH treasuries.

In fact, ETH’s price has surged 198% since April, strengthening its position as a competitive digital reserve. Some analysts suggest that this dual growth of Bitcoin and Ethereum reflects a structural shift in corporate finance.

Still, Sequans remains focused squarely on Bitcoin. Its leadership insists the strategy is not speculative but a disciplined approach to building financial resilience over time. By avoiding diversification into Ethereum or other tokens, Sequans is signalling confidence in Bitcoin’s role as the ultimate digital store of value.

Written By Fazal Ul Vahab C H

The post French Semiconductor Firm Plans to Buy 100,000 Bitcoin by 2030 After $200M Raise appeared first on Trade Brains.

What's Your Reaction?