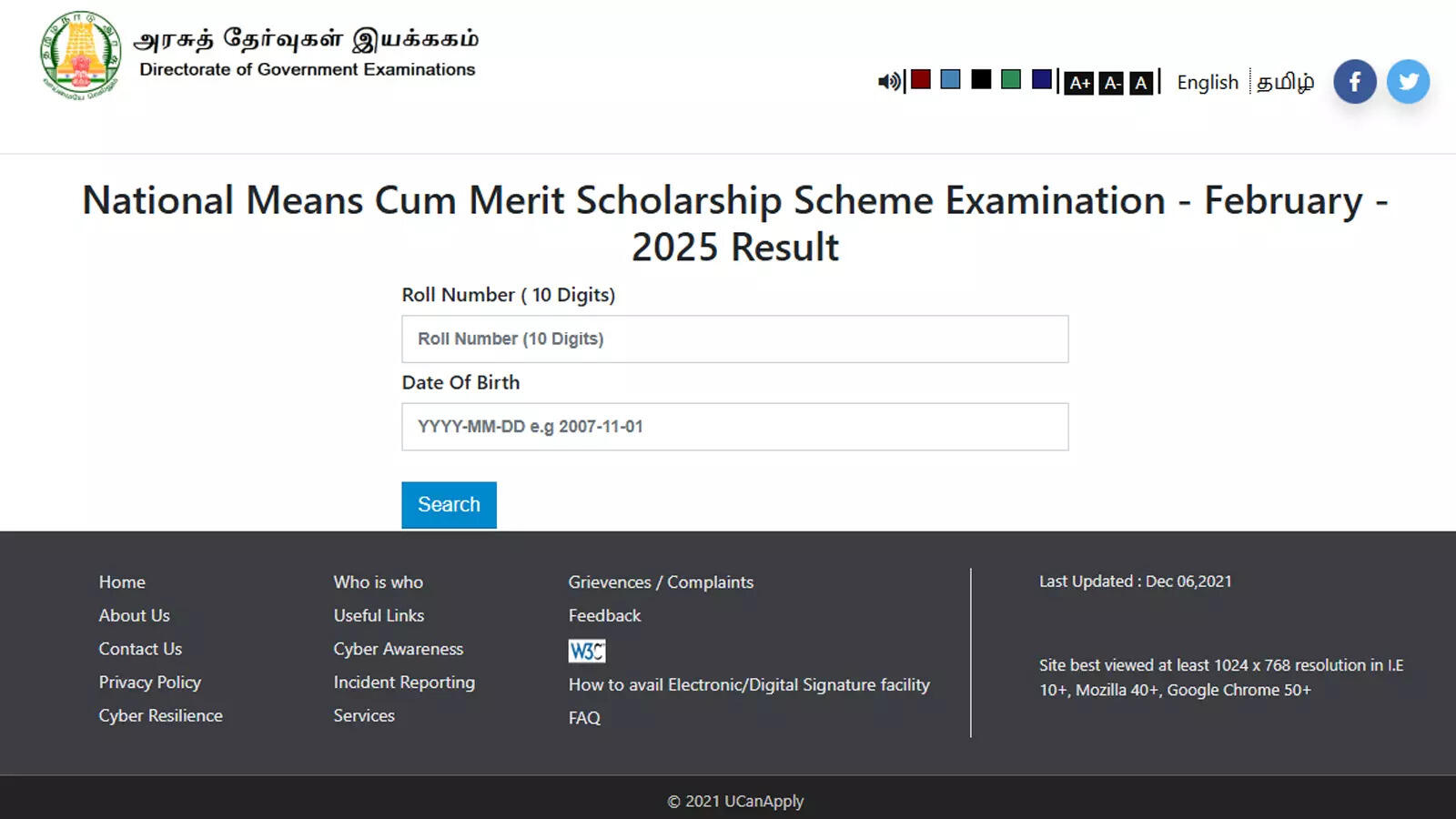

Goldman Sachs-held stock jumps 10% after Donald Trump announces 27% tariff on Indian exports to US

Shares of Leading Textile Stock backed by Vanguard and Goldman Sachs surged after the US announced new tariffs on Indian exports. Despite facing a 27 percent tariff, Indian textile companies are expected to gain a competitive edge as higher tariffs have been imposed on key rivals like Vietnam, Sri Lanka, Bangladesh, and China. This shift […] The post Goldman Sachs-held stock jumps 10% after Donald Trump announces 27% tariff on Indian exports to US appeared first on Trade Brains.

Shares of Leading Textile Stock backed by Vanguard and Goldman Sachs surged after the US announced new tariffs on Indian exports. Despite facing a 27 percent tariff, Indian textile companies are expected to gain a competitive edge as higher tariffs have been imposed on key rivals like Vietnam, Sri Lanka, Bangladesh, and China. This shift is likely to benefit India’s textile exports to the US.

Price Variation

During Thursday’s trading session, shares of Gokaldas Exports reached an intra-day high of Rs.914.00 each, rising 9.1 percent from the previous closing price of Rs.837.70 per share. However, the shares have retreated since then and are trading at Rs.889.30 apiece. Over the past five years, the stock has delivered over 2,500 percent returns.

What Happened

Shares of Gokaldas Exports surged following the announcement by US President Donald Trump of a 27 percent tariff on Indian exports to the US. The company holds a strong position in the export market, with the US accounting for 76 percent of its total revenue in the financial year 2024. Despite the newly imposed tariffs, Indian textile companies are expected to gain a competitive advantage due to the significantly higher tariffs levied on other exporting nations.

Vietnam now faces a 46 percent tariff, while Sri Lanka and Bangladesh are subject to 44 percent and 37 percent tariffs, respectively. China, the largest textile exporter to the US, has been hit with a total tariff of 54 percent, which includes a 20 percent duty that was reinstated in January.

Compared to these nations, Indian exports will be subject to a lower 26 percent tariff, enhancing the competitiveness of Indian textile manufacturers in the US market. This shift is expected to benefit companies like Gokaldas Exports by making Indian textiles a more attractive choice for American buyers.

In FY2024, India’s textile exports to the US, including apparel and home textiles, amounted to approximately USD 10 billion, underscoring the importance of the US as a key market for the Indian textile industry.

Also read: Pharma stocks skyrocket up to 14% after Donald Trump exempts pharma products from new tariffs

Margin Insights

The EBITDA margin showed sequential improvement, reflecting a strong operational performance. However, the overall margin was slightly lower due to increased costs associated with scaling up operations at the Madhya Pradesh unit to fulfill new export orders. The management has set a target to enhance the EBITDA margin by 1 percent over the next 18 months.

Capacity Expansion

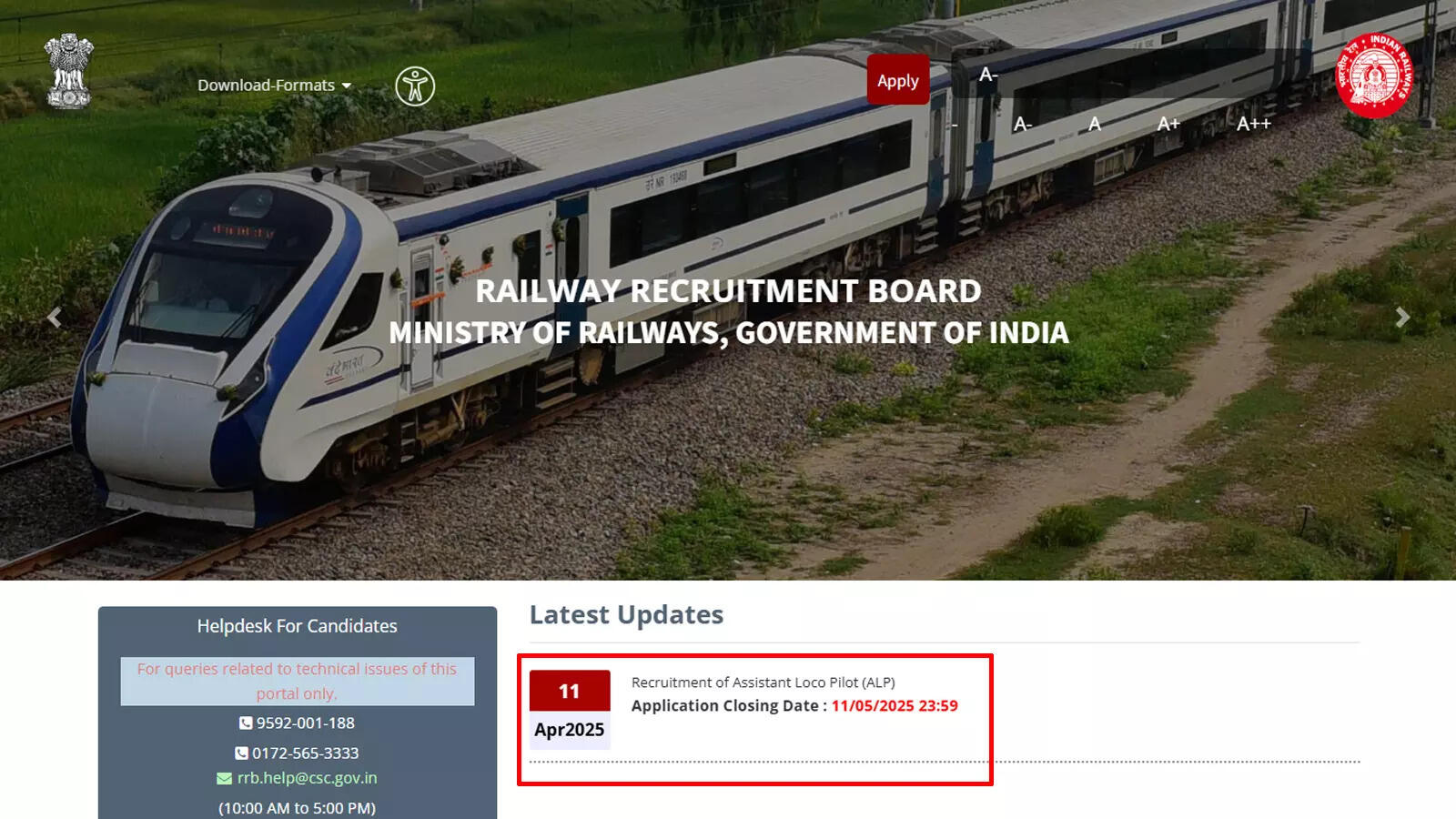

The company is actively investing in three facilities to boost production capacity. A new facility in Madhya Pradesh, equipped with 1,100 machines, is under construction, along with an additional unit in Karnataka featuring 750 machines. Additionally, a new unit in Ranchi, operating on leased premises, is expected to begin operations in FY26. Meanwhile, the last factory established in Madhya Pradesh is already nearing full capacity utilization.

Supply Chain Shift

Global sourcing trends are shifting from China, Vietnam, and Bangladesh to India due to multiple factors. Rising labor costs make India a more cost-effective option, with wages at approximately USD 200 per month compared to USD 300 in Vietnam. Geopolitical tensions and trade sanctions are pushing brands to diversify their sourcing strategies, while political instability in Bangladesh is prompting retailers to explore alternatives. \

Financial Overview

In its recent financial update, Gokaldas Exports reported consolidated revenue of Rs.988 crores for Q3 FY25, reflecting a 79 percent decrease compared to Rs.552 crores in Q3 FY24. Moreover, the company reported a net profit of Rs.50 crores in Q3 FY25, rising 67 percent from Rs.30 crores posted during the same period last year.

Shareholding Pattern

As of December 2024, the shareholding pattern of Gokaldas Exports Ltd shows that promoters hold 9.38 percent stake, while Foreign Institutional Investors hold 26.54 percent, Domestic Institutional Investors hold 37.01 percent, and Retail Investors hold 27.08 percent stake in the company. Vanguard holds 2.38 percent and Goldman Sachs holds 6.8 percent stake in the company.

Written by – Siddesh S Raskar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Goldman Sachs-held stock jumps 10% after Donald Trump announces 27% tariff on Indian exports to US appeared first on Trade Brains.

What's Your Reaction?