Growww Trading at a PE Above 55: Is the Valuation Really Justified?

The Indian stock market has seen many blockbuster listings over the past few years, but few have created as much buzz as Billionbrains Garage Ventures Limited, the parent company of Groww. The company’s strong brand recall, massive user base, and aggressive digital presence helped it build huge excitement before listing — and the markets responded […] The post Growww Trading at a PE Above 55: Is the Valuation Really Justified? appeared first on Trade Brains.

The Indian stock market has seen many blockbuster listings over the past few years, but few have created as much buzz as Billionbrains Garage Ventures Limited, the parent company of Groww. The company’s strong brand recall, massive user base, and aggressive digital presence helped it build huge excitement before listing — and the markets responded with overwhelming enthusiasm. But now that the initial hype has settled and Groww is trading at a PE of over 55, investors are starting to ask the important question: “Is this valuation justified?” Let’s break it down in a simple and practical way.

Financial Performance: Growth With Some Mixed Trends

For Q2 FY26, Groww (Billionbrains Garage Ventures Ltd) reported:

- Revenue: ₹1,018.74 crore

- Down 9.48% YoY (vs ₹1,125.39 crore in Q2 FY25)

- Up 12.64% QoQ (vs ₹904.4 crore in Q1 FY26)

- EBITDA: ₹603.97 crore

- Up 24.97% QoQ

- Up 9.72% YoY

So while revenue has dropped compared to last year, profitability has actually improved. This suggests better cost control, operational efficiency, or rising monetisation per user. However, a YoY decline in revenue for a fast-growing digital platform is something the market always watches carefully.

How Does Groww Compare With Zerodha?

Zerodha, the biggest competitor in the Indian broking industry, has consistently posted profits that are the envy of the entire fintech sector. It remains the gold standard for sustainable and bootstrapped business models.

Zerodha’s financials for FY25 show an 11.5% drop in revenue to ₹8,847 crore and a 22.9% fall in profit to ₹4,237 crore, mainly due to softer market activity and higher expenses, especially salaries. Despite this decline, the company remains extremely healthy financially with a massive cash reserve of ₹22,679 crore, current assets of ₹35,719 crore, zero debt, and strong operating efficiency with margins near 64%. Overall, the article highlights that even in a slower year for brokers, Zerodha continues to be one of India’s most profitable and cash-rich fintech firms.

In short, Groww’s numbers are good, but Zerodha continues to be the benchmark.

Valuation: Here’s Where It Gets Complicated

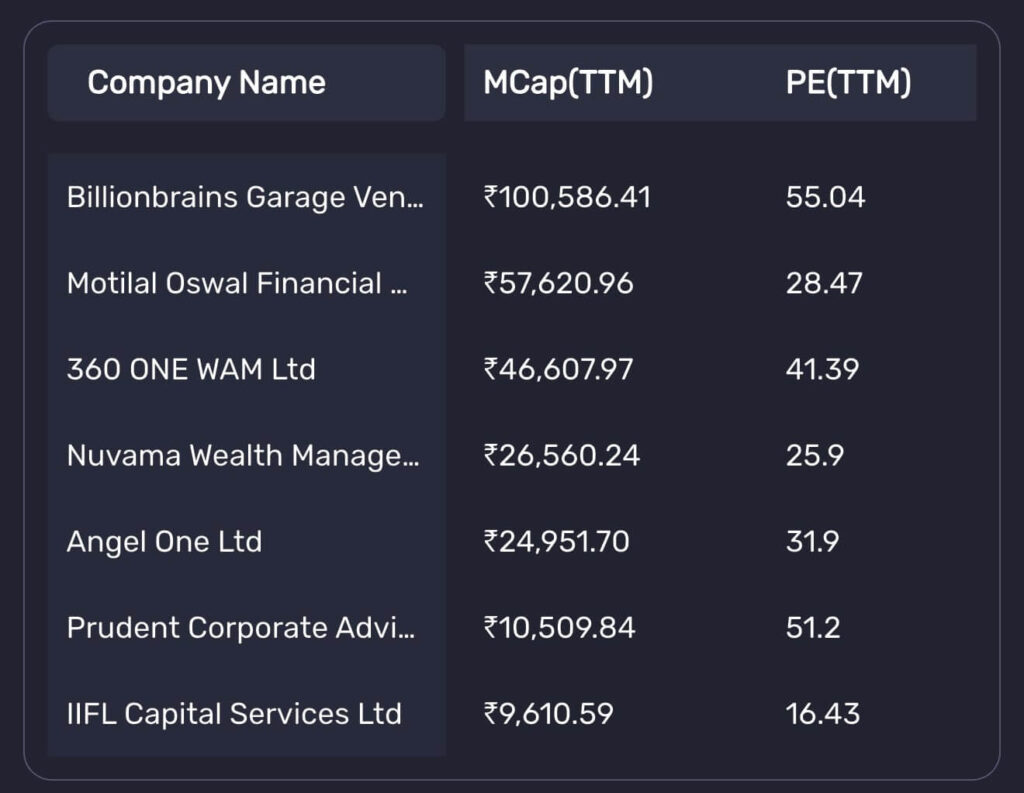

When compared to listed brokerage peers, the contrast becomes even sharper. PE Ratios Across the Brokerage Industry:

This puts Groww at almost double the valuation of India’s top traditional brokerages — all of which have long operating histories, diversified revenue streams, and stable cash flows.

And here’s the surprising part: Groww’s market cap is now similar to that of BSE (Bombay Stock Exchange) — an institution that has existed since 1875 and is Asia’s oldest stock exchange. Think about it. A 9-year-old stockbroker is now valued almost the same as the BSE itself. It’s a bold comparison — and understandably, market veterans aren’t fully comfortable with it.

Why the Market Rewarded Groww So Aggressively

To be fair, the high valuation isn’t random. Groww has a massive young user base, a simple and clean product experience, strong brand presence in metros and tier-2/3 cities, solid growth in equity trading and SIPs and a “tech-first” appeal that attracts new-age investors. Investors often price such companies not on current earnings but on the future growth potential. And that’s exactly why Groww’s PE has shot up so aggressively.

But Is the Valuation Sustainable?

This is where opinions start to diverge. The stock has skyrocketed up nearly 70% since listing, crossed ₹1.05 lakh crore in market cap and surpassed giants like BSE, CDSL, Motilal Oswal, and others.

While this shows strong market confidence, such rapid price movements often raise concerns of Over-optimism, Speculative frenzy, Temporary hype, Valuations racing far ahead of fundamentals. The truth is, the market is ruthless.It lifts you to the sky when the sentiment is positive and can bring you down just as fast when reality kicks in.For a company trading at 55+ PE, even a small slip in performance or user growth can trigger sharp corrections.

The post Growww Trading at a PE Above 55: Is the Valuation Really Justified? appeared first on Trade Brains.

What's Your Reaction?