How to Survive a Bear Market? Top 6 Tips for Beginners!

Synopsis: The Indian stock market is stuck in a range but has not exactly been in a bear market. In 2025, Nifty has given a return of over 11%, which outperforms debt instruments. While it might have severely underperformed compared to gold and silver in 2025, Nifty has not been able to cross 27k levels, […] The post How to Survive a Bear Market? Top 6 Tips for Beginners! appeared first on Trade Brains.

Synopsis: The Indian stock market is stuck in a range but has not exactly been in a bear market. In 2025, Nifty has given a return of over 11%, which outperforms debt instruments. While it might have severely underperformed compared to gold and silver in 2025, Nifty has not been able to cross 27k levels, and investors have started questioning the market’s performance.

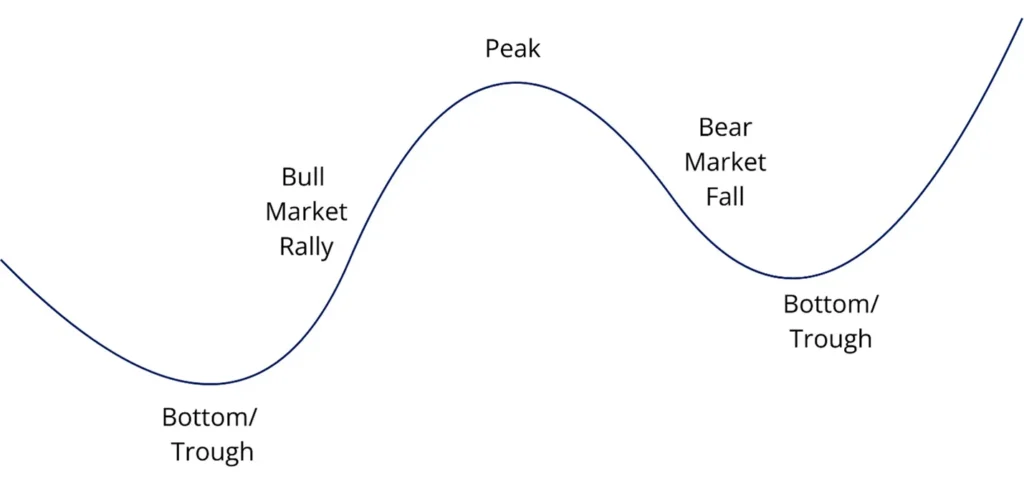

With the current global geopolitical problems and Trump’s erratic moves, 2026 could be a bear market where the equity segment might not perform well. If you are planning to stay in the market, you have to learn to survive the bear market because the best investments are the ones done in the bear market and sold in the bull market.

“In bear markets, stocks return to their rightful owners.” Charlie Munger

In this article, we’ll give you a few simple yet powerful tips to survive the bear market.

1) Have faith. A bear market is always followed by a bull market: This is the most important tip that you should take from this article. Most people stop their SIP or completely stop investing in stocks in a bear market because they lose faith in the market. Later, when the bull market comes, they enter the same stock at an expensive price and are not able to make a profit. Have faith in your stocks if they are fundamentally strong. Keep adding more value stocks or continue your SIPs.

2) Always have cash in hand: In a bear market, always have some cash in hand and never be totally invested in the market. I have always observed that when the market gives the best opportunity, investors will not have money. In the case of a bear market, it will give you repeated opportunities to enter beaten-down stocks, which you can only benefit from if you are not totally invested. If you have capital, keep 20-25% in liquid funds which you can liquidate when the right opportunity arises, but also get higher interest than a savings account.

3) Invest in Smallcap and Midcaps: Though large caps may be saturated and can stay at the same price for the next couple of months in a bear market, small and midcaps that have corrected significantly are capable of giving bigger swings even in the bear market.

4) Find undervalued sectors or beaten-down segments: Although it sounds contrarian, beaten-down sectors will revive in a few years and you can enter them at a dirt-cheap price in a bear market. But remember, no price is too low for a bear. It may happen that the price can go even lower after you enter. Therefore, if the business is good, make sure to keep adding more stocks when they are cheaper, and that’s why the second point, “always have cash in hand,” is essential.

5) Diversify to survive: When equities underperform, debt instruments like bonds and FDs can help you get some returns. Also, have a few investments in shiny metals like gold, silver, and other metals. If you have some investment in real estate, it can also help you manage the overall returns. Also, try to allocate 5-10% of your portfolio in the newest asset of cryptocurrencies that can also reap you good benefits in the upcoming years and you won’t miss out on the asset of the future.

6) Have patience: A bear market tests the patience of investors. It is the time for stocks to move from the impatient investors to the patient investors. As said earlier, remember that in the long run, fundamental stocks go higher only and a bear market is always followed by a bull market. The market takes a pause often to start running with full speed after the break. Till then, you need to keep patience.

“By the time market declines (or advances) are front-page news, they usually have run their course.” ~ Bill Miller

These are the six tips that may help you survive a bear market. In the end, remember that a bear market is the best time to invest in stocks.

The post How to Survive a Bear Market? Top 6 Tips for Beginners! appeared first on Trade Brains.

What's Your Reaction?