Is Trump Greenland Push the Next Big Threat to Global Trade?

Synopsis: President Donald Trump’s renewed push to assert U.S. influence over Greenland triggered fresh trade tensions with Europe, unsettled financial markets, and weakened major currencies. A last-minute security framework announced at the World Economic Forum in Davos helped ease fears, but lingering uncertainty continues to weigh on investor sentiment. Global markets were shaken in 21st […] The post Is Trump Greenland Push the Next Big Threat to Global Trade? appeared first on Trade Brains.

Synopsis: President Donald Trump’s renewed push to assert U.S. influence over Greenland triggered fresh trade tensions with Europe, unsettled financial markets, and weakened major currencies. A last-minute security framework announced at the World Economic Forum in Davos helped ease fears, but lingering uncertainty continues to weigh on investor sentiment.

Global markets were shaken in 21st of January after U.S. President Donald Trump revived his long-standing interest in Greenland, calling for stronger American control over the strategically vital Arctic territory.

On January 17, Trump cited Greenland’s growing importance in rare-earth mining and Arctic security as key reasons for renewed U.S. involvement. The move came shortly after Greenland signed mineral cooperation agreements with the European Union, a development that reportedly angered Washington. Trump’s comments quickly escalated into trade threats, reviving fears of another transatlantic trade conflict.

Tariff Threats

Within days, Trump announced plans to impose new tariffs of 10% on imports from eight countries, including Denmark, Germany, France, and the United Kingdom. He warned that these levies could rise to 25% by mid-year if negotiations failed.

The proposed measures were to be added to existing duties introduced under previous trade arrangements, intensifying concerns over rising costs and supply chain disruptions.

European leaders condemned the move as “economic coercion,” while NATO allies warned that trade disputes could undermine security cooperation. Financial markets reacted sharply, with major European indices sliding and investor confidence weakening. The euro and the British pound both declined against the U.S. dollar as traders priced in heightened geopolitical risk.

Source: Tradingview

European Leaders Push Back

European Union leaders moved quickly to present a united front. European Commission President Ursula von der Leyen publicly reaffirmed the EU’s support for Denmark and warned against further escalation.

Emergency discussions were held in Brussels on possible retaliatory tariffs, reportedly covering up to $100 billion worth of U.S. goods. French President Emmanuel Macron called for the possible use of the EU’s “anti-coercion instrument,” designed to counter economic pressure from third countries. The European Parliament also delayed the ratification of a key U.S.–EU trade agreement signed in 2025, increasing pressure on Washington.

In the UK, Prime Minister Keir Starmer adopted a more cautious tone, signaling a willingness to negotiate while keeping countermeasures on the table. Britain’s fragile fiscal position, highlighted by rising public borrowing in late 2025, added to investor unease. Global risk assets, including equities and cryptocurrencies, declined amid fears of prolonged trade disruption.

Davos Framework Brings Temporary Relief

Tensions eased on January 21 following talks between Trump and NATO Secretary General Mark Rutte at the World Economic Forum in Davos. The two sides announced a preliminary “framework agreement” on Arctic security cooperation, aimed at strengthening NATO’s presence in the region and improving access to critical minerals through joint projects. Shortly after the meeting, Trump confirmed via social media that the proposed tariffs would be suspended.

He also reiterated plans for a large-scale missile defense initiative, dubbed the “Golden Dome,” which he said would strengthen U.S. and allied security in the Arctic. Denmark welcomed the de-escalation but stressed that Greenland’s sovereignty remained non-negotiable. Foreign Minister Lars Lokke Rasmussen called for further dialogue to address security concerns while respecting territorial integrity.

In Greenland, local authorities urged residents to remain calm, although reports indicated increased demand for essential supplies in Nuuk during the height of the uncertainty.

European Markets Rebound

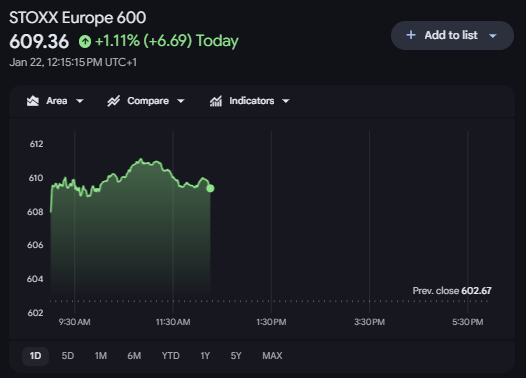

Source: Google Finance

European stocks rallied following the Davos announcement. The Stoxx Europe 600 index rose more than 1% on January 22, reflecting renewed investor confidence. The euro stabilized near recent levels against the dollar, while bond yields eased as fears of immediate retaliation faded. Market participants also focused on easing inflation pressures in the UK and euro zone, raising hopes of future interest rate cuts.

However, analysts warned that unresolved trade and security issues could quickly reignite volatility. Several EU trade initiatives remain frozen pending further clarification from Washington. European policymakers are increasingly emphasizing strategic autonomy, including expanded Arctic defense spending and diversified supply chains.

Pound Recovers Ground

The pound dollar exchange rate followed a similar pattern, recovering after initial losses. Sterling traded near $1.34 in late January, supported by easing trade concerns and slightly stronger inflation data. The currency also gained against the euro and yen as immediate risks to UK exports diminished. The FTSE 100 rose around 0.6% as investor sentiment improved.

Still, structural challenges remain. Analysts note that higher public borrowing, post-Brexit trade frictions, and vulnerability to renewed tariff threats continue to limit the pound’s upside potential. Many expect sterling to remain range-bound between $1.33 and $1.35 in the near term, barring major policy developments.

Lingering Risks Cloud Outlook

While the Davos framework helped avert an immediate crisis, the underlying disputes remain unresolved. Details of the Arctic security arrangement are limited, and European officials remain wary of renewed pressure. Sources indicate that Washington continues to seek expanded military and logistical access in Greenland, an issue likely to remain politically sensitive.

Economists warn that further escalation could undermine transatlantic trust and slow economic growth. The EU is accelerating efforts to reduce dependence on external partners in key sectors such as semiconductors, energy, and critical minerals. For the UK, high borrowing costs and trade uncertainty continue to weigh on medium-term prospects.

Trump’s Greenland push has once again highlighted how geopolitical ambitions can quickly disrupt markets and strain alliances. Although the latest framework agreement has restored short-term stability, fragile trust and unresolved strategic interests suggest that volatility may return. Investors and policymakers alike are now watching closely for the next move in an increasingly complex transatlantic relationship.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Is Trump Greenland Push the Next Big Threat to Global Trade? appeared first on Trade Brains.

What's Your Reaction?