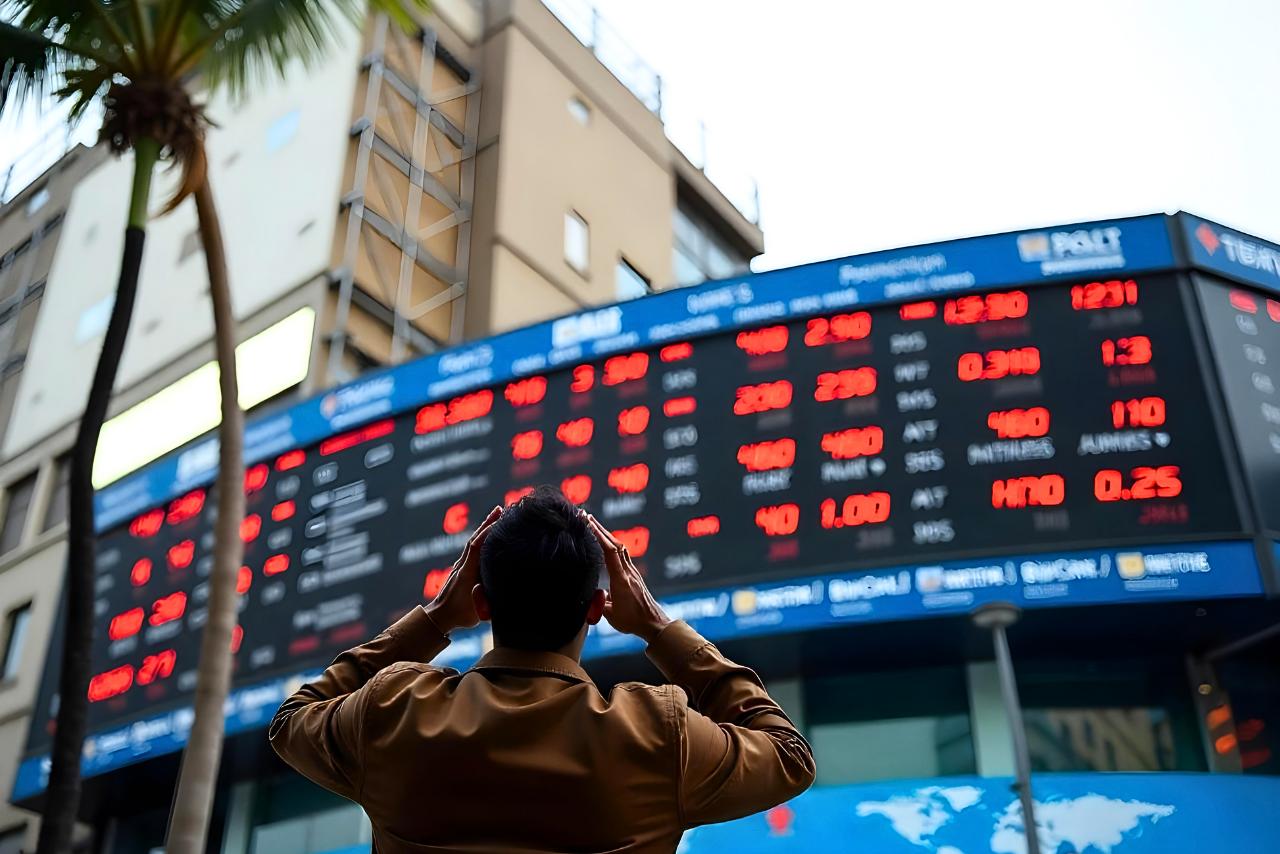

Largecap IT stock crashes after Goldman Sachs cuts its target price by over 30%

Shares of a leading IT stock dropped by 3 percent following a downgrade by Goldman Sachs and a lowered revenue forecast for the sector. The downgrade and reduced growth expectations have raised concerns among investors, affecting the stock’s performance in today’s trading session. Share Price Movement During Friday’s trading session, LTIMindtree Ltd’s share price hit an […] The post Largecap IT stock crashes after Goldman Sachs cuts its target price by over 30% appeared first on Trade Brains.

Shares of a leading IT stock dropped by 3 percent following a downgrade by Goldman Sachs and a lowered revenue forecast for the sector. The downgrade and reduced growth expectations have raised concerns among investors, affecting the stock’s performance in today’s trading session.

Share Price Movement

During Friday’s trading session, LTIMindtree Ltd’s share price hit an intraday low of Rs.4,525.20 apiece, falls 2.5 percent from the previous close of Rs.4,655.90 apiece. The shares moved up slightly since then and are currently trading at Rs.4,616.00 per share.

Brokerage Verdict

Goldman Sachs has downgraded LTIMindtree to ‘Neutral’ and reduced its price target from Rs.6,570 to Rs.4,500 apiece. The brokerage has significantly revised its FY26E revenue growth forecast for India’s IT services sector to 4 percent year-on-year (constant currency), a 230-basis-point reduction from its previous estimate.

This revised forecast is only slightly higher than the 3.5 percent year-on-year growth expected for FY25E. Goldman Sachs cited macroeconomic uncertainty, particularly in the US, as the reason for the downgrade.

The foreign brokerage noted that its US economists recently lowered their GDP growth forecast for 2025 to 1.7 percent from 2.4 percent at the beginning of the year. They also raised the 12-month recession probability to 20 percent from 15 percent, attributing it to the negative effects of tariffs.

Also read: Microcap stock jumps after receiving order from Central Bureau of Investigation

Development in AI

LTIMindtree has secured significant deal wins, driven by its AI initiatives and the framework “AI in everything, Everything for AI, and AI for everyone,” which is fostering innovation and expanding its customer base. A majority of its customers are actively engaged in AI projects, demonstrating growing trust in the company’s capabilities. Additionally, LTIMindtree has collaborated with major players like GitHub, Microsoft, and AWS to enhance its AI-driven solutions.

Vertical Performance

The BFSI vertical showed a growth of 8 percent year-over-year and 4.2 percent quarter-over-quarter in constant currency. Meanwhile, the Manufacturing and Resources vertical experienced a 1 percent year-over-year growth and 9.1 percent quarter-over-quarter growth in constant currency, highlighted by a significant deal valued over US$50 million.

The Technology, Media, and Communications vertical grew by 9.1 percent year-over-year, but it saw a decline of 5.5 percent quarter-over-quarter. The customer business, on the other hand, increased by 2.2 percent year-over-year and 0.2 percent quarter-over-quarter in constant currency. Lastly, the Healthcare, Life Sciences, and Public Services vertical grew 2.2 percent year-over-year and 0.4 percent quarter-over-quarter.

Financial Overview

In its recent financial update, LTIMindtree reported consolidated revenue of Rs.9,661 crores for Q3 FY25, reflecting an increase of 7 percent compared to Rs.9,017 crores in Q3 FY24. Similarly, the company recorded a net profit of Rs.1,087 crores in Q3 FY25, falling 7 percent from Rs.1,169 crores posted during the same period last year.

Ratio Analysis

The company has a Return on Capital Employed (ROCE) of 27.62 percent and a Return on Equity (ROE) of 22.08 percent. Its Price-to-Earnings (P/E) ratio stands at 30.2, lower than the industry average of 35.36. Furthermore, the company maintains a current ratio of 3.7, a debt-to-equity ratio of 0.11, and an Earnings Per Share (EPS) of Rs.154.25.

Written by – Siddesh S Raskar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Largecap IT stock crashes after Goldman Sachs cuts its target price by over 30% appeared first on Trade Brains.

What's Your Reaction?