Market Correction: Is this the best opportunity to accumulate quality stocks?

Motilal Oswal believes that Mid Cap and Small Cap are still trading at expensive valuations when compared to Large Cap stocks, which have corrected to fair valuations, and post an opportunity for selective accumulation in specific sectors. They believe that it is better to be cautious in the Mid and Small Cap stocks as they […] The post Market Correction: Is this the best opportunity to accumulate quality stocks? appeared first on Trade Brains.

Motilal Oswal believes that Mid Cap and Small Cap are still trading at expensive valuations when compared to Large Cap stocks, which have corrected to fair valuations, and post an opportunity for selective accumulation in specific sectors.

They believe that it is better to be cautious in the Mid and Small Cap stocks as they still trade at premium valuations even after a significant price correction of more than 20 percent in the Mid and Small Cap Index.

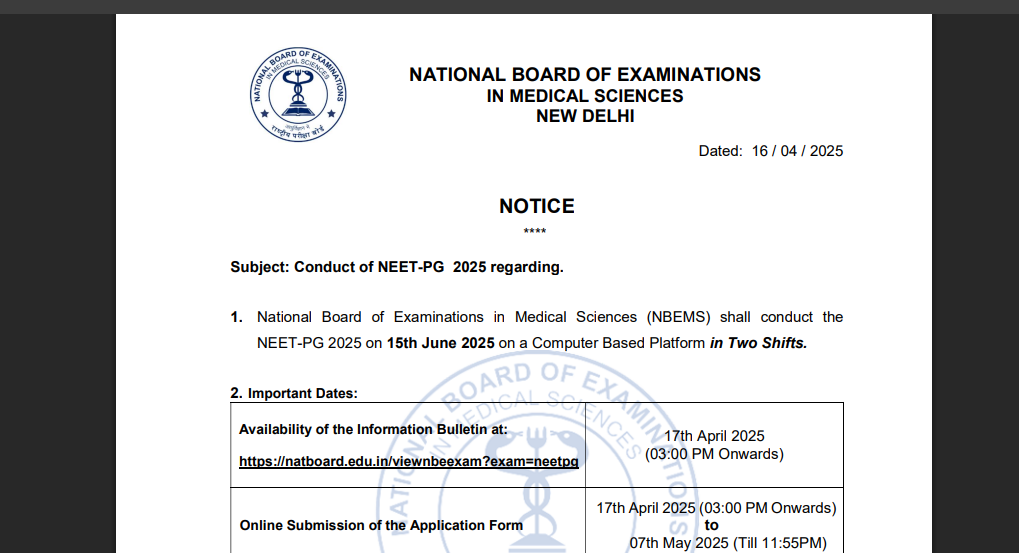

Divergence in Different Indices

Nifty 50 is currently reflecting at a forward P/E ratio of 18.6x, which is reflecting a discount of 9 percent for its long-term forward PE average. But Mid and Small caps still trade at a premium of 22 and 25 percent even after a significant price correction.

Market Cap to GDP Ratio

Market Cap to GDP Ratio of India suggests that the ratio has declined closer to its historical average, and currently is at 120 percent. As Large caps are closer to their historic valuations, it provides a good accumulation opportunity with strong downside protection.

Sectoral Picks from Motilal Oswal

The Performance of sectors has been asymmetrical, with Private banks and Metals displaying strength, and other sectors like Autos, Real estate, and Capital goods have shown a Sharp decline in their Valuations. The Oil & gas sector has been muted as their margins are affected because of lower oil prices, and the Technology sector is still trading at higher valuations even after the recent underperformance.

Motilal suggests sectors such as BFSI, Consumption, and Healthcare can offer attractive opportunities and to have caution in cyclic sectors like Automobile, metals, and Cement.

Written By Abhishek Das

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Market Correction: Is this the best opportunity to accumulate quality stocks? appeared first on Trade Brains.

What's Your Reaction?