Merger: Will merger of Antony Waste Handling help them expand their orderbook in the future?

Synopsis: The merger of AG Enviro into Antony Waste strengthens the company’s core waste management platform by bringing all operations under one entity. The consolidation improves operational efficiency, reduces overheads, and enhances scale. Overall, it sharpens Antony Waste’s positioning in large municipal waste contracts. The shares of this company, which is engaged in the business of […] The post Merger: Will merger of Antony Waste Handling help them expand their orderbook in the future? appeared first on Trade Brains.

Synopsis: The merger of AG Enviro into Antony Waste strengthens the company’s core waste management platform by bringing all operations under one entity. The consolidation improves operational efficiency, reduces overheads, and enhances scale. Overall, it sharpens Antony Waste’s positioning in large municipal waste contracts.

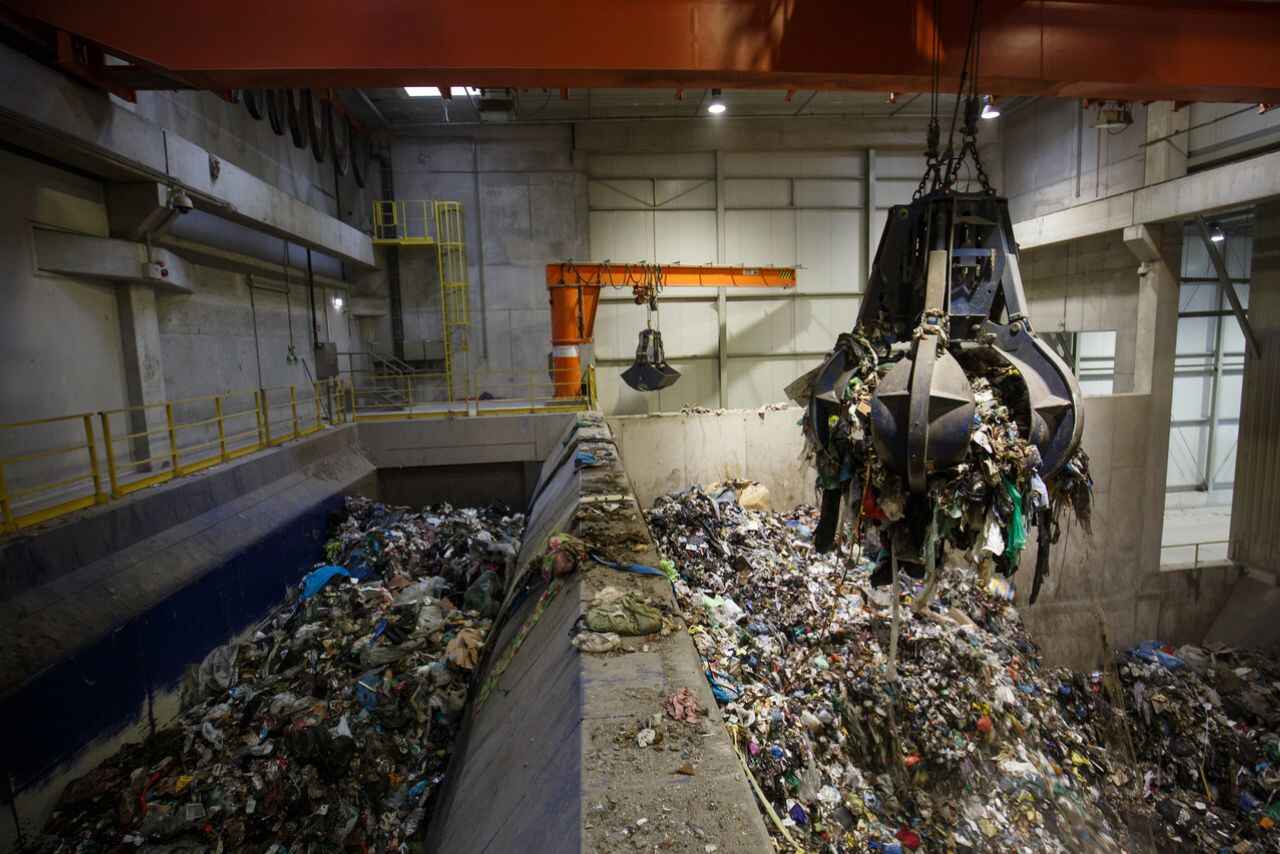

The shares of this company, which is engaged in the business of mechanical power sweeping of roads, collection and transportation of waste, and waste-to-energy projects, were in the news today after the company announced its merger with AG Enviro Infra Projects Pvt., bringing it under the listed parent.

With the market cap of Rs 1,436 crore, the shares of Antony Waste Handling Cell Ltd had hit their intraday high at Rs 547.05, gaining about 6 percent compared to their previous day’s closing price of Rs 517.55. The shares are trading at a PE of 21.2, whereas their industry PE is at 21.1, and have given a return of 25% since their listing in January 2021.

About the merger

The merger of AG Enviro Infra Projects Pvt Ltd into Antony Waste Handling Cell Ltd, approved by the NCLT, is a logical step towards simplifying the group’s structure and sharpening its core waste management business.

Since AG Enviro was a wholly owned subsidiary, bringing it into the listed parent creates a single, unified platform, with the appointed date set as April 1, 2025. The transition is designed to be seamless, ensuring business continuity across all ongoing projects.

About its benefits

Operationally, the merger brings all waste management activities under one roof. Antony Waste now has a fully integrated setup covering municipal solid waste, C&D waste, biomedical and hazardous waste, waste-to-energy projects, and carbon credit initiatives. This consolidation helps reduce overlap, improves coordination across contracts and cities, and allows the company to deploy resources more efficiently while maintaining service quality.

From a financial perspective, the merger is clean and shareholder-friendly. Because AG Enviro was 100% owned, there was no share issuance, no cash payout, and no dilution. At the same time, eliminating a separate legal entity lowers compliance and administrative costs, while allowing Antony Waste to directly manage cash flows and capital allocation more effectively.

Strategically, the merger strengthens Antony Waste’s positioning when bidding for large, long-duration municipal contracts. A single balance sheet, unified operating history, and broader execution capabilities enhance its credibility with urban local bodies and government agencies. Overall, the merger improves efficiency, scale, and competitiveness, reinforcing Antony Waste’s role as a key player in India’s urban waste management and sustainability space.

Financials and more.

The revenue from operations for the company stands at Rs 258 crores in Q2 FY26 compared to Q2 FY25 revenue of Rs 221 crores, up by about 17 per cent YoY. Similarly, the net profit stood at Rs 15 crore in Q2 FY25, whereas it grew to Rs 17 crore in Q2 FY26, giving a growth of about 13 per cent YoY.

Antony Waste Handling Cell Limited (AWHCL) presents itself as a purpose-led organisation focused on addressing one of India’s most pressing urban challenges: municipal solid waste management.

With a track record spanning over two decades, the company has worked closely with municipal corporations across India, building deep experience in handling the complexities of city-level waste collection, transportation, and processing. This long-standing engagement has helped AWHCL establish itself as a trusted and leading player in the sector.

Sustainability sits at the heart of the company’s operations. AWHCL follows a circular approach to waste, aiming to recover maximum value from waste streams while reducing environmental impact.

Through its end-to-end service offerings and use of modern waste management equipment, the company ensures efficient containment, transport, recycling, and processing of waste. By focusing on resource recovery and responsible waste handling, AWHCL supports cleaner cities and contributes to a more sustainable use of resources without compromising operational efficiency.

Written by Leon Mendonca.

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Merger: Will merger of Antony Waste Handling help them expand their orderbook in the future? appeared first on Trade Brains.

What's Your Reaction?