Monopoly stock trading at discount of more than 45% to add to your watchlist

In India, the Depositories sector includes NSDL and CDSL, managing over 326 lakh Demat accounts as of recent data. Clearing Houses, such as NSE Clearing Limited, ensure trade settlements. Other intermediaries like stockbrokers and banks facilitate transactions, enhancing market efficiency and security. Price movement With a market capitalization of Rs 22,203.12 crore, the shares of […] The post Monopoly stock trading at discount of more than 45% to add to your watchlist appeared first on Trade Brains.

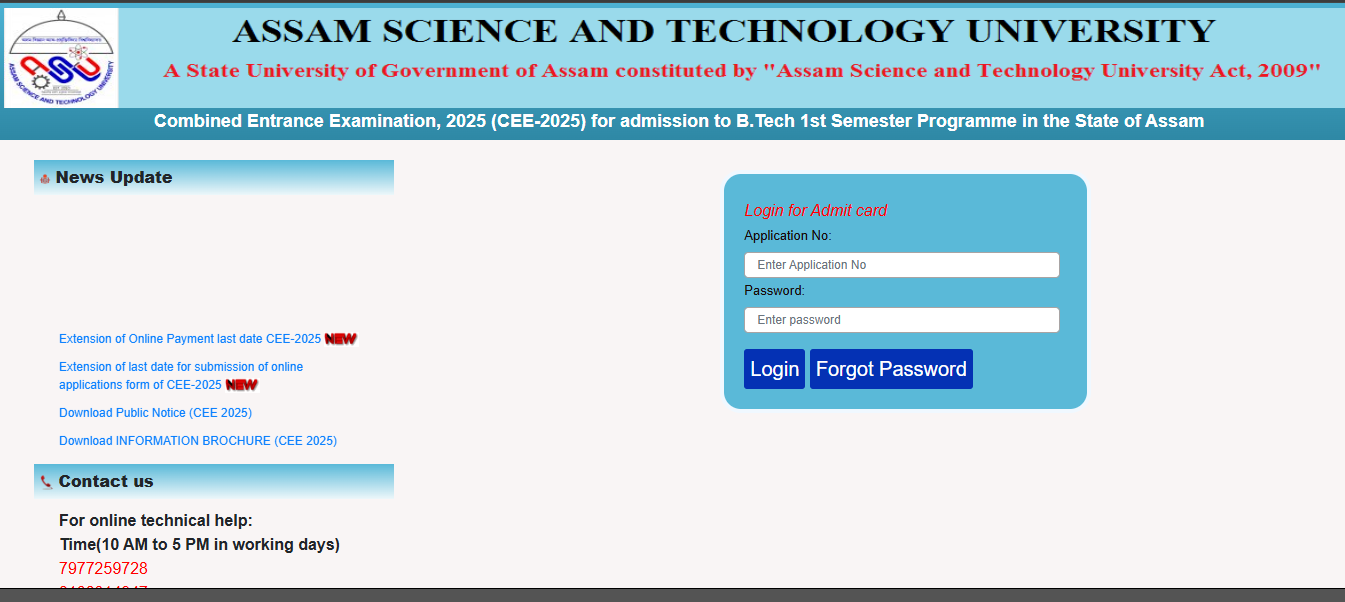

In India, the Depositories sector includes NSDL and CDSL, managing over 326 lakh Demat accounts as of recent data. Clearing Houses, such as NSE Clearing Limited, ensure trade settlements. Other intermediaries like stockbrokers and banks facilitate transactions, enhancing market efficiency and security.

Price movement

With a market capitalization of Rs 22,203.12 crore, the shares of Central Depository Services Limited were trading at Rs 1,060 per share, decreasing around 0.99 percent as compared to the previous closing price of Rs 1,071.00 apiece.

Matter Explanation

Shares of Central Depository Services Ltd. (CDSL) have fallen nearly 44 percent in 2025 so far, almost halving from its peak of Rs 1,989. The stock has also declined 11 percent in the past month alone. The steep drop reflects investor concerns, impacting the depository service provider’s market performance significantly in the fourth quarter of the year.

In February 2025, demat account additions slowed to a 21-month low, with 22.6 lakh new accounts, down 20 percent from January and 48 percent year-on-year. Total accounts reached 19.04 crore across CDSL and IPO-bound NSDL, reflecting a decelerating trend in retail participation amid market conditions.

Demat account additions peaked at 46.8 lakh in January 2024 but have declined since January 2025. Factors include a 25 percent correction in Nifty Midcap and Smallcap indices, stricter F&O norms to curb excessive trading, and fewer IPOs, contributing to the slowdown in new account openings.

Additionally, the NSDL IPO, expected by April 2025, may impact CDSL as both operate in the same depository services sector. Increased competition and investor interest in NSDL could influence CDSL’s market perception and stock performance. However, the extent of the effect will depend on NSDL’s valuation and investor response to the IPO

Industry Overview

India’s capital markets ranked third among the top 15 globally. Average daily turnover surged 64 percent in the first nine months of FY25. Retail participation grew, with demat accounts surpassing 18.5 crore by December 2024. CDSL holds 79 percent market share, reaching 14.65 crore accounts, a 40 percent YoY rise, with 92 lakh accounts added in Q3 FY25.

Also read: Stocks in which Mutual Funds increased their stake in February to keep an eye on

Financial Performance

The company’s Q3 FY25 financial performance showed strong growth, with consolidated total income rising 26 percent to Rs 298 crore from Rs 236 crore in Q3 FY24. Consolidated net profit increased by 21 percent to Rs 130 crore, compared to Rs 107 crore in the previous year, reflecting solid business expansion and profitability.

Company Profile

Central Depository Services (India) Limited is an India-based company, which is engaged in providing depository services, data processing services, and others. The Company operates through three segments: Depository Segment, Data Entry and Storage, and Repository.

Regulatory and Pricing Strategy

Management prioritizes long-term sustainability over short-term gains, aiming to expand market participation beyond the current 7 percent of the population involved in securities, fostering broader financial inclusion and market growth.

Company Profile

Central Depository Services (India) Limited is an India-based company, which is engaged in providing depository services, data processing services, and others. The Company operates through three segments: Depository Segment, Data Entry and Storage, and Repository.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Monopoly stock trading at discount of more than 45% to add to your watchlist appeared first on Trade Brains.

What's Your Reaction?