Mukesh Ambani stock to buy now for an upside potential of 28%; Do you own it?

India’s internet and catalogue retail sector is experiencing rapid growth, with 751.5 million internet users as of early 2024, representing a penetration rate of 52.4%. The e-retail market is projected to reach $160 billion by 2028, driven by increasing digital access and consumer spending patterns. Price movement With a market capitalization of Rs 7,579.64 crore, […] The post Mukesh Ambani stock to buy now for an upside potential of 28%; Do you own it? appeared first on Trade Brains.

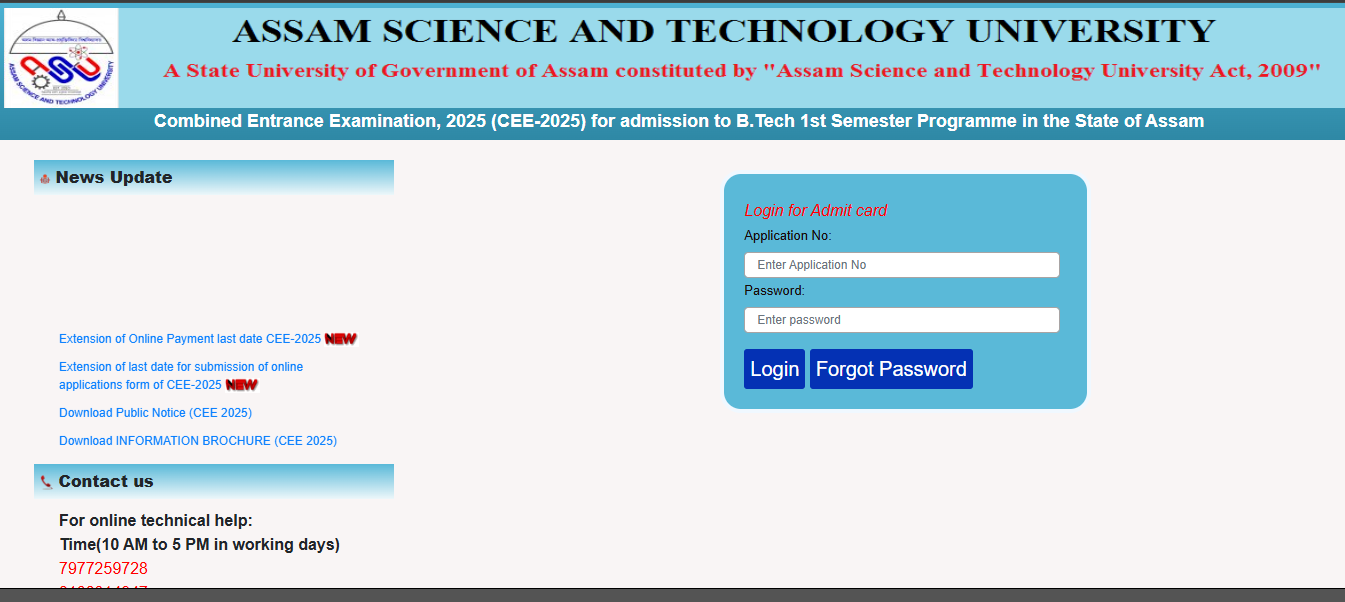

India’s internet and catalogue retail sector is experiencing rapid growth, with 751.5 million internet users as of early 2024, representing a penetration rate of 52.4%. The e-retail market is projected to reach $160 billion by 2028, driven by increasing digital access and consumer spending patterns.

Price movement

With a market capitalization of Rs 7,579.64 crore, the shares of Just Dial Ltd were trading at Rs 891.30 per share, increasing around 0.69 percent as compared to the previous closing price of Rs 897.50 apiece.

Brokerage recommendations

Nuvama, one of the well-known brokerages in India, gave a ‘Buy’ call on the stock with a target price of Rs 1,140 apiece, indicating a potential upside of 32 percent from a Thursday price of Rs 862.30 per share.

Brokerage Rational

Just Dial’s market cap has corrected 20% since its Q3 results, but its core market cap, excluding cash, has dropped 47.6%. Nuvama noted that the company’s valuation is near its lowest, excluding the COVID period, as weaker-than-expected performance over two quarters dampened investor sentiment.

The company’s collections growth slowed to 5.6% in the first nine months of FY25 from 17.7% in FY24, while deferred revenue growth declined to 9.5% from 20.8%. With revenue growth closely linked to collections, further deceleration is expected. Sales strength has returned to pre-COVID levels, falling to 9,765 in Q3FY25.

Despite the slowdown, EBITDA margin improved by 130 basis points quarter-on-quarter in Q3 and is expected to stay stable due to cost-cutting efforts. Nuvama believes that reducing investments further could drive additional margin expansion in the short term as Just Dial shifts focus toward profitability.

Also read: Railway stock with strong revenue guidance of ₹10,000 Cr for FY28 to keep on your radar

Nationwide Presence

The company has a nationwide presence with branches in 11 cities, technology operations in Bengaluru, and an on-the-ground presence in 250+ cities, covering 11,000+ pin codes. Its workforce includes 4,478 tele-sales employees and a 5,287-member feet-on-street salesforce across India.

User Stats

Just Dial enjoys strong brand recall, leveraging its customer base for a robust digital presence. As of Q2FY24, it has 40.2 million listings, 171.7 million quarterly unique visitors, 145.8 million ratings and reviews, and 560,830 active paid campaigns, reflecting high user engagement.

Company Profile

Justdial is the market leader in the local search engine segment in India. The Company provides local search-related services to users across India in a platform-agnostic manner. The multi-platform offering includes an App (Android, iOS), mobile website, desktop /PC, voice, and text.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Mukesh Ambani stock to buy now for an upside potential of 28%; Do you own it? appeared first on Trade Brains.

What's Your Reaction?