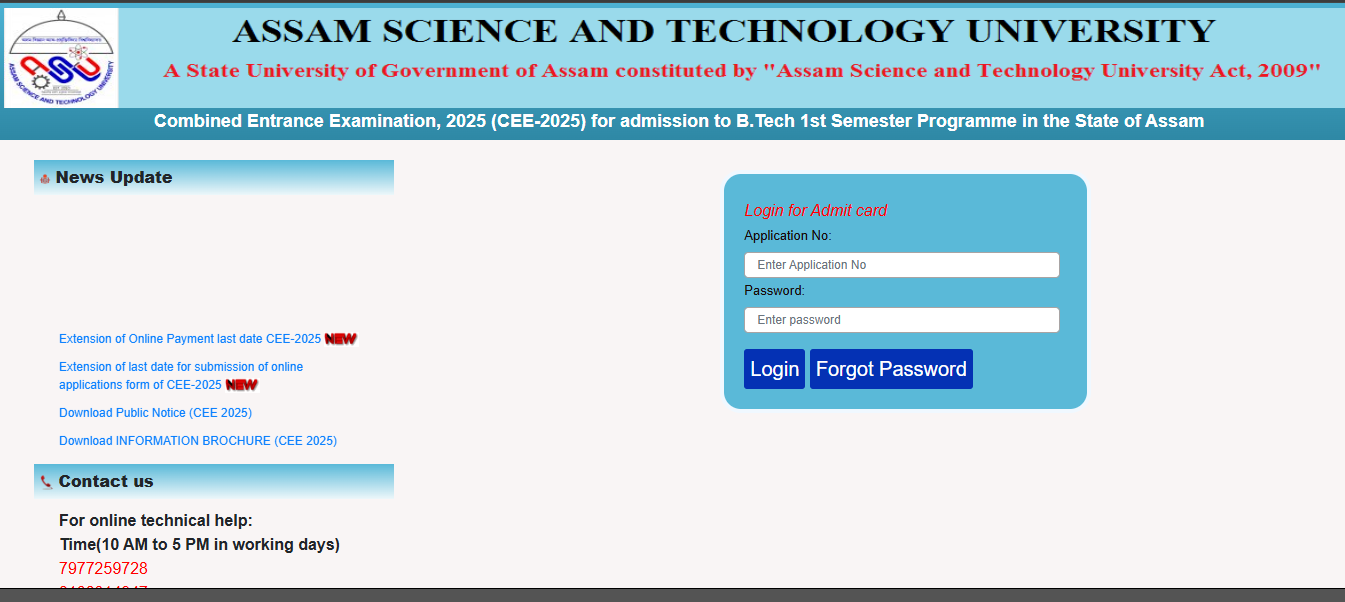

Navaratna stock jumps 4% after signing ₹11,000 Cr loan agreement with Andhra Govt

Navaratna stock surged 4 percent following the announcement of a significant Rs. 11,000 crore loan agreement with the Andhra Pradesh government for the construction of Amaravati. This agreement marks a major step forward in the development of the state capital, boosting investor confidence and reinforcing the company’s position in large-scale infrastructure projects. Price Action During […] The post Navaratna stock jumps 4% after signing ₹11,000 Cr loan agreement with Andhra Govt appeared first on Trade Brains.

Navaratna stock surged 4 percent following the announcement of a significant Rs. 11,000 crore loan agreement with the Andhra Pradesh government for the construction of Amaravati. This agreement marks a major step forward in the development of the state capital, boosting investor confidence and reinforcing the company’s position in large-scale infrastructure projects.

Price Action

During Monday’s trading session, shares of Housing & Urban Development Corporation Ltd jumped to an intraday peak of Rs.187.50 each, reflecting a 4 percent increase from the prior closing price of Rs.180.76 per share. However, the stock retreated later and is currently trading at Rs.186.10 apiece. Over the past five years, the stock has delivered over 750 percent returns.

Strategic Agreements

Andhra Pradesh’s Capital Region Development Authority (CRDA) and HUDCO formalized a significant Rs.11,000 crore loan agreement on Sunday for the development of the greenfield capital city, Amaravati, as confirmed by government sources. The agreement was signed in the presence of Chief Minister N. Chandrababu Naidu at his residence in Undavalli, Guntur district.

According to a press release, the deal outlines that HUDCO will provide a loan of Rs.11,000 crore to finance the construction of the new capital city.

Also read: FMCG stock to buy now for an upside potential of more than 20%; Do you own it?

Orderbook Details

For the first nine months of FY25, Housing & Urban Development Corporation Ltd (HUDCO) reported significant financial performance, with loan sanctions reaching Rs.92,151 crore and loan disbursements totaling Rs.30,428 crore. These figures highlight the corporation’s robust growth and its continued contribution to urban infrastructure development.

Earnings Report

According to its recent financial updates, Housing & Urban Development Corporation Ltd reported remarkable consolidated revenue of Rs.2,760 crores in Q3 FY25, marking a 37 percent increase from Rs.2,013 crores in Q3 FY24. In addition, the company saw a surge of 42 percent in net profit to Rs.735 crores, compared to Rs.519 crores in the same period.

As of January 2025, Housing & Urban Development Corporation Ltd (HUDCO) recorded a gross non-performing asset (NPA) of Rs. 2,233.99 crore and a net NPA of Rs. 321.68 crore. The company maintains a provision coverage ratio of 85.60%, reflecting its strong ability to manage potential credit risks and safeguard against further asset deterioration.

Ratio Analysis

The company has a Return on Capital Employed (ROCE) of 8.13 percent and a Return on Equity (ROE) of 14.4 percent. Its Price-to-Earnings (P/E) ratio stands at 13.49, lower than the industry average of 15.95.

Written by – Siddesh S Raskar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Navaratna stock jumps 4% after signing ₹11,000 Cr loan agreement with Andhra Govt appeared first on Trade Brains.

What's Your Reaction?