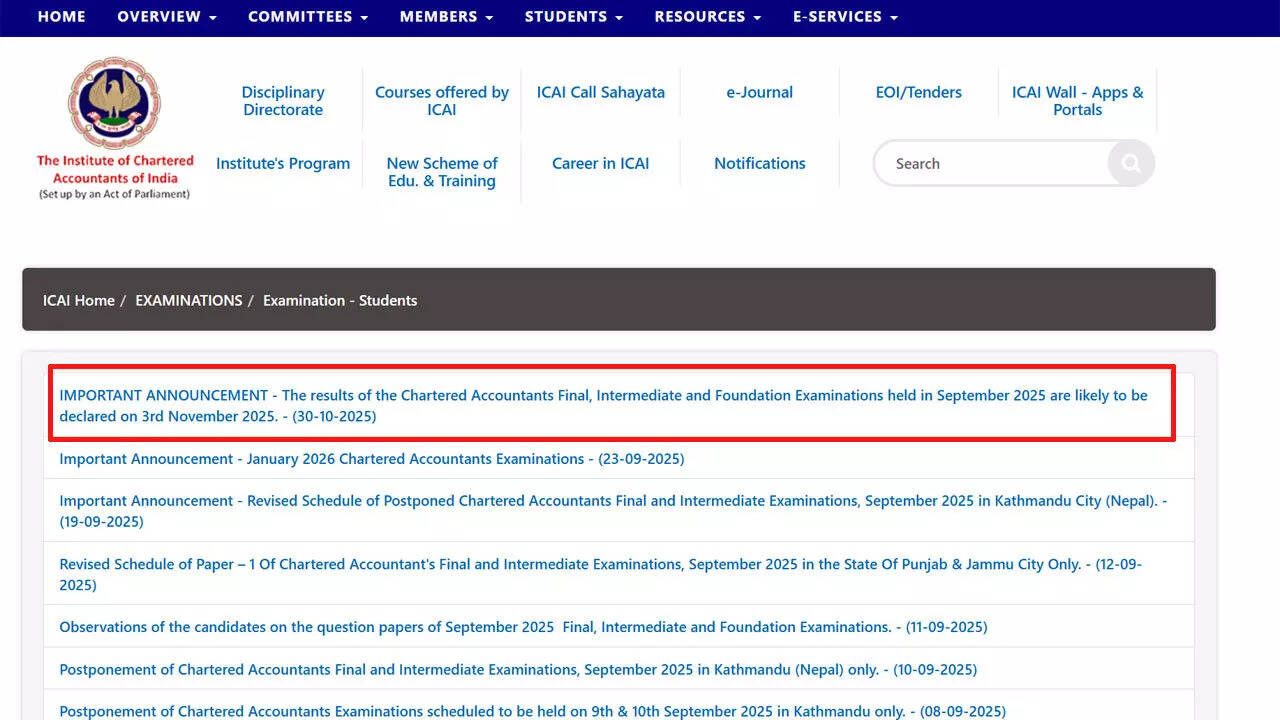

NBFC stock falls 7% after company’s net profit declines 32% YoY

Synopsis: CreditAccess Grameen plunged heavily after Q2 FY26 profit fell 32% YoY to Rs 126 crore, hit by weaker asset quality as GNPA rose to 3.65%. NIM dropped 20 bps to 13.3%. CLSA maintained a Hold rating but raised the target to Rs 1,600, citing margin gains and lower provisions, though higher credit costs are […] The post NBFC stock falls 7% after company’s net profit declines 32% YoY appeared first on Trade Brains.

Synopsis:

CreditAccess Grameen plunged heavily after Q2 FY26 profit fell 32% YoY to Rs 126 crore, hit by weaker asset quality as GNPA rose to 3.65%. NIM dropped 20 bps to 13.3%. CLSA maintained a Hold rating but raised the target to Rs 1,600, citing margin gains and lower provisions, though higher credit costs are expected due to rain-hit overdues.

The shares of this leading NBFC provider that provides financial services to low-income households are in focus after reporting a poor financial performance in this quarter. In this article, we will dive more into the details of it.

With a market capitalization of Rs 22,220 crore, the shares of CreditAccess Grameen Ltd reached a day’s low of Rs 1,373.85 per share, down 7 percent from its previous day’s closing price of Rs 1,474.60 per share. Over the past five years, the stock has delivered a return of 115 percent, underperforming NIFTY 50’s return of 123 percent.

Q2 Highlights

CreditAccess reported a net interest income of Rs 976 crore in Q2 FY26, a growth of 4.7 percent from its Q2 FY25 net interest income of Rs 932 crore. Additionally, on a QoQ basis, it grew by 4.2 percent from Rs 937 crore.

Coming to its profitability, the bank reported a net profit decline of 32 percent to Rs 126 crore in Q2 FY26 as compared to Rs 186 crore in Q2 FY25. However, on a QoQ basis, it grew by 109 percent from Rs 60 crore.

NIM and Cost of Borrowings declined by 20 bps to 13.3 percent and 9.6 percent in Q2 FY26, respectively. Additionally, its Cost to Income ratio surged by 180 bps to 32.5 percent during the same period.

Its Gross Loan Portfolio (GLP) grew by a minor 3 percent to Rs 25,904 crore in Q2 FY26 as compared to Rs 25,133 crore in Q2 FY25. However, on a QoQ basis, it declined by 0.6 percent from Rs 26,055 crore. Coming to its portfolio composition, its GLP comprised 85 percent with Income Generation Loan (IGL), followed by 3 percent with Home Improvement, 11 percent with retail finance, and 1 percent from Family Welfare.

It can be attributed mainly to a drop in borrowers. Total Borrowers declined by 10 percent to 44.4 lakh in Q2 FY26 as compared to 49.3 lakh in Q2 FY25 and declined by 2.7 percent QoQ from 45.6 lakh in Q1 FY26.

Also, Disbursements grew by a staggering 33 percent to Rs 5,322 crore in Q2 FY26 as compared to Rs 4,004 crore in Q2 FY25. However, it declined slightly by 2.5 percent from Rs 5,458 crore in its previous quarter.

Coming to its Asset Quality, it reported a GNPA of 3.65 percent in Q2 FY26, which increased by 121 bps from 2.44 percent in Q2 FY25. Also, NNPA increased by 50 bps to 1.26 percent in Q2 FY26 vs 0.76 percent in Q2 FY25.

Analyst Comments

Leading brokerage, CLSA, has maintained its Hold rating on the stock but has increased its price target to Rs 1,600 per share, signaling an upside potential of 15 percent from its current market price.

CLSA cited that the company’s profit was 52 percent higher than its estimates, which was mainly driven by lower provisioning expenses and higher other income. Margins were expanded by approximately 50 basis points QoQ, which was a result of both higher lending yields and a reduced cost of funds. CLSA believes that margin improvements will still be there in the subsequent quarters.

But, in its post-earnings call, the company increased the credit cost guidance signal for both this year and the next. As a result, management is now forecasting credit costs in FY26 to be 70-100 basis points higher than their initial estimate of 5.5-6 percent, as they attribute it to an increase in the number of overdue accounts due to the heavy rainfall in some areas.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post NBFC stock falls 7% after company’s net profit declines 32% YoY appeared first on Trade Brains.

What's Your Reaction?