PSU stock jumps 8% to record high ahead of earnings; Historical Performance Reviewed

SYNOPSIS: Ahead of its Q2 FY26 results, shares of SAIL witnessed sharp price movement, drawing investor attention. The Maharatna PSU reported an 808 percent YoY rise in Q1 FY26 net profit and announced major capex plans, including a Rs. 36,000 crore IISCO expansion project. Shares of one of the largest steel-making companies in India and […] The post PSU stock jumps 8% to record high ahead of earnings; Historical Performance Reviewed appeared first on Trade Brains.

SYNOPSIS: Ahead of its Q2 FY26 results, shares of SAIL witnessed sharp price movement, drawing investor attention. The Maharatna PSU reported an 808 percent YoY rise in Q1 FY26 net profit and announced major capex plans, including a Rs. 36,000 crore IISCO expansion project.

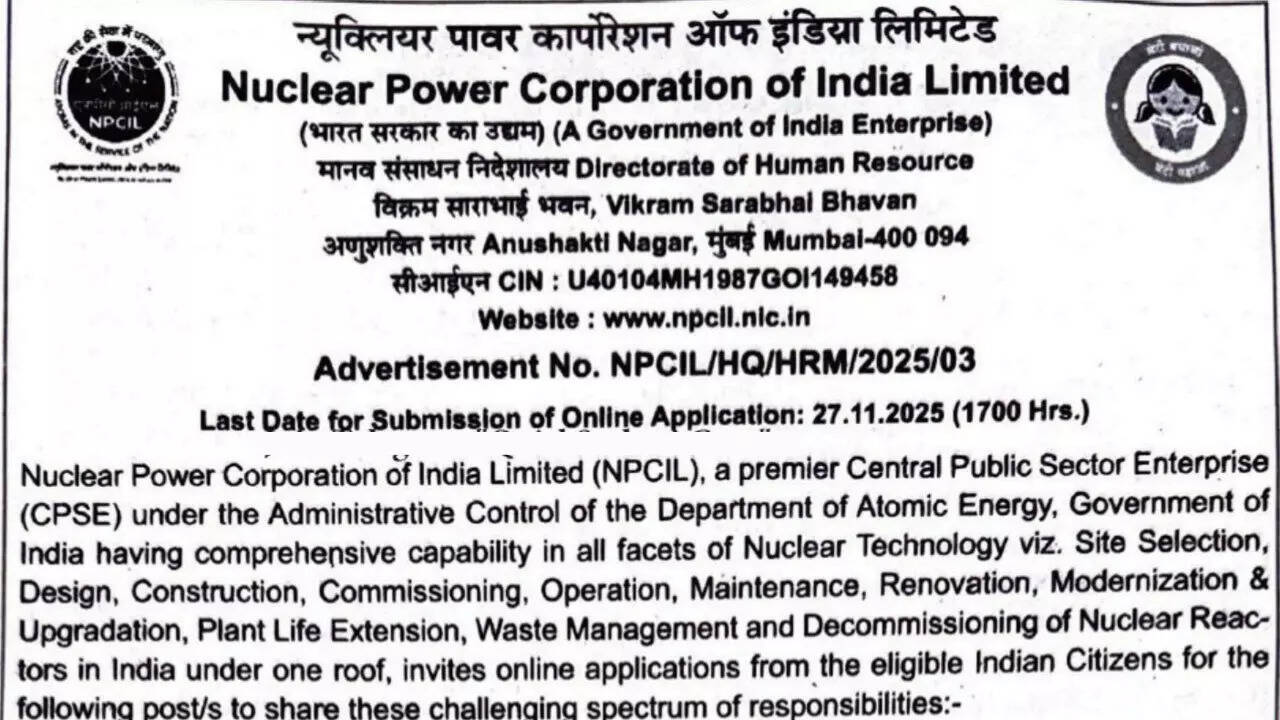

Shares of one of the largest steel-making companies in India and one of the Maharatnas of the country’s Central Public Sector Enterprises surged nearly 8.2 percent to hit a new 52-week high at Rs. 143.2 on Wednesday. The rally comes ahead of the company’s Q2 FY26 financial earnings, expected to be announced shortly.

At 02:19 p.m., the shares of Steel Authority of India Limited were trading in the green at Rs. 140.55 on BSE, up by around 6 percent, as against its previous closing price of Rs. 132.3, with a market cap of Rs. 58,048 crores.

The stock has delivered positive returns of over 21 percent in the last one year, and has gained by around 7 percent in the last one month.

Financial Performance History

Steel Authority of India Limited (SAIL) is a Public Sector Undertaking (PSU) conferred with Maharatna status by the Government of India, and is one of the largest steel producers in the country. With the sharp price movement drawing attention, here’s a look back at its historical financial performance, both on a quarter-on-quarter and year-on-year basis.

As per regulatory filings dated 24th October, the company announced that a Board meeting is scheduled for Thursday, 29th October, 2025, to consider and approve the Standalone and Consolidated Unaudited Financial Results of the company for the Quarter and Half Year ended 30th September 2025.

For Q1 FY26, SAIL reported a consolidated revenue from operations of Rs. 25,922 crores, reflecting a decline of around 13 percent QoQ from Rs. 29,316 crores in Q4 FY25, as well as a rise of over 22 percent from Rs. 23,998 crores in Q1 FY25.

During the same period, net profit stood at Rs. 745 crores, indicating a decline of around 40.4 percent QoQ from Rs. 1,251 crores, but an impressive growth on a year-on-year basis by more than 808 percent from Rs. 82 crores.

For the first quarter of FY26, on the mining front, SAIL produced 8.791 million tonnes (MT) of iron ore, 0.338 MT of limestone, and 0.062 MT of dolomite. In terms of production, hot metal output stood at 5.128 MT, crude steel production at 4.854 MT, and saleable steel at 4.712 MT.

During the quarter, domestic sales reached 4.426 MT, while exports accounted for 0.124 MT, resulting in total sales of 4.550 MT.

As of the quarter end, the company’s total debt (IndAS) stood at Rs. 36,276 crore, with a debt-equity ratio of 0.64, indicating a well-managed leverage position. SAIL reported a Debt Service Coverage Ratio (DSCR) of 2.74 and an Interest Coverage Ratio of 1.98.

For FY25, the company incurred a capex of around Rs. 6,000 crore, while for FY26, the Board has approved a target capex of Rs. 7,500 crore. In the first quarter of FY26 alone, SAIL achieved a capex of Rs. 1,642 crore, surpassing its quarterly target. Looking ahead, FY27 is expected to witness a significant increase in spending, primarily driven by the ramp-up of the IISCO Steel Plant expansion project.

The IISCO expansion entails the addition of 4.5 MT of capacity, comprising 4 MT of new capacity and 0.5 MT of debottlenecking. The total project cost is estimated at around Rs. 36,000 crore. The execution timeline includes order placements during FY26 (December 2025 to January 2026), with expenditure expected to commence in FY27, spanning over a 36-month implementation period. In addition to IISCO, SAIL has also initiated expansion plans across its other plants, with tendering activities and project pipelines actively progressing.

Written by Shivani Singh

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post PSU stock jumps 8% to record high ahead of earnings; Historical Performance Reviewed appeared first on Trade Brains.

What's Your Reaction?