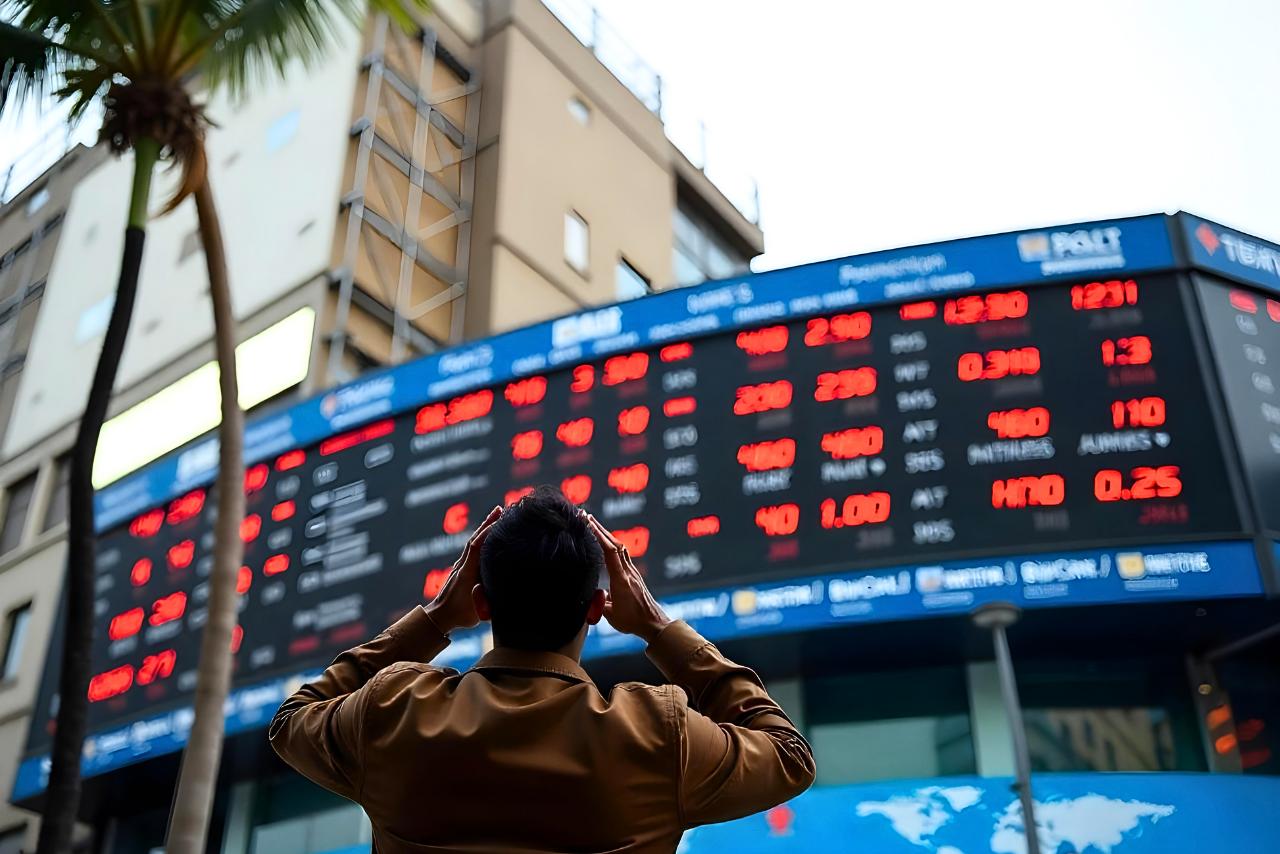

Sectoral Indices that have entered Bear Market with fall of up to 32%

Nifty-50 Index had declined 16.41 percent from its peak of 26,277 in September last year to a recent low of 21,964. The total market cap of NSE listed stocks has fallen from 477.93 Lakh crores to 382.71 lakh crores, reducing the investors’ wealth by 95.22 lakh crores. Several Indices are now trading around the Bear […] The post Sectoral Indices that have entered Bear Market with fall of up to 32% appeared first on Trade Brains.

Nifty-50 Index had declined 16.41 percent from its peak of 26,277 in September last year to a recent low of 21,964. The total market cap of NSE listed stocks has fallen from 477.93 Lakh crores to 382.71 lakh crores, reducing the investors’ wealth by 95.22 lakh crores.

Several Indices are now trading around the Bear Market zone. Any index or stock enters a Bear market when it declines 20 percent or more from its recent high. And this phase further strengthened with increased volatility, declining investor confidence and global uncertainties.

List of Indices that have entered Bear Market territory with a fall of up to 32%:

- NIFTY AUTO: Nifty Auto has declined 22.89 percent from its 52-week High of 27,696 and is currently at 21,355 levels.

- NIFTY REALTY: Nifty Realty has declined 28.26 percent from its 52-week High of 1,157 and is currently at 830 levels.

- NIFTY IT: Nifty IT has declined 22.14 percent from its 52-week High of 46,088 and is currently at 35,880 levels.

- NIFTY FMCG: Nifty FMCG has declined 21.43 percent from its 52-week High of 66,438 and is currently at 52,200 levels.

- NIFTY MEDIA: Nifty MEDIA has declined 32.17 percent from its 52-week High of 2,182 and is currently at 1,480 levels.

- NIFTY PSU BANK: Nifty PSU BANK has declined 25.49 percent from its 52-week High of 8,053 and is currently at 6,000 levels.

- NIFTY OIL & GAS: Nifty OIL & GAS has declined 25.14 percent from its 52-week High of 13,607 and is currently at 10,185 levels.

Sectoral Indices that have fallen less than 20 percent and are showing strength in this Market decline are Nifty Bank, Private Bank, Financial Services, Healthcare, Metal, and Pharma. The fall in these sectors ranges from 7 to 14 percent from their 52-week high.

Major Reasons for Decline

Stock Market has been under pressure due to continuous selling by Foreign Institutional Investors (FIIs). One of the key reasons is the strengthening of the US dollar, which makes emerging markets less attractive. Additionally, concerns over a slowdown in corporate earnings growth, global economic uncertainties, high valuations of Indian stocks compared to other emerging markets, and trump tariff risks have further contributed to the market decline.

Written By Abhishek Das

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Sectoral Indices that have entered Bear Market with fall of up to 32% appeared first on Trade Brains.

What's Your Reaction?