Should you buy Premier Energies? Here’s what JP Morgan has to say

The shares of one of the leading solar cells and solar panels manufacturers with a product portfolio of solar cells, solar modules, monofacial and bifacial modules, as well as EPC and O&M solutions are in focus after global brokerage, JP Morgan has reduced its price target by 20%. Price Action The shares of Premier Energies […] The post Should you buy Premier Energies? Here’s what JP Morgan has to say appeared first on Trade Brains.

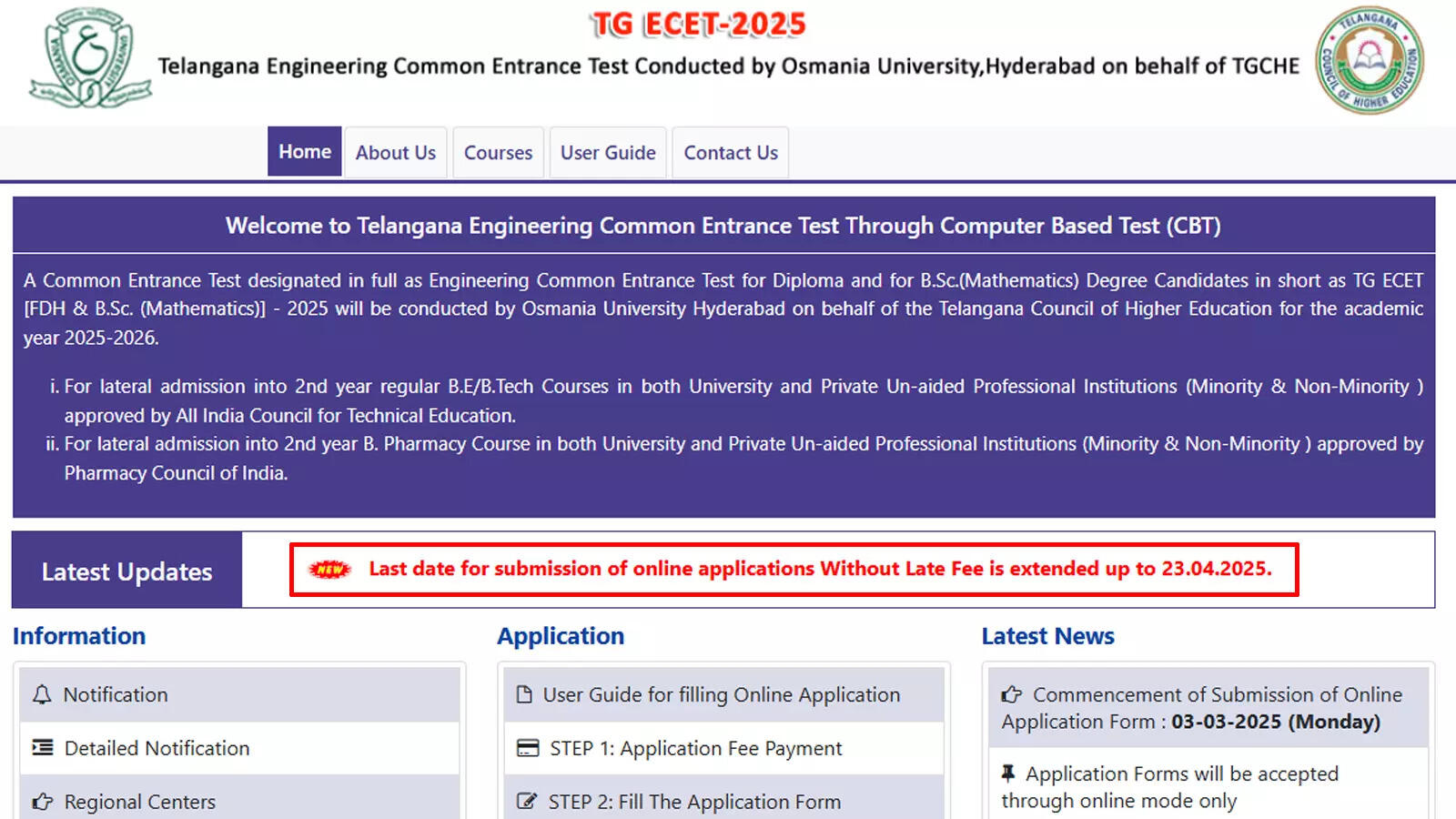

The shares of one of the leading solar cells and solar panels manufacturers with a product portfolio of solar cells, solar modules, monofacial and bifacial modules, as well as EPC and O&M solutions are in focus after global brokerage, JP Morgan has reduced its price target by 20%.

Price Action

The shares of Premier Energies Ltd, with a total market capitalization of Rs 42,219.53 Crore on Thursday, were trading at Rs 937 per share which was around 0.7 percent higher than the previous closing price of Rs 930.7.

Brokerage Target

On Thursday, March 20, JP Morgan has a “Neutral” rating on the shares of Premier Energies Ltd. However, it slashed its price target by 20 percent stating short-term margin risks. The Brokerage firm reduced the target price from Rs 1,170 per share to Rs 940 per share.

Brokerage Rationale

The Brokerage noted that Premier Energies had reported a significant increase in margins from 17 percent in Q3FY24 to 30 percent in Q3FY25. However, JP Morgan is cautious that these margins could come under pressure in the short term because of falling prices of non-DCR (Domestic Content Requirement) modules, which could also bring down local DCR prices. Non-DCR solar panels are those in which the solar cell and solar module are not designed and manufactured in India.

The Brokerage added that stable Headline wafer prices could cause compression in margins. JP Morgan further stated that the Indian Cell capacity has seen a rapid increase from 13 GW in October 2024 to 25.2 GW currently, this could increase the supply of DCR cells and modules and consequently reduce the pricing premiums.

Also read: Bulk Deal: IT stock under ₹50 hits 5% upper circuit after DII buys stake in the Co.

Order Book

As of Q3FY25, the company has an order book of 4,539 MW valued at Rs 6,946 Crore, of which 63 percent of the order book pertains to solar modules, 36 percent to Solar cells, and 1 percent to EPC.

Financials

The company reported an increase of 140 percent YoY in revenue from operations from Rs 712 Crore in Q3FY24 to Rs 1,713 Crore in Q3FY25. Their Net Profit also surged by 491 percent YoY from Rs 43 Crore to Rs 255 Crore over the same period.

About Premier Energies Ltd

Premier Energies is an integrated solar cell and solar module manufacturing company. Its cutting-edge manufacturing units are spread across three locations in Telangana, totaling an aggregate land area of over 44.91 acres. As of June 2024, the group had a total module capacity of 4.1 GW and a cell capacity of 2 GW.

Written By Adhvaitha Nayani

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Should you buy Premier Energies? Here’s what JP Morgan has to say appeared first on Trade Brains.

What's Your Reaction?