Stake Sale: Govt sells 3% stake in this bank stock; Shares fall 4.2%

Synopsis:- Shares fell about 4% after the government announced a 3% stake sale at a ₹34 floor price. Despite near-term pressure, fundamentals remain strong with 15% revenue growth, 58% profit jump, ROE of ~20%, and NNPA at just 0.28%, highlighting improved asset quality and profitability. The shares of this financial service provider plummeted 4.2 percent […] The post Stake Sale: Govt sells 3% stake in this bank stock; Shares fall 4.2% appeared first on Trade Brains.

Synopsis:- Shares fell about 4% after the government announced a 3% stake sale at a ₹34 floor price. Despite near-term pressure, fundamentals remain strong with 15% revenue growth, 58% profit jump, ROE of ~20%, and NNPA at just 0.28%, highlighting improved asset quality and profitability.

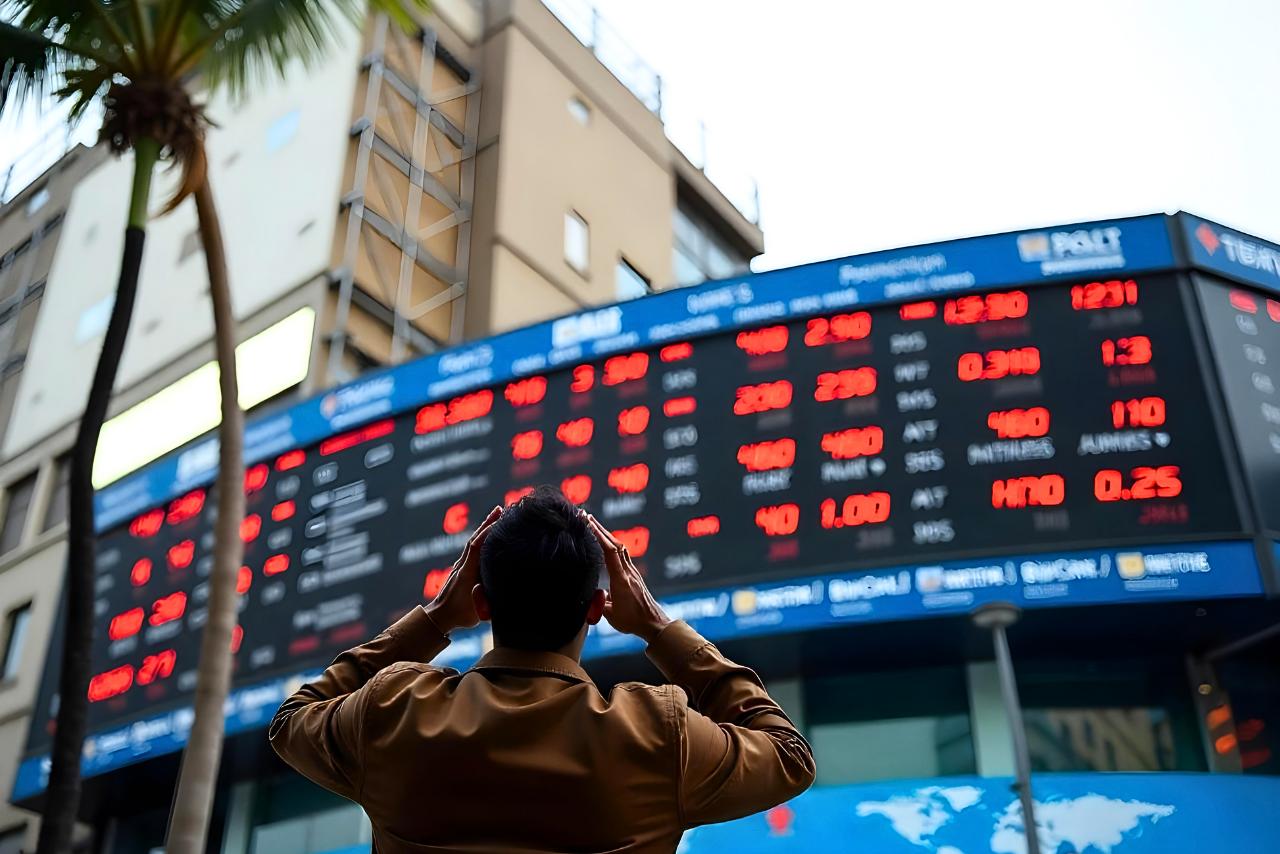

The shares of this financial service provider plummeted 4.2 percent in today’s trading session after the Government of India announced it would sell up to 38.51 crore equity shares of the bank.

With a market capitalisation of Rs 67,629.14 crore, the shares of Indian Overseas Bank were trading at Rs 35.12 per share, decreasing around 3.96 percent as compared to the previous closing price of Rs 36.57 apiece.

Government Selling

The shares of Indian Overseas Bank have seen dearish movement after the government will sell up to 38.51 crore equity shares of the bank (equivalent to 2% of the paid-up equity as the base offer size) on December 17–18, with an option to additionally sell 19.25 crore shares (1% stake), through a separate designated window of the BSE and NSE. The floor price has been fixed at Rs 34 per share.

Financial & other Highlights

The company delivered a strong Q2FY26 performance, with revenue rising 15% year-on-year to Rs 7,849 crore, reflecting steady business growth. Net profit surged 58% to Rs 1,226 crore, indicating improved margins, better operating leverage, and effective cost management, which together highlight strengthening profitability and overall financial health.

Indian Overseas Bank’s September 2025 highlights strengthening fundamentals and improving efficiency. The bank delivered healthy profitability with ROE of 19.95% and ROA of 1.20%, supported by strong net interest income. Low GNPA of 1.83% and NNPA of 0.28% reflect sound asset quality, while a solid CASA ratio of 40.52% supports stable funding.

Indian Overseas Bank’s domestic advances grew at a 12% CAGR, led by retail (19%) and agriculture (20%) segments. Retail now accounts for 30% and agriculture 32% of the loan mix as of Sept’25, up from 25% and 31% a year ago. MSME stands at 19%, reflecting a well-diversified, lower-risk loan portfolio.

Indian Overseas Bank has delivered a sharp improvement in net asset quality, with NNPA declining from 5.44% in FY20 to just 0.28% in H1FY26. In absolute terms, net NPAs fell from Rs 6,603 crore to Rs 776 crore, well below the PSU bank average of 0.45%, reflecting strong recoveries and disciplined credit management.

Indian Overseas Bank is a leading public sector bank in India with a strong domestic and overseas presence. The bank offers a wide range of retail, corporate, MSME, and international banking services, focusing on inclusive growth, improving asset quality, and sustainable profitability.

Written by Abhishek Singh

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stake Sale: Govt sells 3% stake in this bank stock; Shares fall 4.2% appeared first on Trade Brains.

What's Your Reaction?