Stock jumps 8% after receiving an order worth ₹900 Cr for US data center project

Synopsis: Shares rose after a Rs 900 crore ($99.2 million) export order from a US firm marked entry into global data centers. The landmark deal, the largest ever, spans 12–20 months and involves supplying hyperscale-grade power transformers, strengthening export visibility, and long-term growth prospects. The shares of the power equipment gained up 8.2 percent in […] The post Stock jumps 8% after receiving an order worth ₹900 Cr for US data center project appeared first on Trade Brains.

Synopsis: Shares rose after a Rs 900 crore ($99.2 million) export order from a US firm marked entry into global data centers. The landmark deal, the largest ever, spans 12–20 months and involves supplying hyperscale-grade power transformers, strengthening export visibility, and long-term growth prospects.

The shares of the power equipment gained up 8.2 percent in today’s trading session after the company made its entry into the global data center segment by bagging a Rs 900 crore order from Tallgrass.

With a market capitalization of Rs 93,539.26 crore, the shares of CG Power and Industrial Solutions Ltd were trading at Rs 593.90 per share, increasing around 6 percent as compared to the previous closing price of Rs 561.85 apiece.

Significant Order

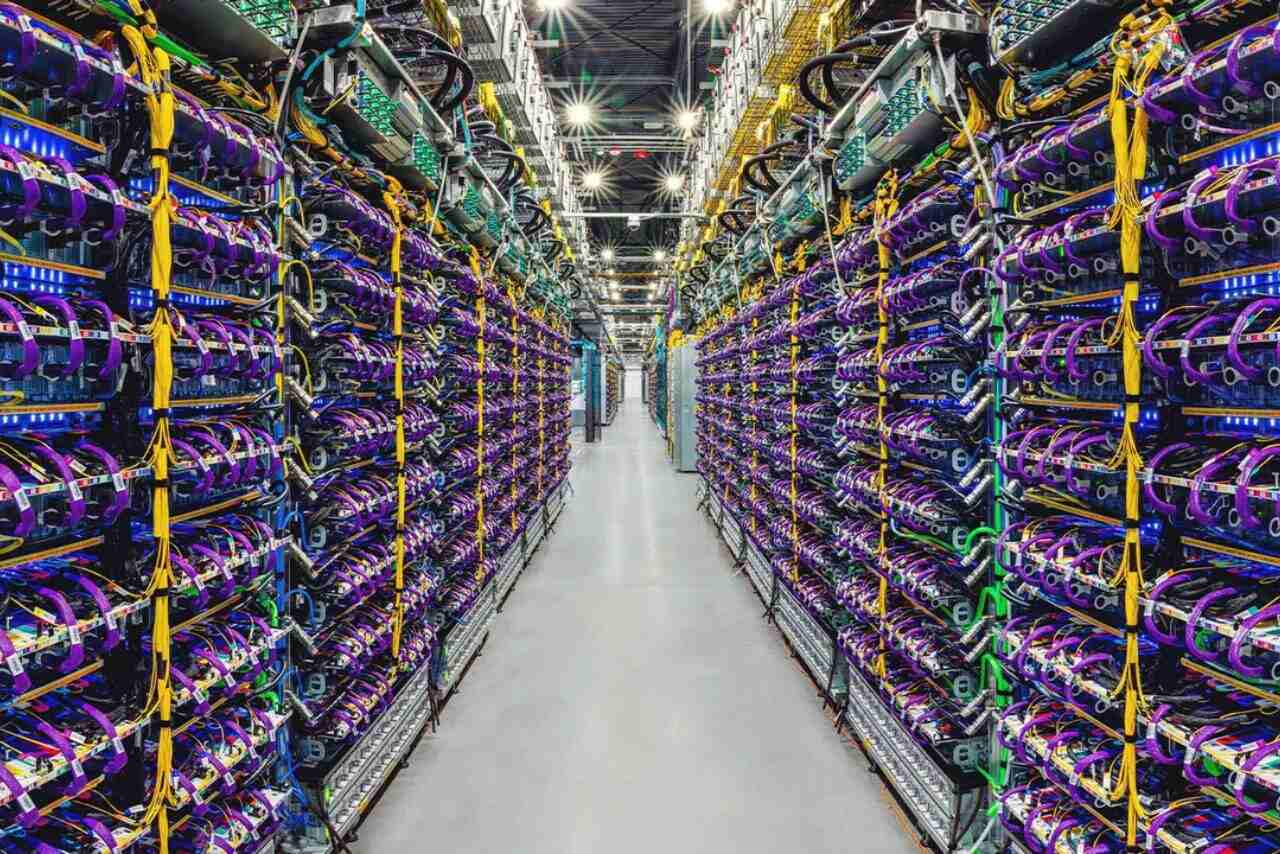

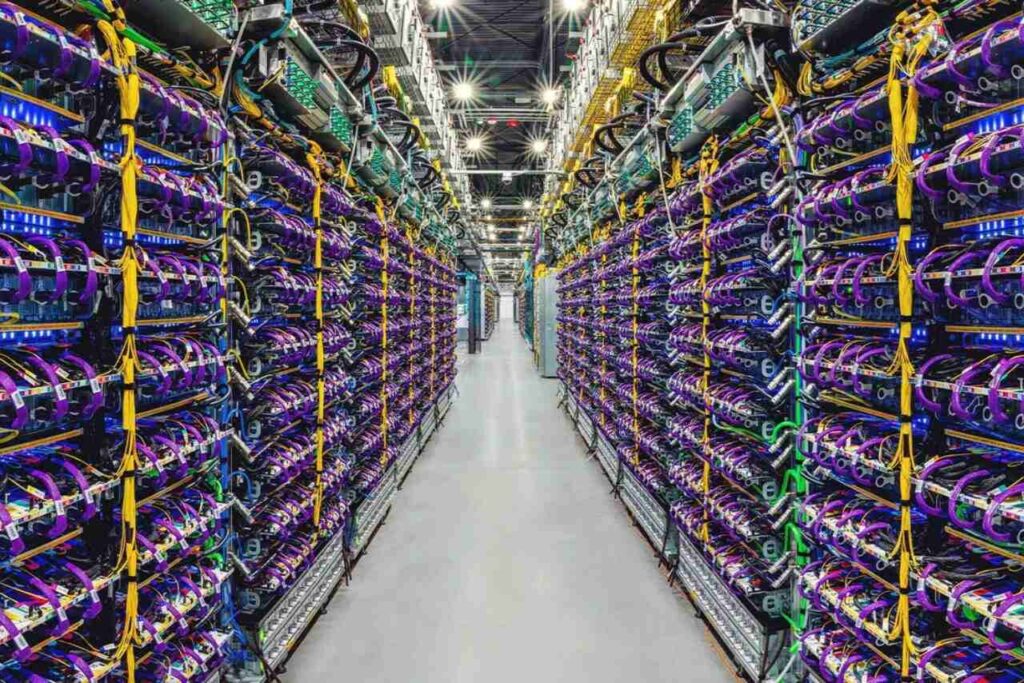

The shares of CG Power and Industrial Solutions Ltd have seen positive movement after securing a landmark Rs 900 crore ($99.2 million) export order from Tallgrass Integrated Logistics Solutions LLC for a large-scale US data center project. This deal marks CG Power’s entry into the global data center segment, one of the fastest-growing and most reliability-driven infrastructure markets worldwide.

Notably, this is the largest single order ever won by CG Power and involves the direct export of specially engineered power transformers for hyperscale data centers. The order underlines CG’s strong manufacturing capabilities and global competitiveness. Execution over 12–20 months with FAS Mumbai Port delivery further enhances revenue visibility and strengthens its export-led growth narrative.

Moreover, the order highlights CG Power and Industrial Solutions Ltd’s strong engineering and manufacturing capabilities. The transformers will be designed, manufactured, and tested at its advanced Indian facilities, reinforcing domestic execution strength. CG’s selection reflects confidence in its technical depth and disciplined CG EDGE operating model, which enables reliable, large-scale delivery of complex, global projects.

Amar Kaul highlighted that the Tallgrass order is a strategic breakthrough for CG Power and Industrial Solutions Ltd, marking its entry into the fast-growing global data center space. He noted it validates CG’s ability to deliver mission-critical, globally benchmarked solutions from India and opens a strong long-term pipeline aligned with cloud, AI, and margin-accretive global growth.

Financials

Looking ahead, CG Power and Industrial Solutions Ltd reported robust growth in Q2FY26. Revenue increased 21% from Rs 2,413 crore to Rs 2,923 crore. Net profit rose 29%, climbing from Rs 220 crore to Rs 284 crore, highlighting strong execution, improving margins, and sustained demand across key segments.

CG Power and Industrial Solutions Ltd has maintained a stable operating margin profile. OPM improved from 12% in Q2FY25 to around 13% in Q2FY26, reflecting better cost control and operating leverage. Despite higher expenses, consistent operating profit growth indicates disciplined execution and margin resilience across quarters.

CG Power and Industrial Solutions Ltd is a leading Indian electrical and engineering company with a strong presence in power and industrial systems. It manufactures transformers, switchgear, motors, and automation solutions, serving utilities, infrastructure, railways, and global industrial customers with a growing export footprint.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stock jumps 8% after receiving an order worth ₹900 Cr for US data center project appeared first on Trade Brains.

What's Your Reaction?