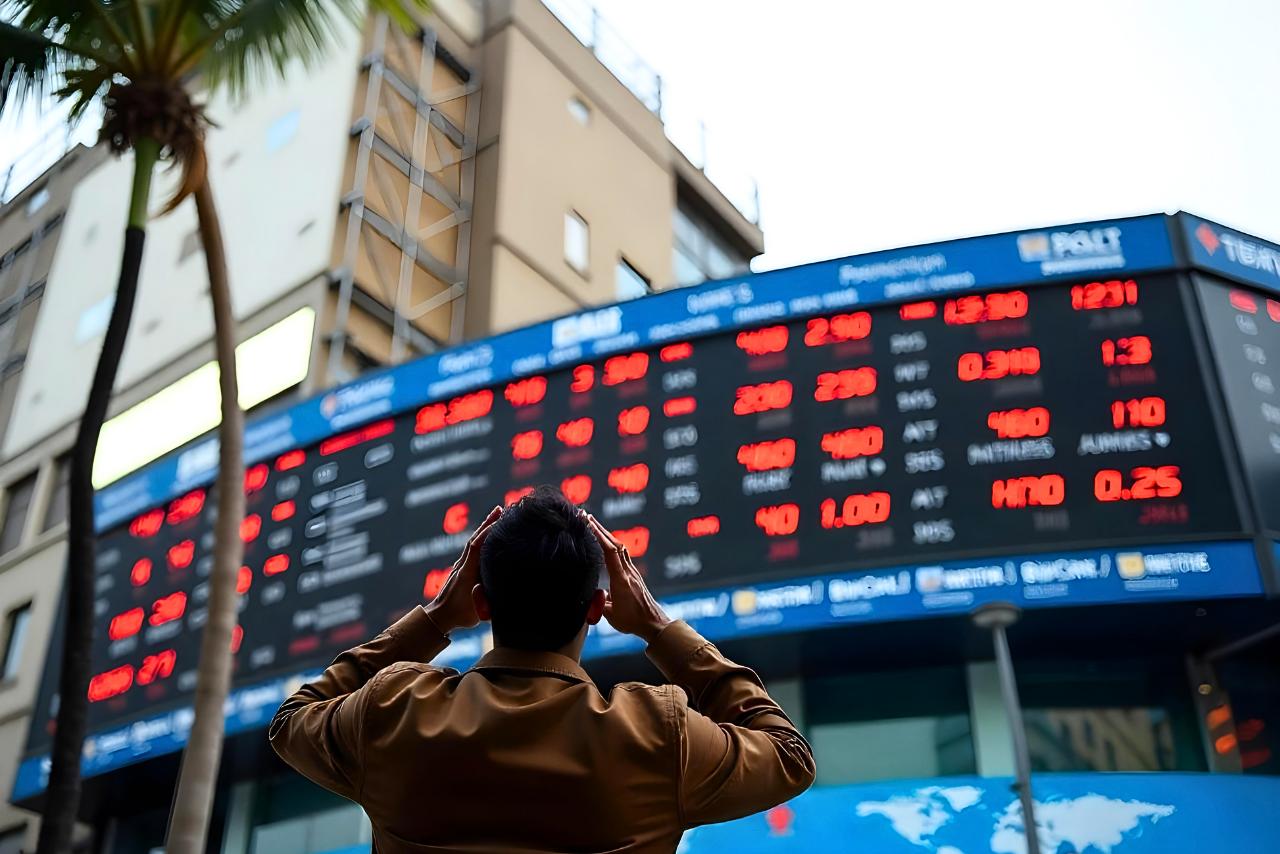

Stock market crash: Here are 6 reasons why markets are falling

Synopsis: Indian markets fell sharply due to FII selling, US tariff concerns, market pressure, rising crude oil prices, and a weak rupee, which has fueled both the Sensex and Nifty lower. The Indian stock market has experienced a significant fall today, with both the Nifty 50 and Sensex showing a considerable decline. Investors and traders […] The post Stock market crash: Here are 6 reasons why markets are falling appeared first on Trade Brains.

Synopsis: Indian markets fell sharply due to FII selling, US tariff concerns, market pressure, rising crude oil prices, and a weak rupee, which has fueled both the Sensex and Nifty lower.

The Indian stock market has experienced a significant fall today, with both the Nifty 50 and Sensex showing a considerable decline. Investors and traders are closely watching the evolving global and domestic market conditions as they try to understand the reasons behind this Bearish market.

In today’s session, both indices opened with a slight gap down, reflecting negative views from the start. As trading continued, buying pressure increased a bit, causing a slight rise in the indices. Then, as the session continued, both Sensex and Nifty led to a sharp intraday fall, highlighting the negative sentiment among market participants.

Index Overview

The equity benchmark indices extended their losses for the fifth straight session on Friday, as a combination of factors weighed on investor sentiment. The Nifty Index opened at 25,840.40, marking a slight gap-down opening from its previous close of 25,876.85, and fell by nearly 200 points from the previous close.

Meanwhile, the Sensex Index opened at 84,022.09, representing a slight gap-down from its previous close of 84,180.96, but has since declined more than 650 points from the previous close.

Here are the reasons for the fall

FII Selling

Foreign Institutional Investors (FIIs), who are major players in India’s financial markets, continued their selling streak on Thursday. They offloaded equities worth Rs. 3,367 crore, marking the fourth consecutive session in which they have been net sellers.

US Tariff Concerns

Investors are closely watching the US Supreme Court ruling on the legality of tariffs imposed by former President Trump. If the tariffs are declared illegal, the US government may be required to refund nearly USD 150 billion to importers.

The Chief Investment Strategist at Geojit said that after yesterday’s sharp drop due to the threat of 500% US tariffs on India under the Russia Sanctions Act, markets are now focused on today’s US Supreme Court verdict on the tariffs’ legality. A ruling against Trump could boost Indian markets, but the impact will depend on whether the tariffs are partially or fully struck down, as India has been most affected by the 50% tariffs.

Market Pressure

Benchmark indices have fallen sharply over the past four sessions, with the Sensex and Nifty down after Trump hinted at higher tariffs on Indian goods due to India’s Russian crude purchases. He has also approved a sanctions bill that could impose 500% tariffs on countries buying Russian oil.

US Senator Lindsey Graham noted that the bill would give Trump significant leverage over countries like India, China, and Brazil to curb Russian oil imports. Also, the CEO of Enrich Money, said that ongoing concerns over potential US tariffs and stalled US–India trade talks are keeping market sentiment fragile, particularly among foreign investors.

Rise in crude oil prices

Brent crude, the global oil benchmark, climbed 0.53 percent to USD 62.32 a barrel. Rising crude prices can raise India’s import costs and fuel inflationary pressures, which can, in turn, negatively impact the equity market.

Rupee weakness

The rupee fell 33 paise to 90.23 against the US dollar in Friday’s trade, opening at 89.86, due to sustained foreign fund outflows and rising crude prices. Forex traders cited concerns over potential US tariffs and weak domestic equity markets as key factors pressuring the currency.

Technical viewpoint

From a technical viewpoint, the Nifty index is currently trading around 25,680. The support is seen at the 25,400- 25,500 level, and if it continues to fall, it could decline further to 25,000. On the resistance side, the immediate resistance is at 26,000, with the next resistance around 26,300.

The Sensex index is currently trading around 83,520. The support is seen at the 83,000- 83,100 level. On the resistance side, the immediate resistance, the major resistance is seen at 86,000.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stock market crash: Here are 6 reasons why markets are falling appeared first on Trade Brains.

What's Your Reaction?