Stock under ₹30 hits 5% upper circuit after receiving orders from Ministry of Road Transport & Highways

During Wednesday’s trading session, the shares of a company specialising in managing infrastructure projects hit a 5 percent upper circuit on NSE, after the announced emerging as the Lowest Bidder (L1) for a project from the Ministry of Road Transport and Highways (MoRTH) of India. Price Movement With a market cap of Rs. 48.7 crores, […] The post Stock under ₹30 hits 5% upper circuit after receiving orders from Ministry of Road Transport & Highways appeared first on Trade Brains.

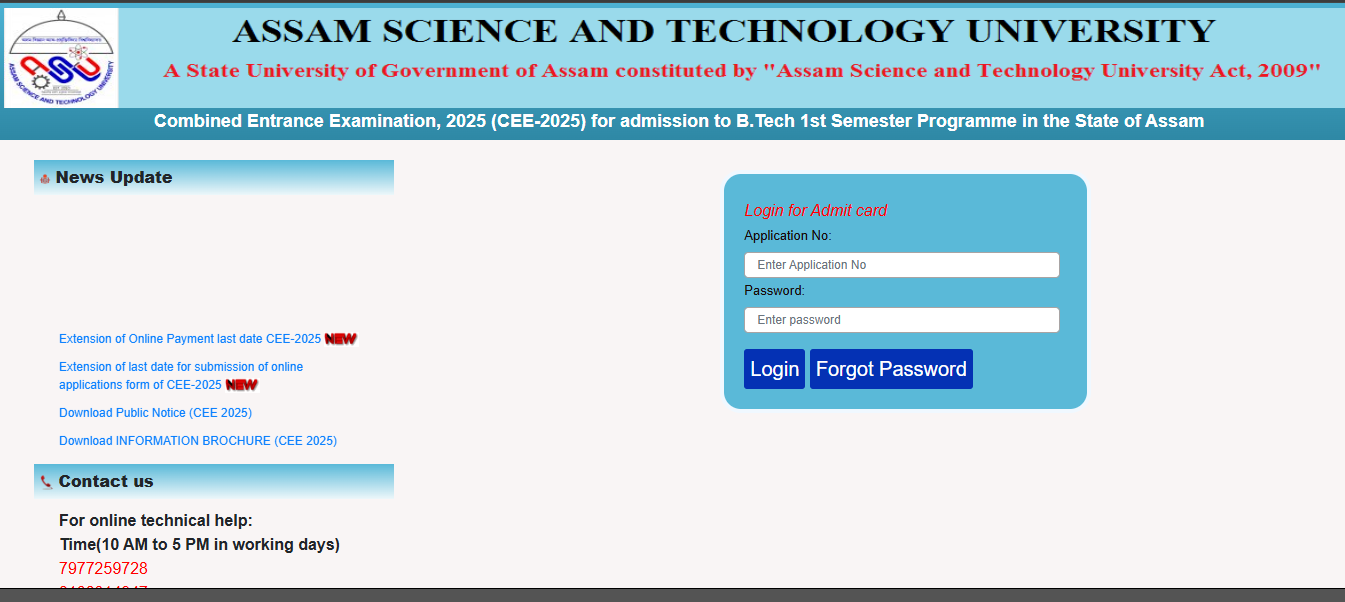

During Wednesday’s trading session, the shares of a company specialising in managing infrastructure projects hit a 5 percent upper circuit on NSE, after the announced emerging as the Lowest Bidder (L1) for a project from the Ministry of Road Transport and Highways (MoRTH) of India.

Price Movement

With a market cap of Rs. 48.7 crores, the shares of Manglam Infra & Engineering Limited hit a 5 percent upper circuit at Rs. 27.7, compared to its previous closing price of Rs. 26.4. The stock hit its 52-week high at Rs. 123.1 on 2nd August 2024, and compared to its closing price of Rs. 27.7, the stock is trading at a discount of nearly 77 percent.

What’s the news

As per the latest regulatory filings with the NSE, Manglam Infra & Engineering Limited emerged as the Lowest Bidder (L1) for a project from the Ministry of Road Transport and Highways (MoRTH) of India.

The project, valued at Rs. 2 crores, involves providing Consultancy Services for the Authority Engineer for the Shewali Fata to Kalambhir section (0.443 to 4.500) and Nizampur to Chadwel section (13.485 to 26.265) in Maharashtra. The project is expected to be completed within 18 months.

Additionally, on 4th March, the company was also declared L1 for another MoRTH project worth Rs. 1.97 crores. This project involves Consultancy Services for the Authority Engineer for the supervision of the section from 0.000 to Ch km 21.411 in Maharashtra, with an execution timeline of 18 months.

Also read: Why are FIIs consistently increasing their stake in GE Vernova and Transformers & Rectifiers?

Previous Order

25th February: Manglam Infra secured a contract worth ~Rs. 66.6 crores for Engaging Technical Consultant to prepare the Feasibility Study (FS) and Detailed Project Report (DPR) on an EPC mode for the construction of the Gelemo-Pukar La road (new alignment) from Km 0.00 to Km 25.00 (total length 25.00 km).

The project will follow Green Field Alignment to NHSL specifications in the Area of Responsibility (AOR) of 128 RCC under the 23 BRTF Project Arunank in Arunachal Pradesh.

Financials

Manglam Infra experienced a decline in its revenue from operations by around 50 percent, from Rs. 35 crores in H2 FY24 to Rs. 17.7 crores in H1 FY25. Similarly, its net profit increased during the same period down from Rs. 6.6 crores to Rs. 3 crores, indicating a decline of nearly 54.5 percent YoY.

About the company

Established in 2010, Manglam Infra & Engineering Limited is an engineering consulting organization engaged in the business of delivering design, planning, engineering, consulting and construction management solutions for highways, roads, bridges, tunnels, and buildings.

The company also provides services & solutions for rural and urban development, capacity building, and environmental engineering and undertakes construction material testing and geotechnical investigations.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stock under ₹30 hits 5% upper circuit after receiving orders from Ministry of Road Transport & Highways appeared first on Trade Brains.

What's Your Reaction?