Stocks to benefit after Govt. to boost green steel with 37% purchase mandate

The Steel Ministry has proposed a 37 percent purchase preference for green steel in government tenders, aiming to promote eco-friendly production methods. This move supports sustainability goals and boosts demand for green steel. Companies in the sector are expected to benefit from this policy shift. Here are a few companies that would benefit from this […] The post Stocks to benefit after Govt. to boost green steel with 37% purchase mandate appeared first on Trade Brains.

The Steel Ministry has proposed a 37 percent purchase preference for green steel in government tenders, aiming to promote eco-friendly production methods. This move supports sustainability goals and boosts demand for green steel. Companies in the sector are expected to benefit from this policy shift.

Here are a few companies that would benefit from this development:

1. Tata Steel Ltd

With a market capitalization of Rs.1.84 lakh crore, the share price of Tata Steel Ltd is currently trading at Rs.145.11 per share on Wednesday, 0.3 percent lower than its previous close.

Tata Steel is dedicated to achieving carbon neutrality by 2045 and is actively transitioning to green steel production. By 2030, the company aims to reduce emissions by 40 percent with the installation of a Direct Reduction Plant (DRP) and Electric Arc Furnaces (EAF) in the Netherlands.

Additional reductions are planned through the gradual decommissioning of blast furnaces, targeting an 80 percent emissions cut by 2045. The new EAFs at Port Talbot are projected to lower carbon emissions by up to 90 percent, equivalent to nearly 5 million tonnes of CO₂ annually. Tata Steel is also advancing hydrogen-based steelmaking to replace coking coal and prioritizes recycling and minimizing waste in its processes.

In its recent financial updates, the company’s revenue fell 3 percent to Rs.53,905 crore compared to the same quarter a year ago and net profits grew from a net loss of Rs.6,511 crore to Rs.759 crore in the same period.

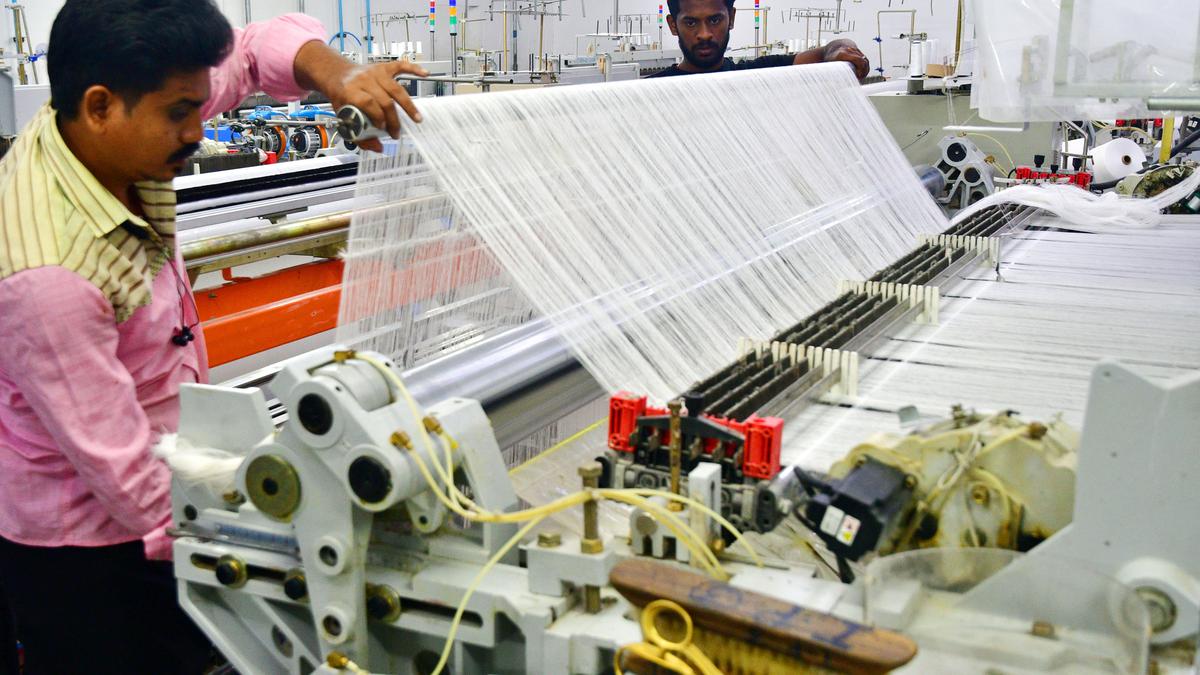

2. JSW Steel Ltd

With a market capitalization of Rs.2.41 lakh crore, the share price of JSW Steel Ltd is currently trading at Rs.955.85 per share on Wednesday, 1.14 percent lower than its previous close.

JSW Steel Ltd is advancing its commitment to sustainable steel production, aiming to position itself as a leader in green steel. The company, in collaboration with JSW Energy, is developing India’s largest commercial-scale green hydrogen project, with an initial annual output of 3,800 tonnes of green hydrogen, scaling up to 85,000-90,000 tonnes by 2030.

This initiative supports the production of green steel and contributes to significant carbon emission reductions. JSW Steel is also establishing a low-carbon steel manufacturing facility with a capacity of 4 million tonnes per year, with the first phase of 2 million tonnes set to commence by 2030.

The company has launched a decarbonization program aiming for a 42 percent reduction in CO₂ emission intensity by 2030 and plans to achieve complete recycling of solid waste.

Additionally, JSW Steel is adopting energy-efficient technologies and practices, resulting in reduced energy consumption and greenhouse gas emissions.

In its recent financial updates, the company’s revenue fell 11 percent to Rs.39,684 crore compared to the same quarter a year ago and net profits fell 85 percent to Rs.404 crore in the same period.

Also read….

3. Gensol Engineering Ltd

With a market capitalization of Rs.2,955 crore, the share price of Gensol Engineering Ltd is currently trading at Rs.781.95 per share on Wednesday, 1.25 percent higher than its previous close.

Gensol Engineering Ltd is leading the charge in sustainable steel production in India through its collaboration with Matrix Gas & Renewables to establish the nation’s first and largest green hydrogen-powered steel plant. Aligned with the National Green Hydrogen Mission, this project will utilize 100 percent green hydrogen in place of traditional fossil fuels, enabling substantial reductions in carbon emissions.

The initiative involves a capital investment of Rs.321 crore, with 50 percent of the cost supported by government incentives. The facility will leverage direct reduced iron (DRI) vertical shaft technology, optimized for Indian-grade iron ore, to produce sponge iron without emitting CO₂.

With an initial capacity of 50 tons per day (TPD), this pilot project is set to serve as a model for future green steel facilities in the country. Gensol’s collaboration also includes partnerships with the Indian Institute of Technology Bhubaneswar and Sweden-based Metsol AB, reflecting its focus on innovation and sustainability.

Additionally, Gensol is advancing India’s first biomass-to-green hydrogen project, aiming to produce 1 tonne of green hydrogen daily from bio-waste.

In its recent financial updates, the company’s revenue grew 14 percent to Rs.346 crore compared to the same quarter a year ago and net profits grew 28 percent to Rs.23 crore.

Written by – Siddesh S Raskar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stocks to benefit after Govt. to boost green steel with 37% purchase mandate appeared first on Trade Brains.

What's Your Reaction?