Trump vs Putin: Who will India prioritise amid 500% tariff blackmail?

Synopsis: India strategically benefits from Venezuela’s crisis by diversifying crude suppliers away from Russian dependency. With oil prices falling to $50/bbl by June 2026, India gains inflation relief, rupee strength, and GDP boost. ONGC and RIL stocks rally on potential Venezuelan asset recovery and refining margin expansion. Long-term energy security improves through multi-source sourcing strategy […] The post Trump vs Putin: Who will India prioritise amid 500% tariff blackmail? appeared first on Trade Brains.

Synopsis: India strategically benefits from Venezuela’s crisis by diversifying crude suppliers away from Russian dependency. With oil prices falling to $50/bbl by June 2026, India gains inflation relief, rupee strength, and GDP boost. ONGC and RIL stocks rally on potential Venezuelan asset recovery and refining margin expansion. Long-term energy security improves through multi-source sourcing strategy

As the world watches geopolitical turbulence unfold in Venezuela, refinery chiefs in India are quietly calculating spreadsheets with growing confidence. While global oil markets brace for uncertainty, India finds itself in a peculiar position, not threatened, but strategically positioned. The Venezuelan crisis of January 2026 exposes a truth that India’s policymakers understood years ago: energy security is built not on dependency on a single supplier, but on the agility to pivot when the geopolitical tectonic plates shift.

For decades, India’s energy imports resembled a delicate balancing act. But in the span of just four years, from the Ukraine war to today, India has fundamentally rewired its crude sourcing architecture. What started as a crisis-driven scramble to offset Western sanctions on Russian oil has evolved into a sophisticated, multi-vector energy strategy. And now, as Venezuela’s political landscape undergoes American intervention, India isn’t bracing for impact; it’s preparing for opportunity.

A Brief History

To understand India’s current positioning, one must first rewind to the 2000s and 2010s, when Venezuelan crude was the crown jewel of India’s oil imports. Back then, Indian refineries, particularly complex refineries like those operated by Reliance Industries, imported over 400,000 barrels per day of Venezuelan heavy crude. At its peak in 2013, Venezuela accounted for a robust 12.4% of India’s total crude oil basket.

ONGC Videsh Ltd (OVL), India’s flagship overseas oil arm, was deeply invested in the Orinoco belt, Venezuela’s treasure trove of extra-heavy crude. The San Cristobal oilfield, jointly operated by OVL and Venezuela’s state oil company PDVSA, was a crown jewel in India’s upstream portfolio. This wasn’t just about buying oil; it was about securing strategic equity stakes in some of the world’s most prolific oil reserves.

However, this golden era came crashing down in 2019. The Trump administration’s sweeping sanctions on Venezuela made trade relationships radioactive. What had been a comfortable $6 billion bilateral trade relationship in 2019 collapsed to just $364.5 million by FY25, a staggering 94% decline in mere years. Worse, Indian refiners were forced to cut Venezuelan imports to near-zero to avoid secondary sanctions. OVL’s production at San Cristobal plummeted from operating levels to a mere 5,000-10,000 barrels per day, essentially stranded reserves in a country under American economic siege.

This retreat wasn’t just a loss of crude barrels; it represented nearly $1 billion in unpaid dividends and debt to Indian entities, trapped capital that would remain inaccessible for years.

Evolution of India’s Crude Oil Import Sources: From Venezuelan Dependence (2013) to Diversified Strategy (2026 Projected)

The Russian Interlude: Tactical Necessity Masquerading as Strategy

As Venezuelan supplies evaporated post-2019, India faced an uncomfortable reality. Its traditional Middle Eastern suppliers, Saudi Arabia, Iraq, and others, offered geopolitically reliable but costlier alternatives. The Indian economy, growing at 7%+ annually, required consistent, affordable crude.

Then came February 2022 and Russia’s invasion of Ukraine. Western nations pivoted away from Russian oil in moral indignation. But India, guided by rational energy security calculus and its foreign policy of strategic autonomy, did not. Instead, as European refineries shuttered Russian supply lines, India stepped in, buying discounted barrels at steep discounts. Russian crude, which traded at a $14-17 per barrel discount to Brent in 2023, was too attractive to ignore for an energy-importing nation battling inflation.

By 2024-25, Russia had become India’s largest crude supplier, accounting for nearly 40% of all imports, a meteoric rise from near-zero before the Ukraine war. India has accumulated €144 billion ($162 billion) worth of Russian oil imports since 2022, becoming Moscow’s lifeline as European and American markets shut the door.

However, this period, while economically rational, was always designed as a tactical interlude, not a permanent strategy. Indian policymakers understood the vulnerability of over-dependence on sanctioned suppliers. The risk was always clear: secondary sanctions targeting India itself, or sudden supply disruptions if geopolitical winds shifted.

The Pivot Begins

Fast-forward to November 2025. The U.S. imposed fresh sanctions on Russia’s major oil exporters, Rosneft and Lukoil, which together supplied 60% of Indian Russian crude intake. The response from Indian refiners was instructive: they didn’t panic; they pivoted. Within weeks, Indian refiners had secured supply diversification orders across multiple regions. The strategy was clear and multi-pronged:

From the Middle East: Indian refiners locked in commitments from Saudi Arabia, Iraq, Kuwait, and the UAE, collectively accounting for nearly 40% of India’s import basket. Unlike the volatility of sanctioned suppliers, Middle Eastern crude, while priced higher, came with geopolitical stability.

From the United States: India’s refiners identified 24 million barrels of American crude for early 2026 delivery, a dramatic shift from the near-zero U.S. imports of the 2000s and 2010s.

From Africa: West African crudes (Nigeria, Angola) began flowing in increasing quantities, offering quality and pricing flexibility.

From the Americas: Brazil, Guyana, Colombia, and Argentina emerged as rising options, particularly as U.S. tariffs on Russian crude made Washington’s own crude increasingly competitive.

By December 2025, the results were visible in import data. While Russian shipments averaged 1.8 million barrels per day in November, refiners, already anticipating sanctions, had begun front-loading purchases before the November 21 deadline. Post-sanctions, Russian volumes contracted. By early January 2026, Reliance Industries announced it would not expect Russian crude deliveries as negotiations continued on potential trade deals. The diversification wasn’t a retreat; it was strategic rebalancing. Over 80% of India’s crude now sourced from Russia and the Middle East reflected this calculated positioning.

Venezuela’s Crisis: India’s Long-Awaited Inflection Point

Then came January 3, 2026. American special forces conducted an operation in Venezuela, effectively removing President Nicolás Maduro from power. For most nations, this would spell energy market uncertainty. For India, it opened a door that had been slammed shut for six years.

On the surface, the Venezuelan crisis presents no immediate threat to India. In 2025, Venezuela contributed merely 0.6% of India’s crude mix, averaging just 28,000 barrels per day, down from the 400,000 bpd glory days. With India importing 178 million tonnes between April-November 2025 and Venezuelan supplies effectively non-existent, the short-term energy impact is negligible.

But this is where the opportunity emerges.

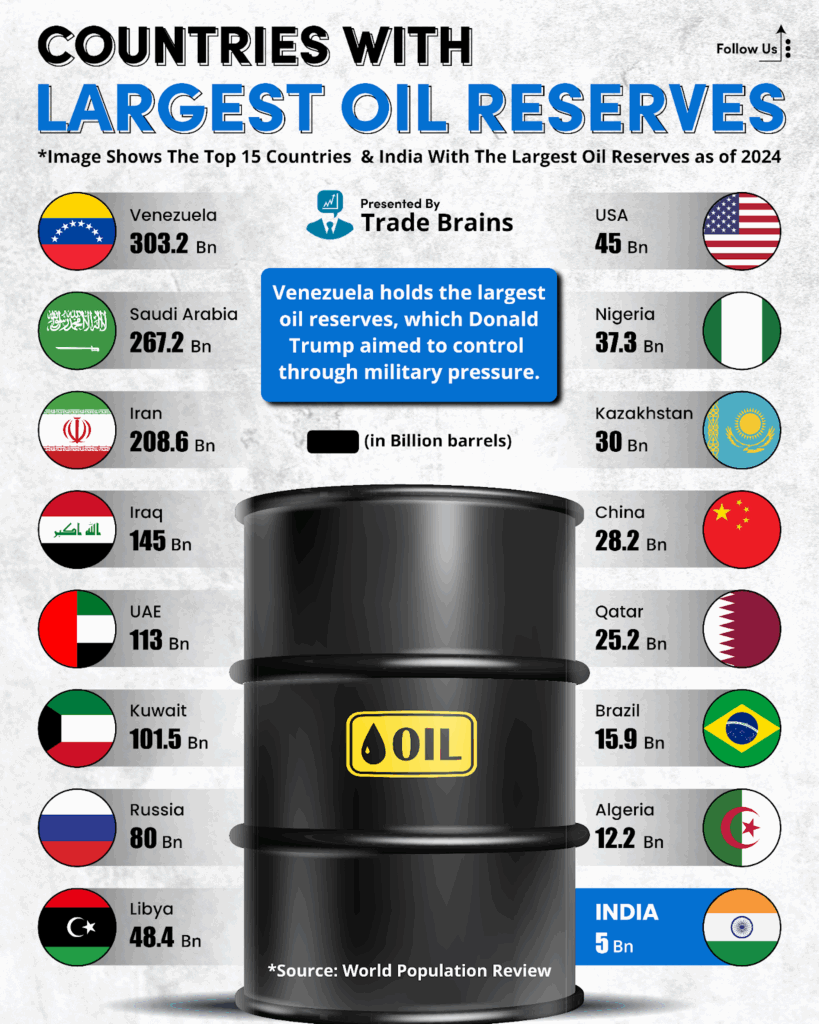

Venezuela holds 18% of the world’s proven oil reserves, more than Saudi Arabia (16%), Russia (5-6%), and the United States (4%) combined. If American intervention leads to sanctions relief and restructuring of Venezuela’s oil sector, the long-term implications for India are profound.

First, there’s the capital recovery angle. OVL’s investments in San Cristobal, tied up for years in disputed payments, could be revived. Industry experts suggest that if sanctions are eased and U.S. companies resume Venezuelan oil sector investments, OVL could potentially revive production to 80,000-100,000 barrels per day, a 10x increase from current stranded output. Beyond crude production, OVL could recover nearly $1 billion in pending dividend payments owed by PDVSA.

Second, there’s the crude supply angle. Indian refineries, particularly those with complex refining capability (like RIL’s), are uniquely suited to process Venezuelan heavy crude. The price economics are compelling. Pre-sanctions, Venezuela offered crude at attractive discounts, $496 per tonne versus an average of $586 per tonne in FY25. If Venezuelan crude re-enters global markets under American stewardship and a new governance structure, it would likely re-emerge at a discount to lighter crudes, making it economically attractive for India’s specialized refineries.

Third, there’s the geopolitical repositioning. By the 2010s, India and Venezuela were strategic partners in OPEC and non-OPEC forums. Renewed access to Venezuelan crude would give India enhanced negotiating leverage with other suppliers, the ability to pit options against each other, securing better pricing and terms.

The Stock Market’s Verdict

The market reaction to the Venezuelan developments was swift and telling. On January 5, 2026, oil stocks in India surged as institutional money rotated into energy names on the betting that geopolitical shifts could benefit upstream producers.

ONGC, India’s flag-bearer in upstream exploration, emerged as the top gainer on the Nifty 50 index, climbing 2% to Rs 246.80. Why? ONGC holds strategic interests in foreign oil assets and would directly benefit from OVL’s recovery in Venezuela. The market was pricing in the possibility of dividend upside when stranded assets come back online.

Reliance Industries extended its bull run, hitting a fresh 52-week high of Rs 1,611.80, taking its market capitalization to nearly Rs 22 lakh crore. RIL benefits on two counts: (1) its complex refineries are ideally positioned to process Venezuelan heavy crude, and (2) it has the technological edge and scale to benefit from diversified supply chains.

Even downstream oil marketing companies (OMCs) rallied. HPCL jumped 6% to Rs 508.45, a 52-week high, while BPCL gained 4% to Rs 385.45, also marking year-highs. The logic: if Venezuelan crude re-enters as a discounted supply option, refining margins improve and downstream distribution becomes more lucrative.

Within the broader Oil & Gas index, there was broad-based strength. The index surged 2.5% as traders bet on a virtuous cycle: lower crude costs to refiners, better margins, and higher earnings for stakeholders across the value chain.

This wasn’t euphoria; it was rational pricing of probabilities. Investors were calculating: What if Venezuelan crude re-enters at $45-50 per barrel while the broader market settles at $55-60? That arbitrage could be substantial.

Indian Oil & Gas Stocks Rally: Recent Performance (Early January 2026) Amid Venezuela Crisis and Supply Diversification

In January 2026, US President Donald Trump backed the “Sanctioning Russia Act of 2025,” a bipartisan bill that threatens tariffs of up to 500% on countries importing Russian oil, directly targeting India, China, and Brazil. This escalates from the existing 50% tariffs already imposed in August 2025, making India’s energy security and trade relations precarious. India has shifted its sourcing strategy away from Russian dependency by increasing purchases from multiple regions such as the Middle East, LATAM and North America.

India has demonstrated tactical compliance by cutting Russian imports by 38% from November to December 2025, reaching near three-year lows of 1 million bpd. However, India has continued purchasing through alternative channels, sourcing from non-sanctioned Russian suppliers like Tatneft, Redwood Global Supply, Rusexport, and Morexport, which replaced the sanctioned Rosneft and Lukoil.

India is actively pursuing alternative export markets to reduce US dependence, such as Negotiating trade agreements with EU, Japan, and ASEAN nations to diversify export destinations, expanding bilateral trade relationships with non-US markets to hedge against tariff escalation, and targeting emerging markets in Africa and Southeast Asia to create new revenue streams. In this way, India is positioning itself as a responsible buyer, maintaining sanctions compliance while asserting strategic autonomy on energy security, neither fully aligning with the US nor with Russia.

The Oil Price Inflection: A Tailwind for India

The Venezuelan crisis occurs at an unexpected juncture in the global oil cycle. By January 2026, crude prices were under significant pressure. The Indian crude basket, which averaged Rs 62+ per barrel in late 2025, was trending downward. More importantly, global supply conditions had shifted decisively.

The International Energy Agency projected global oversupply of 3.85 million barrels per day in 2026, approximately 4% of world consumption. This wasn’t a blip; it reflected structural changes: OPEC+ had increased production by nearly 2.9 million barrels per day from April to December 2025, inventory builds were accelerating, and demand growth remained underwhelming globally, particularly with electric vehicle adoption capping growth.

SBI Research, in its January 2026 analysis, projected that the Indian crude basket could fall to $50 per barrel, or potentially lower, by June 2026. Other brokerages and the U.S. Energy Information Administration offered similar guidance, with Brent crude expected to average $55 per barrel in Q1 2026, down from $60+ in late 2025.

For India, this price deflation is a massive tailwind. Consider the economics: A 14% decline in crude prices translates to a 22 basis point reduction in Consumer Price Index inflation. With the Reserve Bank of India targeting 4% inflation and current levels around 3.4%, lower oil prices create policy flexibility. If crude prices hit $50 per barrel, imported inflation pressures ease substantially, potentially allowing the RBI room for rate cuts if growth falters.

Moreover, lower crude prices support currency stability. SBI Research estimates that a 14% fall in crude prices could drive a 3% rupee appreciation, taking the USD/INR rate from 90.28 to approximately Rs 87.5 per dollar. A stronger rupee improves import competitiveness and reduces external debt servicing costs.

At the macro level, SBI projects an estimated 10-15 basis points boost to GDP growth, a meaningful contribution to India’s growth trajectory as the world’s fastest-growing major economy.

India’s Strategic Response to 500% US Tariff Threat: Safeguarding Energy Interests

What makes India’s current energy strategy distinct from previous cycles is that it’s not merely reactive; it’s proactive and strategic. The government has quietly but systematically built infrastructure and policy frameworks to support energy security.

- Strategic Petroleum Reserves provide buffers against supply shocks, with capacity to store crude for several weeks of national consumption.

- Dynamic Pricing Mechanism transmits global crude prices to consumers in near-real-time, creating incentive alignment and reducing fiscal strain during price spikes.

- Diversified Sourcing facilitated through government coordination enables long-term contracts with multiple suppliers across geographies, reducing concentration risk.

- Trade Negotiations with the U.S. are actively ongoing to secure tariff relief while demonstrating energy cooperation and diversification away from Russian crude.

- Energy Transition Initiatives include concurrent investments in renewable energy, ethanol blending (E20 fuels), and electric vehicle adoption, gradually moderating demand growth and reducing energy import dependency.

- Upstream investments through ONGC Videsh continue in exploration and production in stable geographies, building medium-term supply security.

The Road Ahead: From 2026 to 2030

Looking ahead, the trajectory is becoming clearer. The next phase of India’s energy strategy will likely see:

Continued Russian exposure, but at lower levels. Sanctions have made Russian supplies riskier and more expensive (wider risk premiums). Unless secondary sanctions are relaxed or U.S. policies shift, Russian crude’s share of India’s basket could stabilize around 15-20%, down from the 35-40% seen in late 2025.

Middle Eastern Renaissance: Saudi Arabia, Iraq, and other Gulf producers will likely reclaim primacy in India’s crude basket. Expect the 42-43% share seen in late 2025 to rise toward 50-55% by 2027.

Emerging alternatives: African, American, and Latin American crude will comprise the diversified residual. As Guyana’s production ramps (already a major supplier to Asia) and Brazil’s deepwater fields mature, India’s portfolio will become increasingly varied.

Venezuelan revival (if sanctions ease): If U.S. policy enables Venezuelan oil sector revival and sanctions are progressively lifted, India could re-emerge as a significant Venezuelan crude buyer by 2027-28. Expect the 400,000 bpd glory days to normalize at 100,000-150,000 bpd, material enough to move the needle on India’s economics and provide pricing leverage.

Price normalization: Oil prices, after the oversupply-driven depression of 2025-2026, are likely to normalize toward $55-70 per barrel in the 2027-30 period as demand recovery and supply discipline reassert themselves. However, the structural shift toward non-OPEC, high-cost production (U.S. shale, deepwater) will likely keep prices lower than the 2010s average ($80-100).

Analyst’s Opinion

From my perspective, the Venezuelan crisis marks an inflection point, not because of immediate supply impacts, but because it crystallizes India’s strategic shift. For over two decades, India’s energy security was built on Middle Eastern dependency, a stable but politically constrained model. The Ukraine war and Russian sanctions forced an abrupt reorientation toward discounted Russian crude. Now, with Venezuelan opportunities emerging and Russian supplies becoming unreliable, India is evolving toward true diversification, a portfolio approach where no single supplier controls more than 40-45% of crude mix. This is strategically sound and economically rational.

For investors, the implication is clear: Oil and gas stocks are transitioning from geopolitical plays to fundamental value plays. ONGC becomes attractive not because of short-term Venezuelan upside, but because stranded assets in Venezuela could unlock years of production growth and dividend upside from 2027 onwards. RIL’s complex refineries will benefit from margin expansion as crude basket diversification moderates input costs. OMCs will see sustained margin benefits as lower crude prices persist through 2026 and refining efficiency improves. However, I’d caution that the Venezuelan upside is a medium-term story (2027-2030), not a 2026 catalyst. Near-term (2026), the dominant factor will be oil price deflation and its impact on inflation, rupee strength, and GDP growth.

The broader economy benefits far more from $50 crude than energy stocks do. For Indian policymakers, the strategic takeaway is equally clear: Energy security is best built not through geopolitical alignment with single suppliers, but through infrastructure, technology, and portfolio diversity. The next frontier should be accelerating renewable energy capacity, scaling battery storage, and continuing ethanol blending and EV adoption, reducing absolute oil import dependency, not just diversifying suppliers. India’s energy story, at the inflection of 2026, is one of quiet strength. It’s not dramatic; it’s planned. And that, in energy security, is precisely the point.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Trump vs Putin: Who will India prioritise amid 500% tariff blackmail? appeared first on Trade Brains.

What's Your Reaction?