2 Bank stocks with loan book of more than 85% to keep an eye on

Synopsis: Banks with a predominantly secured loan book tend to exhibit stronger asset quality and lower earnings volatility. Kotak Mahindra Bank and IDFC First Bank stand out with over 85% of their loan portfolios secured, reflecting a conservative and risk-aware lending approach. In a scenario where there is intense focus on unsecured lending and growing […] The post 2 Bank stocks with loan book of more than 85% to keep an eye on appeared first on Trade Brains.

Synopsis: Banks with a predominantly secured loan book tend to exhibit stronger asset quality and lower earnings volatility. Kotak Mahindra Bank and IDFC First Bank stand out with over 85% of their loan portfolios secured, reflecting a conservative and risk-aware lending approach.

In a scenario where there is intense focus on unsecured lending and growing concerns about credit risks, banks with a larger proportion of secured lending are being viewed as more attractive options by investors. A secured loan portfolio, which is secured by collateral such as real estate, vehicles, or gold, is generally more resilient to credit risks. Kotak Mahindra Bank and IDFC First Bank have carved a niche for themselves by maintaining a secured loan portfolio of over 85%.

Their strategy of focusing on asset-backed lending has helped them maintain a stable asset quality, enhance visibility, and mitigate risks, making them more resilient in the wake of changing regulatory and credit scenarios in the Indian banking industry.

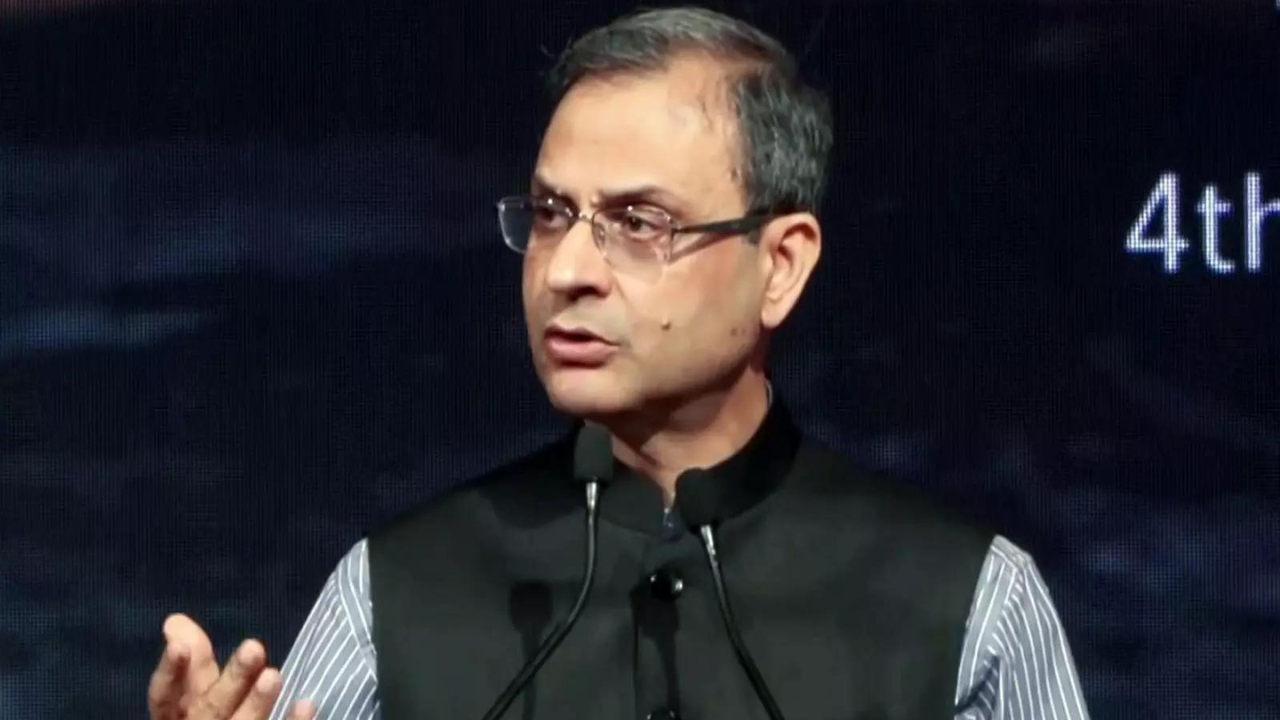

Kotak Mahindra Bank Ltd

Kotak Mahindra Bank is a diversified financial services group providing a wide range of banking and financial services, including retail banking, treasury and corporate banking, Investment Banking, stockbroking, vehicle finance, advisory services, asset management, life insurance and general insurance.

With the market cap of Rs 4,09,291 crore, the shares of Kotak Mahindra Bank Ltd have closed at Rs 411.5 and are trading at a PE of 21.8, whereas its industry PE is at 15.8. The shares are trading just 10.6% below their 52-week high price.

Kotak Mahindra Bank continues to have a highly secured loan book, with unsecured retail loans comprising only 8.9% of the total as of December 2025. This means that the bank has more than 91% of its retail loan book secured, which is a testament to the bank’s conservative approach to lending.

The fact that the unsecured loan portion has been steadily decreasing over the past few quarters is a sign of the bank’s disciplined approach to lending. A secured loan book is also a key factor behind Kotak’s strong asset quality and ability to withstand credit cycles with lower earnings volatility.

Kotak Mahindra Bank has shown strong operating results in Q3 FY26, with PAT increasing to Rs 3,446 crore, backed by strong profitability ratios. Although NIM eased to 4.54% compared to the same period last year, the bank’s ROA of 1.89% remains healthy, indicating optimal use of the balance sheet. Cost management continues to be prudent, with the cost-to-income ratio at 48.3%, and credit cost remains low at 0.63%, indicating prudent risk management and stable asset quality.

The balance sheet remains strong, with customer assets rising to Rs 5,29,455 crore and deposits rising to Rs 5,42,638 crore, showing robust YoY growth. The asset quality further improved, with net NPA reducing to 0.31% and CASA ratio of 41.3%, indicating stable funding. The bank’s capital adequacy remains comfortable, with a CAR of 22.6%, offering a sufficient buffer against any adversity.

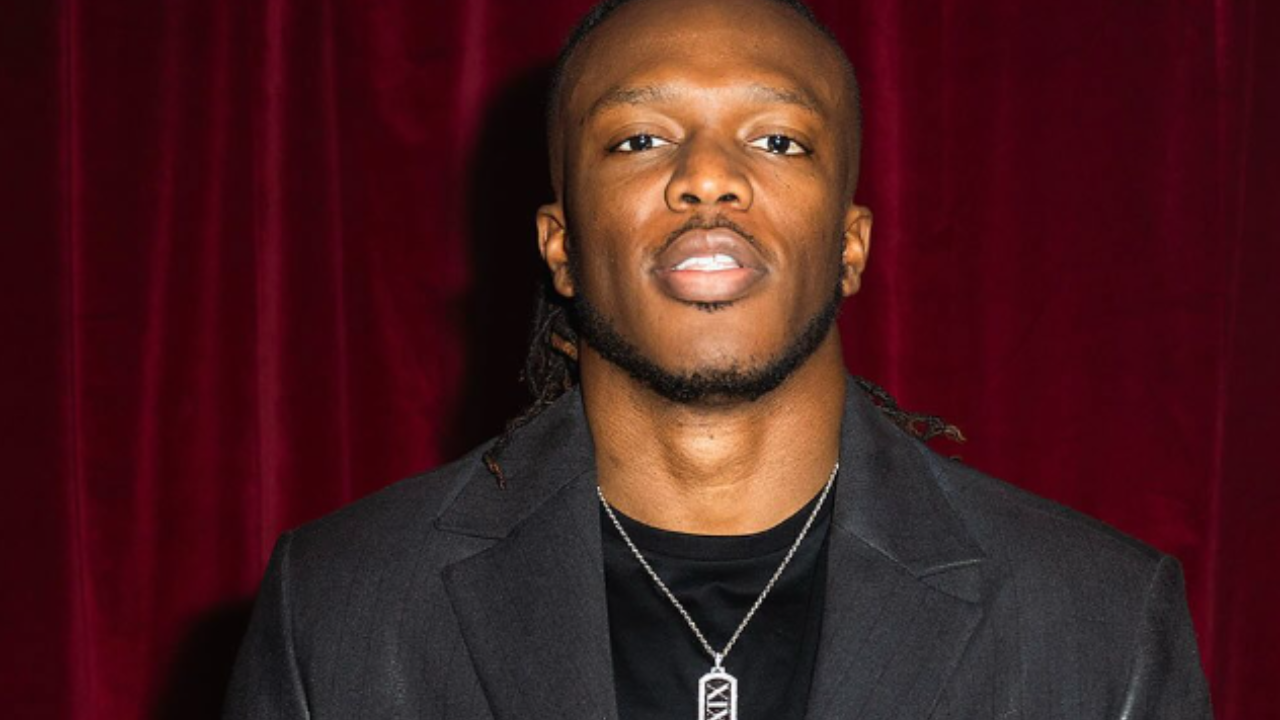

IDFC First Bank Ltd

IDFC First Bank is a fast-growing, new-age private sector bank, formed by the merger of IDFC Bank and Capital First in 2018. Since 2019, it has expanded its product range, including loans, deposits, and wealth management, and introduced new products like home loans, credit cards, FASTag, etc.

With the market cap of Rs 73,468 crore, the shares of IDFC First Bank Ltd have closed at Rs 85.5 and are trading at a PE of 46.7, whereas its industry PE is at 15.8.The shares have given a return of 76% over the last 5 years.

IDFC First Bank disclosed that only 14% of its overall loan portfolio is unsecured retail lending, which means that the remaining 86% of its loan portfolio is secured. This secured bias is fuelled by the bank’s housing loans, LAP, auto loans, and other asset-backed retail loans.

The secured loan business of the bank has helped it maintain its improving asset quality, with GNPA and NNPA under control. The secured loan book helps the bank maintain its earnings visibility.

The bank has reported loans and advances of Rs 2,79,428 crore, marking a 21% YoY growth, which is a clear indication of the robust credit demand in the key sectors. The bank’s asset quality has remained stable, with GNPA of 1.69% and NNPA of 0.53%, which have registered a marginal improvement on a YoY basis. The fact that the NPAs have remained under control indicates that the bank has been following prudent lending practices and monitoring, despite the fact that the loan book has grown at a healthy pace.

On the funding side, the bank has a robust deposit base, with CASA deposits of Rs 1,50,350 crore and a CASA ratio of 51.6%, which is a clear indication of the bank’s ability to maintain a low cost of funds. The bank’s capital position remains comfortable, with a capital adequacy ratio of 16.22%.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post 2 Bank stocks with loan book of more than 85% to keep an eye on appeared first on Trade Brains.

What's Your Reaction?

.png)