3:1 Bonus Shares: Auto Ancillary Stock Jumps 6% After Announcing Q3 Results and Bonus Issue

Synopsis: Auto components stock surged 6% after announcing a 3:1 bonus issue and strong Q3 results. Revenue grew 26% YoY, while net profit jumped 147% YoY, reflecting improved margins and performance. A micro-cap company, primarily engaged in the manufacturing of valves and cores for automobile tubes and supplies to tyre, tube and original equipment manufacturers, […] The post 3:1 Bonus Shares: Auto Ancillary Stock Jumps 6% After Announcing Q3 Results and Bonus Issue appeared first on Trade Brains.

Synopsis: Auto components stock surged 6% after announcing a 3:1 bonus issue and strong Q3 results. Revenue grew 26% YoY, while net profit jumped 147% YoY, reflecting improved margins and performance.

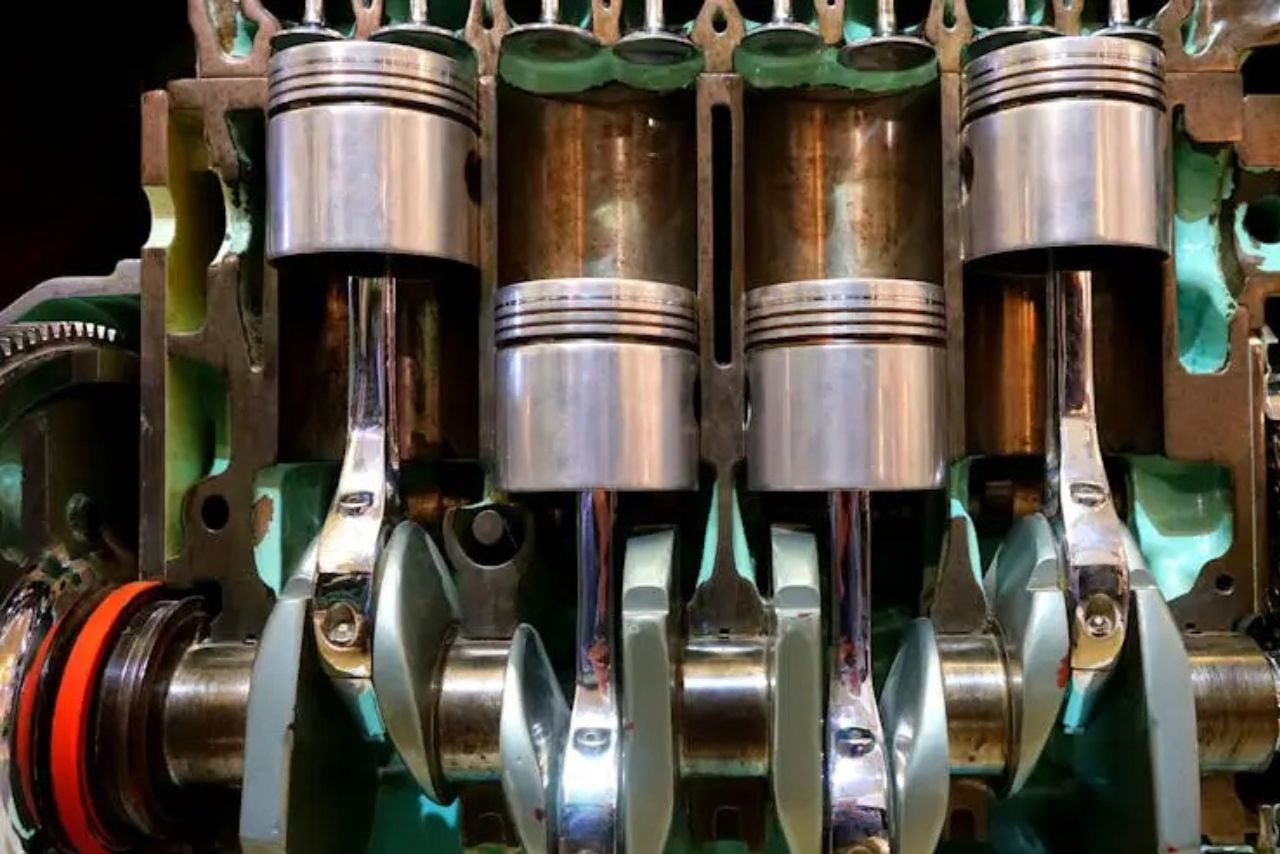

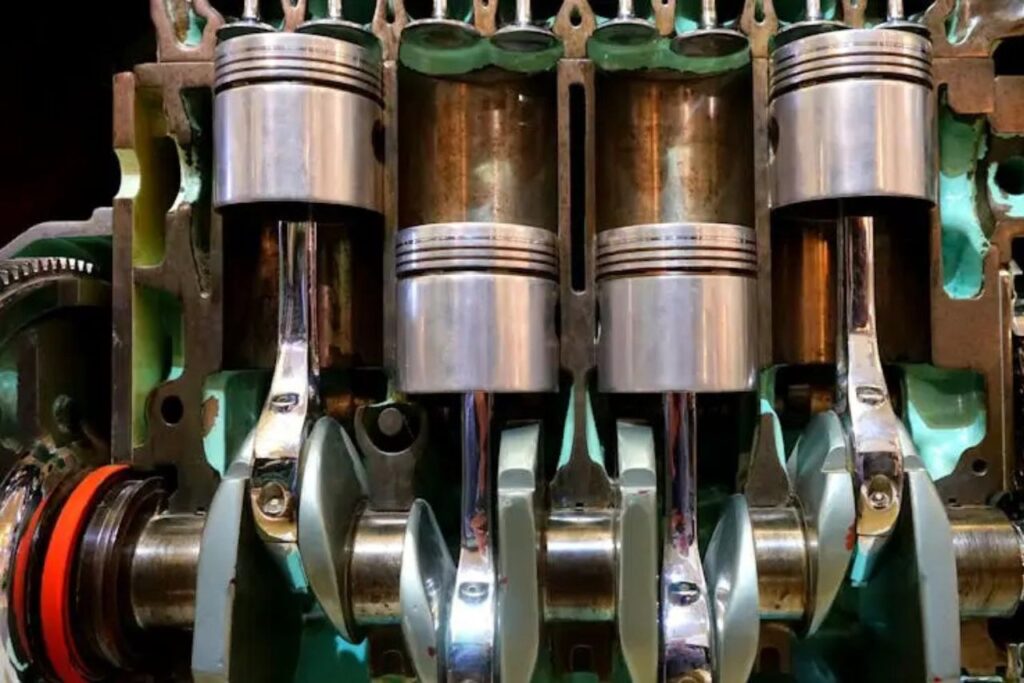

A micro-cap company, primarily engaged in the manufacturing of valves and cores for automobile tubes and supplies to tyre, tube and original equipment manufacturers, has come into the spotlight following the announcement of its Bonus Issue, attracting attention from investors and market watchers.

With a market capitalization of Rs. 453.81 crore, the shares of Triton Valves Limited were trading at Rs. 3,543.95, up by 1.05 percent from its previous day’s closing price of Rs. 3,507.25 per equity share. The stock has touched an intraday high of Rs. 3,721.80 implying an upside of 6.12 percent from previous day’s close price.

Bonus Issue

The Board of Directors, at its meeting held on February 12, 2026, recommended the issuance of bonus shares in the ratio of 3:1, meaning three fully paid-up equity shares of Rs. 10 each will be issued for every one fully paid-up equity share held, subject to shareholders’ approval and compliance with the applicable provisions of the Companies Act, 2013. Upon approval, the company will utilize Rs. 384.16 lakhs from its securities premium account in accordance with Section 52 of the Companies Act, 2013.

Q3FY26 Results

The company reported revenue of Rs. 152.75 crore in Q3FY26, registering a healthy 25.6 percent YoY growth compared to Rs. 121.65 crore in Q3FY25. On a sequential basis, revenue increased by 16.1 percent QoQ from Rs. 131.61 crore in Q2FY26, reflecting steady improvement in topline performance.

EBITDA stood at Rs. 11.31 crore in Q3FY26, marking a 52.0 percent YoY rise from Rs. 7.44 crore in the corresponding quarter last year. Compared to Rs. 8.90 crore in Q2FY26, EBITDA grew 27.1 percent QoQ, indicating improved operating efficiency and margin expansion during the quarter.

Net profit came in at Rs. 2.64 crore in Q3FY26, up 146.7 percent YoY from Rs. 1.07 crore in Q3FY25. Sequentially, profit rose 36.1 percent QoQ from Rs. 1.94 crore in Q2FY26, highlighting strong bottom-line growth alongside operational gains.

Triton Valves Limited is an India-based manufacturer of valves, cores, and related accessories catering to tire, tube, and original equipment manufacturers (OEMs) in domestic and international markets. The company offers a wide range of products including valves for bicycles, two-wheelers, passenger vehicles, trucks and buses, off-road vehicles, tractors, aircraft, and tubeless systems, along with TPMS valves, curing bag valves, industrial and air-conditioning valves, CTIS components, pressure relief valves, and aluminum charging valves. It also supplies valve caps, extensions, and various accessories.

In addition, the company provides specialized service tools such as core tightening tools, inflation and deflation adaptors, core runner machines, snap-in valve pullers, nut tightening machines, and tread depth gauges. Incorporated in 1975 and headquartered in Bengaluru, Triton Valves serves diverse industries including automotive, electric vehicles, aerospace and defense, mining, construction, and industrial and home air conditioning.

A return on equity (ROE) of about 4.83 percent, a return on capital employed (ROCE) of about 8.75 percent and debt to equity ratio at 1.09 demonstrate the company’s financial position. At the moment, the company’s P/E ratio is 55.8x higher as compared to its industry P/E 28x.

Over the past three years, the company has demonstrated strong growth, achieving a revenue CAGR of 15 percent, a profit CAGR of 55 percent and a share price CAGR of 27 percent, reflecting operational performance and share price performance.

As of December 2025, the shareholding pattern of Triton Valves Limited reflects a predominantly public ownership structure. Promoters hold a 45.96 percent stake in the company, while the remaining 54.04 percent is held by public shareholders, indicating a widely held equity base with majority participation from non-promoter investors.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post 3:1 Bonus Shares: Auto Ancillary Stock Jumps 6% After Announcing Q3 Results and Bonus Issue appeared first on Trade Brains.

What's Your Reaction?