Bitcoin Whale Exchange Ratio Climbs To Highest Level In 11 Years — Data

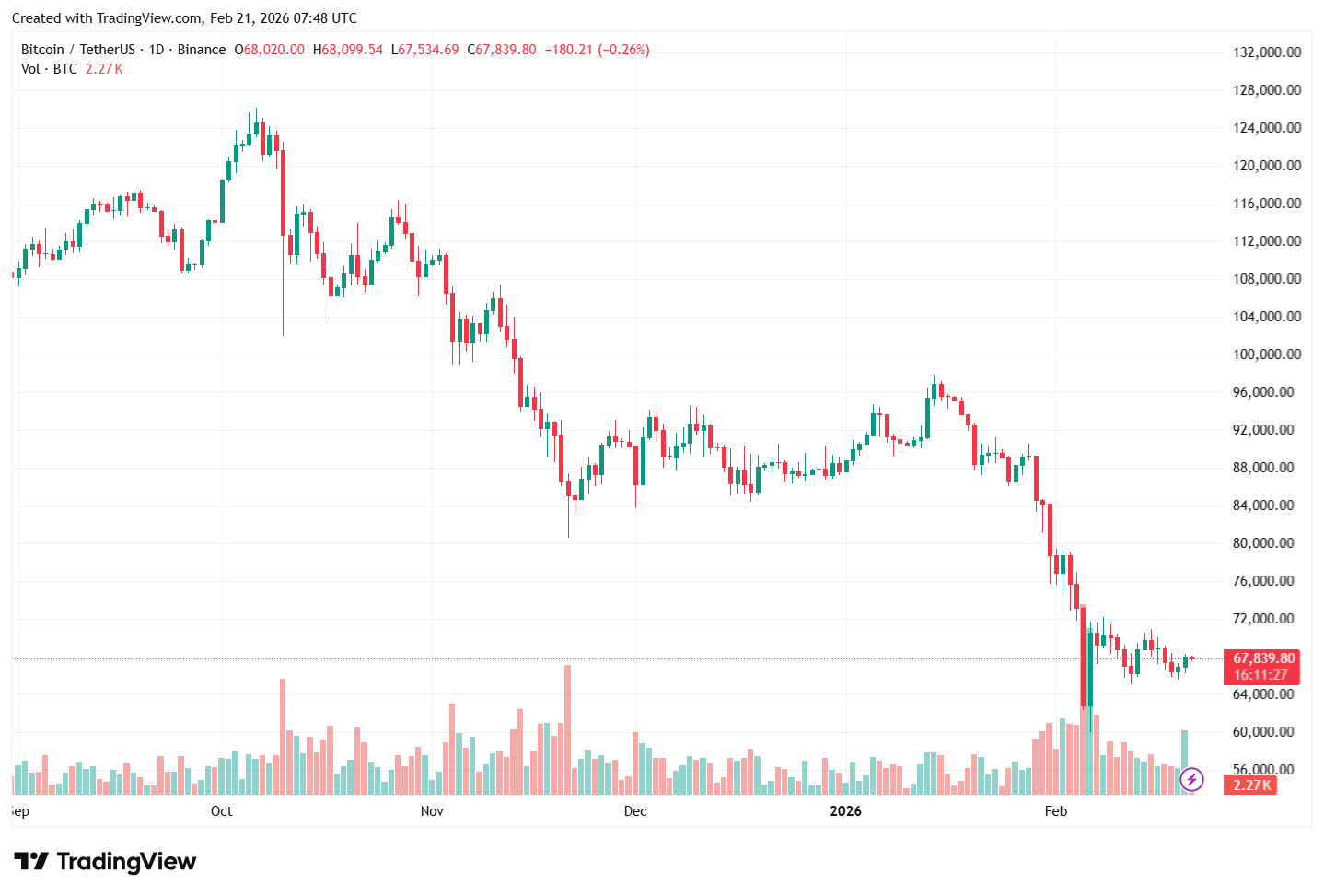

The price of Bitcoin has been stuck in a consolidation range below $70,000 so far this week, after spending most of the previous weekend above it. While the flagship cryptocurrency’s price movement has been largely — and painfully — sideways in recent weeks, this represents a notable improvement from how the month of February started. […]

The price of Bitcoin has been stuck in a consolidation range below $70,000 so far this week, after spending most of the previous weekend above it. While the flagship cryptocurrency’s price movement has been largely — and painfully — sideways in recent weeks, this represents a notable improvement from how the month of February started.

The new month ushered in a fresh low just above the $61,000 level for Bitcoin, confirming the start of the bear market. Amidst the relative stability in recent weeks, a recent on-chain evaluation suggests that BTC and the broader cryptocurrency mark is still at risk of further downside volatility.

BTC’s Future In The Hands Of Large Investors: CryptoQuant

In the last bull cycle, the price action of Bitcoin was heavily influenced and impacted by the increased influx and activity of institutional investors (primarily through the spot exchange-traded funds). Similarly, it appears that the large investor cohort will still be at the wheel even during the bear market.

According to CryptoQuant’s latest market report, the Bitcoin exchange inflows — and the immediate selling pressure — have normalized since the capitulation spike in early February. This trend can be seen in the decline in exchange inflows from around 60,000 BTC at the start of the month to around 23,000 BTC now.

While the acute sell-off phase appears to be easing off, a troubling trend seems to be brewing among Bitcoin’s largest investors. In its market report, CryptoQuant highlighted that the BTC exchange whale ratio has climbed to 0.64, its highest level since 2015, suggesting that whale inflows account for a significant portion of the exchange deposits being seen.

Meanwhile, the average BTC deposit size has also reached a level not seen since mid-2022, during the heat of the last bear market. This trend further reinforces the idea that institutional or large investors are behind the increasing exchange supply.

CryptoQuant noted that the altcoin market is still facing elevated distribution pressure, with the average daily number of altcoin exchange deposits rising from 40,000 in Q4 2025 to 49,000 in 2026. This continuous capital rotation out of riskier assets reflects weakened market confidence and increases the risk of downside volatility.

![[20 February 2026] Exchange Flow Redistribution: Whale Deposit Activity Grows Amid Declining Stablecoin Inflows](https://i0.wp.com/bucket.cryptoquant.com/research/vhKU3eAo_f9d6c7c031686bfd623832b4a9af0d3e55ed890a23e747cab76d866905521427.png?ssl=1)

Meanwhile, the ongoing flow of stablecoins out of exchanges points to a decline in marginal buying power (or “dry powder”) in the Bitcoin market. According to CryptoQuant data, net USDT flows into exchanges have fallen sharply from a one-year high of $616M in November 2025 to only $27M, turning negative at times (-$469M in late January). Ultimately, the combination of the increased selling pressure from Bitcoin’s large holders, rising altcoin distribution, and consistent stablecoin outflows suggests that the crypto market structure remains at risk of further downside volatility.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin stands at around $67,580, reflecting a mild 1% increase in the past 24 hours.

What's Your Reaction?