EMS stock jumps 10% after reporting a 107% YoY increase in net profit

Synopsis: A small cap EMS stock with a three year sales CAGR of 44 percent saw its stock to be in the spotlight soon after the company witnessed a 107 percent YoY profit growth while the 9MFY26 profits saw a 200 percent growth. A company in the EMS or Electronics Manufacturing Services industry saw its […] The post EMS stock jumps 10% after reporting a 107% YoY increase in net profit appeared first on Trade Brains.

Synopsis: A small cap EMS stock with a three year sales CAGR of 44 percent saw its stock to be in the spotlight soon after the company witnessed a 107 percent YoY profit growth while the 9MFY26 profits saw a 200 percent growth.

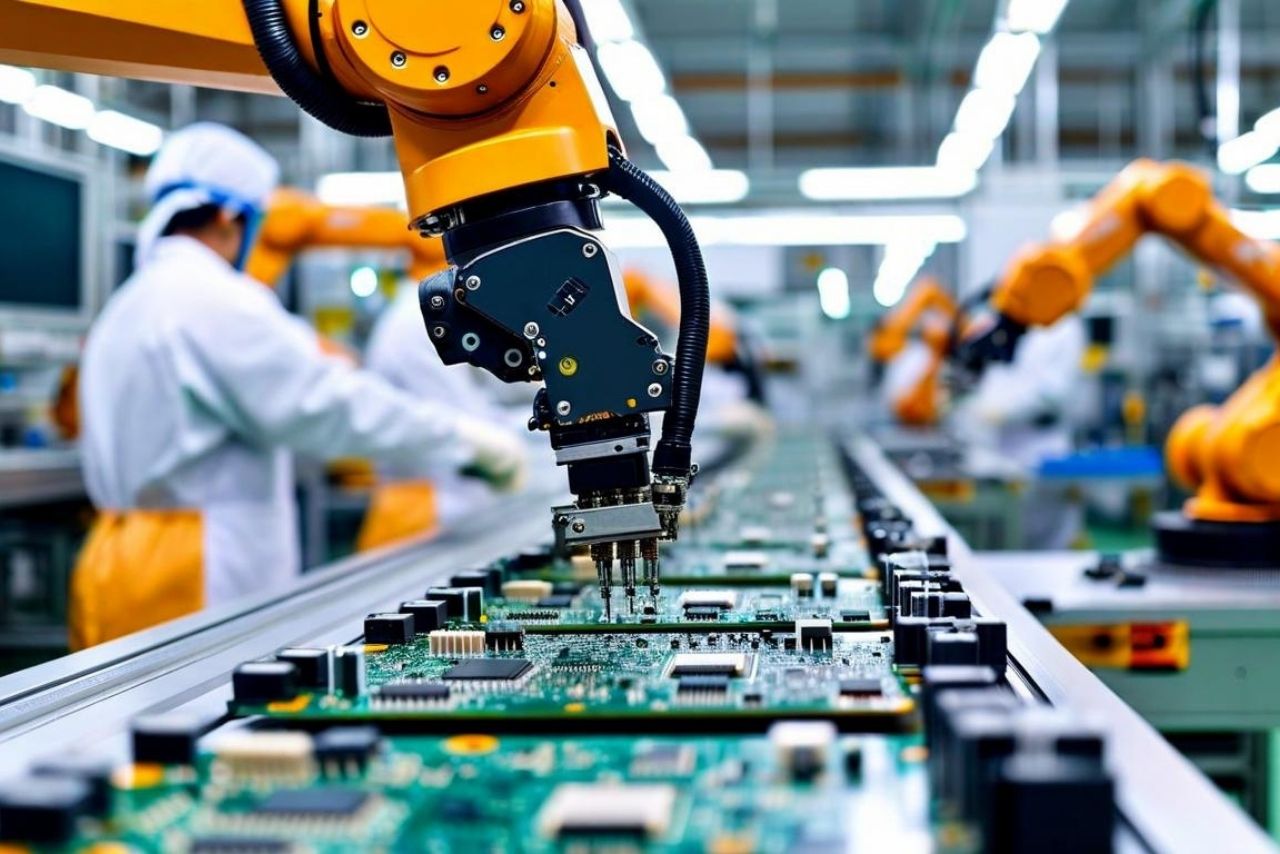

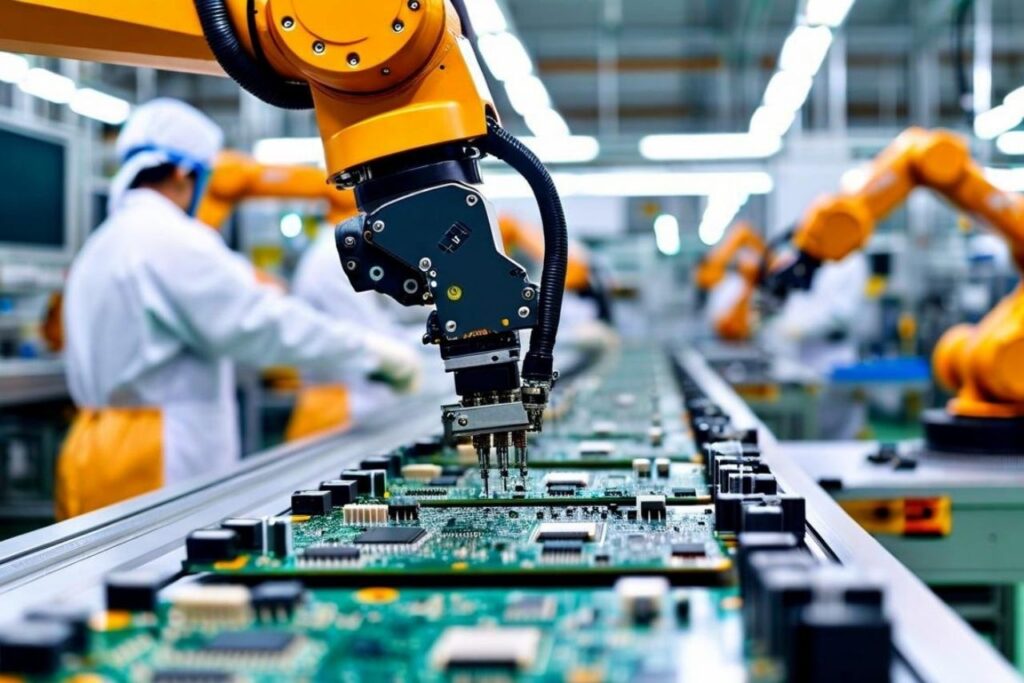

A company in the EMS or Electronics Manufacturing Services industry saw its stock surge by 10 percent soon after the company announced its Q3FY26 result. This company has seen its EBITDA margins go up by 384 bps from 9MFY25 to 9MFY26.

With a market cap of Rs 14,694 Cr, Syrma SGS Technology Ltd saw its stock hit an intraday high of Rs 801 which is 10 percent higher than the previous close of Rs 725. The company stock has given a compounded return of 42 percent in the last three years.

The Q3FY26 Result

In the latest quarterly result the company has seen its revenue from operations increase by 45 percent YoY, from Rs 870 Cr in Q3FY25 to Rs 1,264 Cr in Q3FY26, while the QoQ increased by 10 percent from Rs 1,146 Cr.

The net profits grew by 107 percent going from Rs 53 Cr in Q3FY25 to Rs 110 Cr in Q3FY26, while the QoQ increased by 66 percent from Q2FY26’s Rs 66 Cr. Its ebitda margins grew from 11.4 percent to 13.3 percent.

In 9M numbers of the fiscal year, the company saw its revenue from operations increase by 17 percent YoY, from Rs 2862 Cr in 9MFY25 to Rs 3354 Cr in 9MFY26. The net profits for the same period grew by 200 percent going from Rs 113 Cr to Rs 226 Cr.The company has seen its EBITDA margin go up by 384 bps from 7.2 percent in 9MFY25 to the current 11.04 percent.

The company has a 3 year sales CAGR of 44 percent, while the TTM is at 7 percent. The company’s 3 year profit CAGR is at 28 percent, while the TTM number is at 102 percent. The company also has a ROCE of 12 percent and a ROE of 9 percent.

Result Highlight & Revenue Mix

Out of the Rs 1264 Cr revenue the company has generated in Q3FY26, the company has seen 23 percent coming from Auto industry, 30 percent from Consumer sector, another 30 percent from Industrial and the rest from Healthcare , IT and Railways.

Recent Announcements

Syrma SGS Technology has announced multiple strategic joint ventures and acquisitions to strengthen its electronics manufacturing footprint. The company successfully completed the acquisition of a 60 percent stake in Elcome for Rs 2,350 million.

In the renewable segment, the transaction closure process is underway for the Solar Inverter joint venture with Premier Energies through the acquisition of Ksolare. Additionally, the Elemaster joint venture is progressing with closure conditions currently in process.

Under the PCB venture, Syrma SGS completed a capital infusion of around Rs 45 crore, initiated site development and civil infrastructure work, and secured key PLI and state incentive approvals.

Business Overview

Syrma SGS Technology Limited, incorporated in 2004, is a Chennai-headquartered engineering and electronics manufacturing services (EMS) company. It offers end-to-end solutions to original equipment manufacturers (OEMs), covering product design, engineering, prototyping and high-volume manufacturing. The company works closely with clients from the early concept and co-creation stage through to product realization across diverse electronics applications.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post EMS stock jumps 10% after reporting a 107% YoY increase in net profit appeared first on Trade Brains.

What's Your Reaction?

.png)