How Indians Are Legally and Illegally Evading the 30% Crypto Tax in India

Synopsis- Bitcoin’s price surge dazzled Indian investors, delivering over 123% gains last year. Yet, celebrating profits feels impossible under India’s harsh crypto tax regime. A steep 30% flat tax, a relentless 1% transaction levy (TDS), and draconian loss rules cripple returns. As a result, traders are scrambling for exits. Some embrace legal alternatives; others vanish […] The post How Indians Are Legally and Illegally Evading the 30% Crypto Tax in India appeared first on Trade Brains.

Synopsis- Bitcoin’s price surge dazzled Indian investors, delivering over 123% gains last year. Yet, celebrating profits feels impossible under India’s harsh crypto tax regime. A steep 30% flat tax, a relentless 1% transaction levy (TDS), and draconian loss rules cripple returns. As a result, traders are scrambling for exits. Some embrace legal alternatives; others vanish into regulatory shadows.

India taxes cryptocurrency profits brutally. Firstly, gains face a flat 30% rate. Moreover, a 4% cess and surcharge inflate this burden significantly. Every single trade triggers a mandatory 1% TDS deduction. Critically, this applies regardless of profit or loss. Worst of all, investors cannot offset crypto losses against other income. Furthermore, these losses cannot even carry forward to future years. Essentially, long-term holders suffer like reckless gamblers. This punitive system strangles profitability. Naturally, investors seek relief urgently. The tax feels less like policy and more like confiscation.

A Regulatory Contrast

On the other hand, Japan offers a starkly different crypto landscape. Japanese regulators actively foster clearer digital asset rules. Their approach emphasizes investor protection alongside taxation. Unlike India’s blanket penalties, Japan taxes crypto profits as miscellaneous income. Rates vary based on overall earnings. Significantly, Japan allows loss carry-forwards. This provides crucial breathing room for traders. Japan’s stance highlights alternative regulatory philosophies. Their market stability contrasts India’s investor exodus. This divergence pressures global crypto policy debates. However, Indian investors need solutions now.

How USD is Changing The Game

Global currency movements influence Indian crypto choices. The US dollar often strengthens against the Japanese Yen. This means accessing US-listed Bitcoin ETFs becomes relatively cheaper for INR holders. Vice versa, Yen weakness affects Japan-based crypto options. Fluctuating USD/INR rates also alter investment math. A stronger dollar makes foreign ETFs more expensive over time. Therefore, investors must monitor forex shifts constantly. These dynamics add another layer to tax planning. Ultimately, currency risks compound existing tax headaches for Indians.

The Smart, Legal Tax Escape

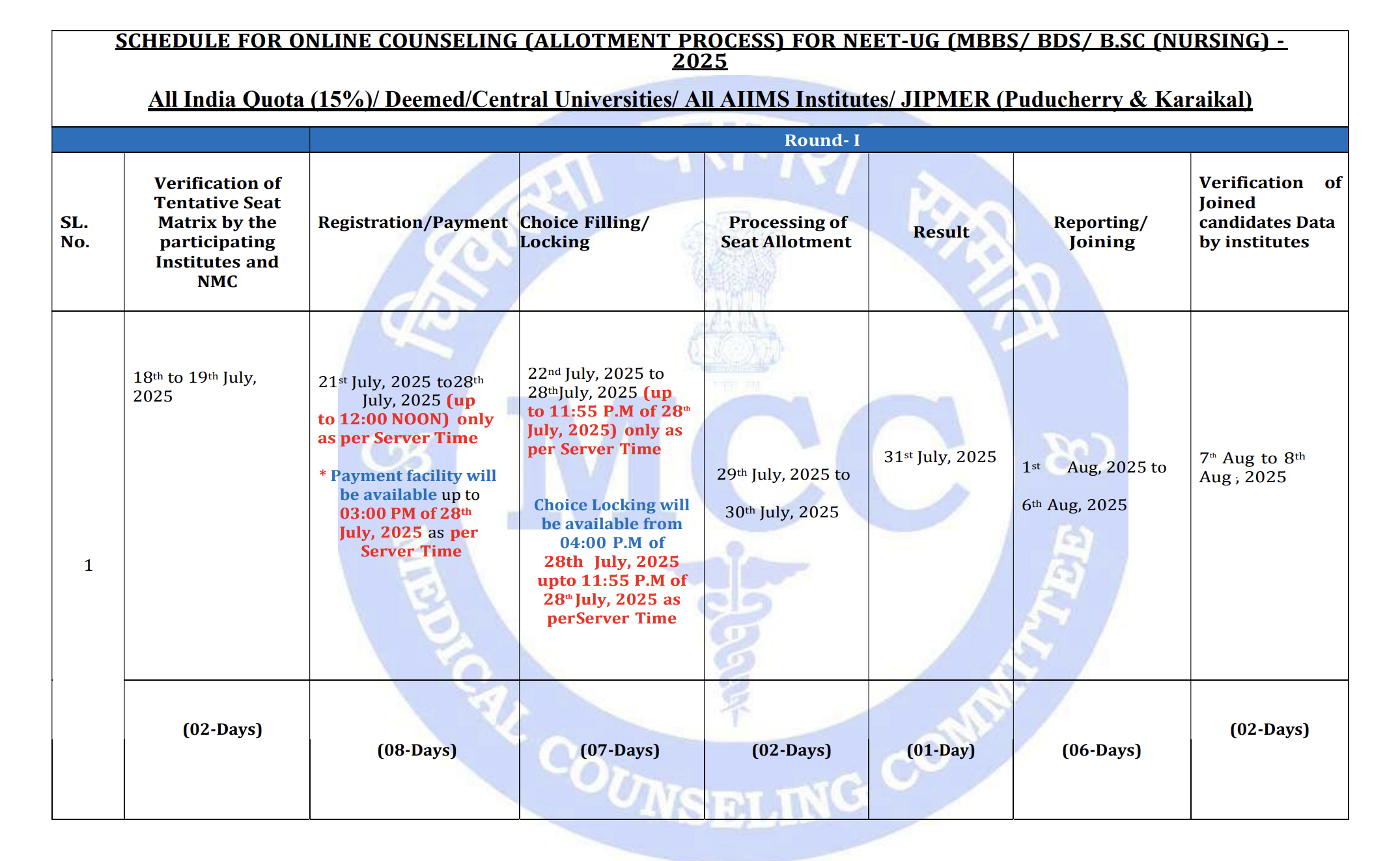

Fortunately, a powerful legal alternative exists: Bitcoin ETFs. These exchange-traded funds track Bitcoin’s price. Indian tax law treats them differently. Specifically, they avoid the dreaded Virtual Digital Asset (VDA) classification. Instead, they count as foreign mutual fund units. Hold them over 24 months for massive tax savings. Long-term gains then face just 12.5% tax, not 30%. Shorter holdings use your income tax slab. Importantly, no 1% TDS erodes every transaction. Additionally, ETF losses can offset other capital gains. They also carry forward to future years. This structure offers up to 60% tax savings. For serious investors, ETFs are the regulated, efficient path. Platforms now enable access via GIFT City routes. Undeniably, ETFs outshine direct crypto investing today.

The Shadowy Route

On the other hand, some pursue riskier, non-compliant paths. Platforms like Octo and dYdX attract tax-weary traders. These decentralised exchanges (DEXs) promise anonymity. Critically, they demand no personal details (KYC). Therefore, trades vanish from the taxman’s sight. As a result, the 30% tax and 1% TDS disappear.

Users bypass reporting automatically enforced by CoinDCX or Binance. Octo, linked to CoinDCX but operating differently, exemplifies this. It offers futures trading with minimal fees. Deposits use networks like Arbitrum with USDC stablecoins. Sign-up requires only an email. Withdrawals face no reporting limits. Early users even chase reward points and potential token airdrops. Essentially, profits stay entirely off the books. Presenters often warn: taxes should still be declared. Realistically, many traders using DEXs likely skip this step. This path dodges taxes but courts significant legal risks.

The Clear Choice

Faced with punitive taxes, Indian Bitcoin investors diverge. The smart, safe money flows towards Bitcoin ETFs. They deliver massive tax efficiency and regulatory peace. Conversely, the shadowy DEX route offers dangerous, non-compliant relief.

Japan’s model suggests calmer regulatory waters exist elsewhere. Currency swings further complicate access strategies. However, the core dilemma remains stark: endure India’s tax raid, embrace the legal ETF exit, or gamble in the regulatory shadows. For sustainable wealth building, Bitcoin ETFs shine as the undeniable frontrunner. They blend crypto’s potential with traditional finance’s safeguards. As unregulated platforms stumble, the ETF path looks increasingly essential.

Written By Fazal Ul Vahab C H

The post How Indians Are Legally and Illegally Evading the 30% Crypto Tax in India appeared first on Trade Brains.

What's Your Reaction?