IT Sector: JP Morgan and HSBC Share Market Outlook on AI for the Sector; Check the Details

Synopsis: JPMorgan and HSBC see AI as a productivity booster for IT, creating new revenue streams and partnerships. While near-term valuations are modest, large-cap IT firms like TCS and Infosys stand to gain in the long term. JPMorgan and HSBC are spotlighting artificial intelligence (AI) as a major driver for growth in the IT sector. […] The post IT Sector: JP Morgan and HSBC Share Market Outlook on AI for the Sector; Check the Details appeared first on Trade Brains.

Synopsis: JPMorgan and HSBC see AI as a productivity booster for IT, creating new revenue streams and partnerships. While near-term valuations are modest, large-cap IT firms like TCS and Infosys stand to gain in the long term.

JPMorgan and HSBC are spotlighting artificial intelligence (AI) as a major driver for growth in the IT sector. Both see AI not only as a productivity booster but also as a catalyst for new revenue streams, strategic partnerships, and long-term expansion opportunities for large-cap IT firms.

JPMorgan on AI Driving Opportunities

JPMorgan’s latest analysis of the IT sector highlights the transformative impact of artificial intelligence (AI) alongside prevailing market conditions. While the firm acknowledges that fears around AI could trigger sharp market corrections, it emphasises that IT companies remain the essential “plumbers” of the technology world, providing the infrastructure that underpins modern digital operations.

AI as a Productivity Multiplier

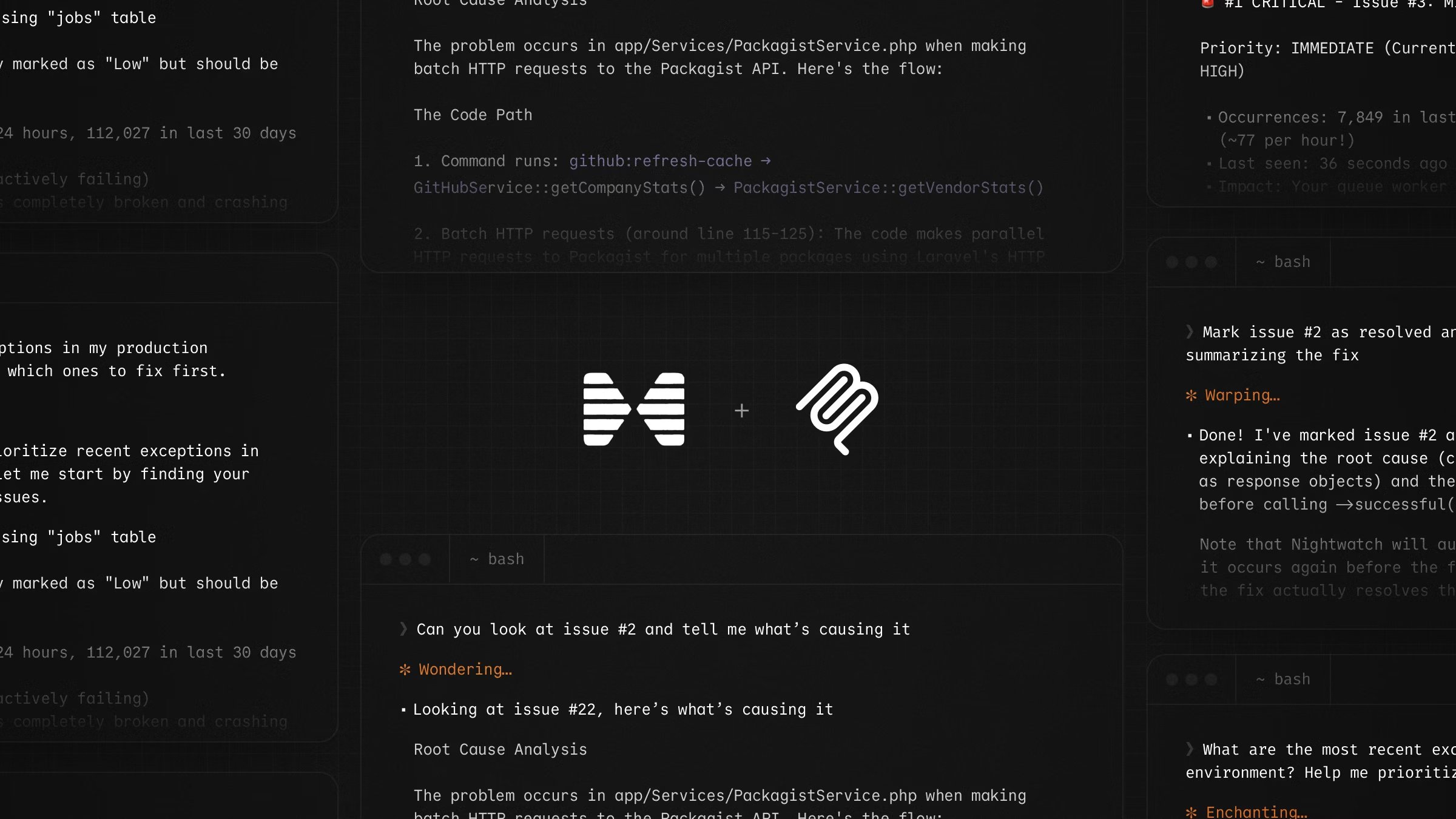

It underscores the potential of advanced AI tools to accelerate complex workflows. Innovations such as Claude code’s Cowork plugin are expected to streamline tasks that once took significant time, while Agentic AI has the capability to generate vast amounts of software autonomously. This could not only boost productivity but also create new work streams, opening opportunities for IT firms in areas traditionally reliant on offshore labor, enterprise software, and cloud solutions.

JPMorgan also anticipates partnerships between AI tool developers and IT services companies, further expanding the market for AI-enabled solutions. Such collaborations are expected to reshape workflows, allowing IT firms to capture value in previously untapped areas.

Market Outlook and Valuation

From a market perspective, JPMorgan’s reverse discounted cash flow (DCF) analysis suggests that current IT stocks reflect a modest 4% terminal growth, assuming no near-term acceleration. The analysis warns that a severe downside exceeding 30% would only materialise if companies fail to grow in the future. The firm considers both scenarios overly pessimistic, citing emerging AI-driven work streams and the likely cyclical recovery in the sector.

JPMorgan also highlights that free cash flow (FCF) and dividend yields for IT stocks are at deep-value levels, comparable to those observed during major market disruptions such as the Global Financial Crisis (GFC) and the COVID-19 pandemic.

The Barbell Approach

For investors, JPMorgan recommends a barbell approach, focusing on deep-value opportunities within large-cap IT companies. The firm is particularly overweight on INFOSYS, TCS, Persistent Systems, and Sagility, signalling confidence in these firms’ ability to benefit from AI adoption and long-term sector growth. Overall, JPMorgan’s outlook balances caution with optimism, recognising the dual role of AI as both a potential disruptor and a catalyst for growth.

HSBC Commentary

For the IT services sector, HSBC highlights that the bigger impact of AI is in coding productivity. Industry-wide efficiency improvements are estimated at 8–10%, and the launch of Claude Opus 4.6 could contribute an additional 500 basis points boost. This shows that AI is helping IT teams get more done faster, even if it’s not replacing core enterprise systems.

HSBC believes that large language model (LLM) AI products are unlikely to replace existing SaaS platforms anytime soon. The brokerage points out that there are almost no examples of Fortune 500 companies swapping core enterprise systems like SAP or Salesforce for standalone AI models. These platforms have decades of built-in business knowledge, which continues to act as a strong competitive moat.

While these productivity gains may create some downward pressure on pricing, HSBC doesn’t see the effect as significant at this stage. Overall, the brokerage expects low returns for the IT sector in 2026, acknowledging that risks this cycle may be more credible than in the past but that the sector still has solid growth potential.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post IT Sector: JP Morgan and HSBC Share Market Outlook on AI for the Sector; Check the Details appeared first on Trade Brains.

What's Your Reaction?

.jpg)