IT Stock Soars 9% After Bagging Huge Data Centre Project in Mumbai

Synopsis: Small-cap Software & Consulting stock rises 8% after winning a major Data centre upgrade project, enhancing its expertise in live infrastructure and presence in India’s top data centre hub. The shares of the Small-cap, specializing in enterprise-level digital innovation, software products, and services for the banking, fintech, mobility, and government sectors, are in focus […] The post IT Stock Soars 9% After Bagging Huge Data Centre Project in Mumbai appeared first on Trade Brains.

Synopsis: Small-cap Software & Consulting stock rises 8% after winning a major Data centre upgrade project, enhancing its expertise in live infrastructure and presence in India’s top data centre hub.

The shares of the Small-cap, specializing in enterprise-level digital innovation, software products, and services for the banking, fintech, mobility, and government sectors, are in focus upon securing a major data centre deal with a global developer.

With a market capitalization of Rs. 5,322.58 Crores on the Day’s Trade, the shares of Aurionpro Solutions Ltd rose by 9.2 percent, reaching a high of Rs. 1020.00 compared to its previous close of Rs. 933.65.

What Happened

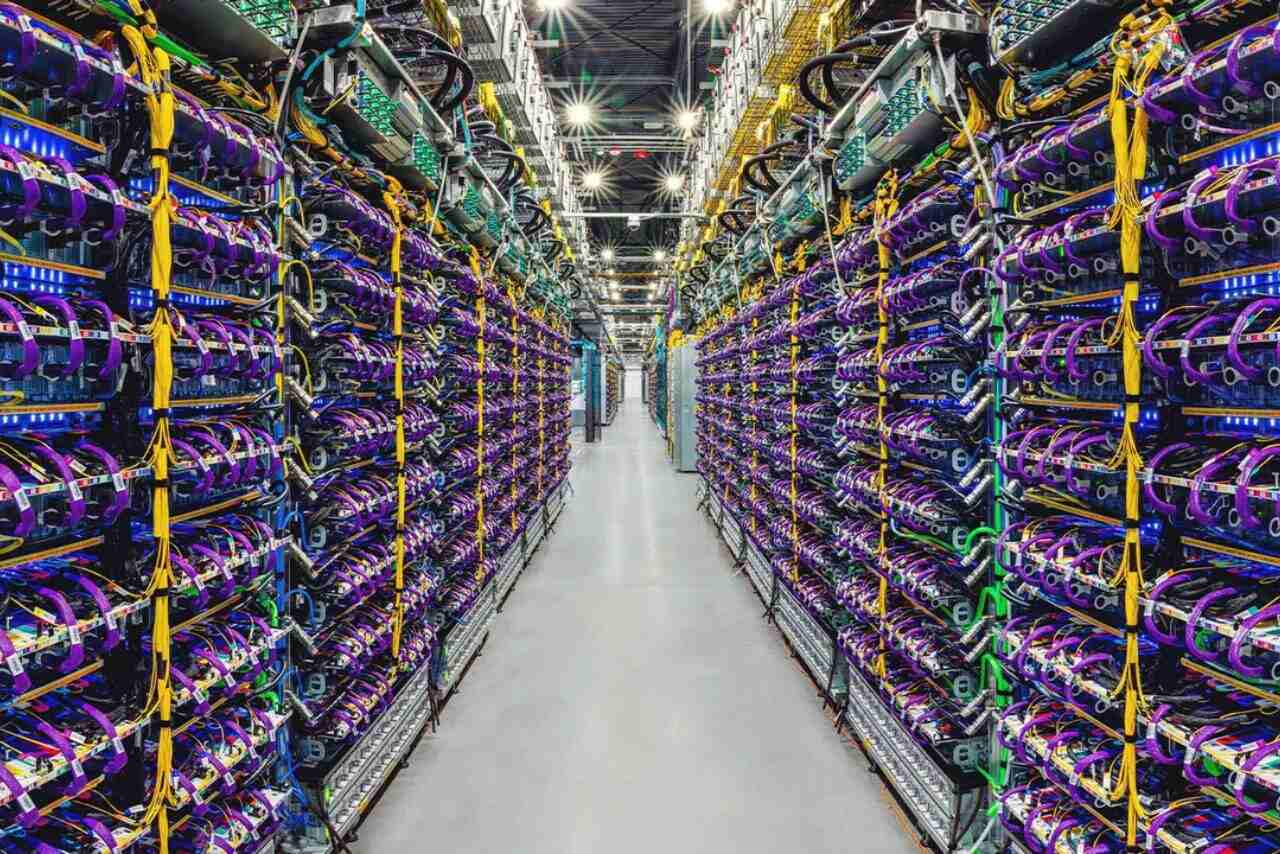

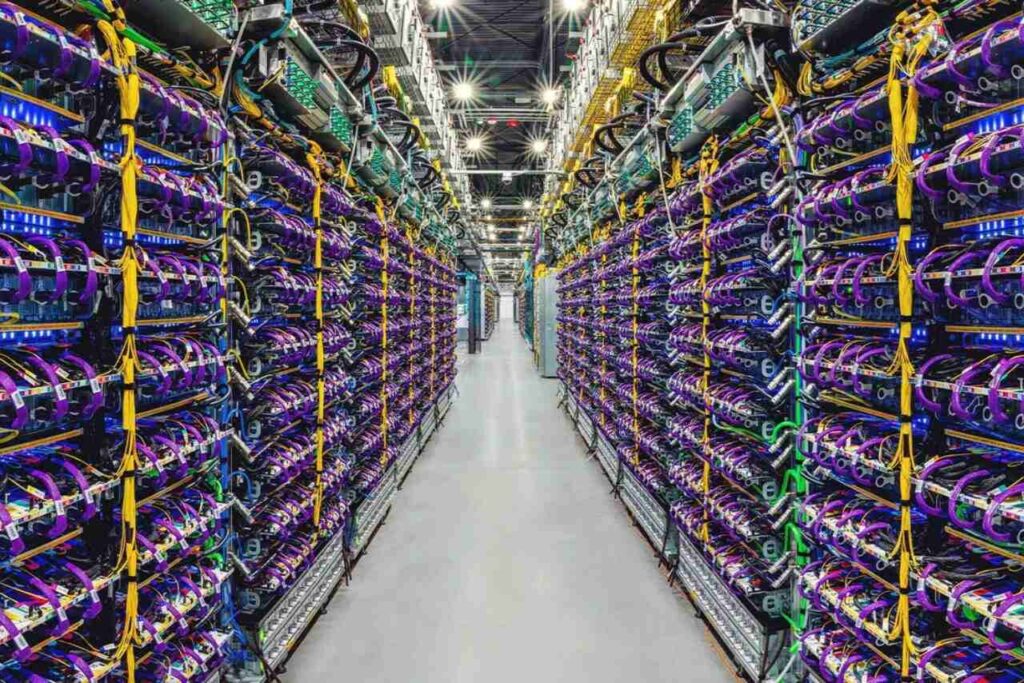

Aurionpro Solutions Ltd, engaged in enterprise-level digital innovation, software products, and services for the banking, fintech, mobility, and government sectors, has won a significant order from a leading global data centre developer and operator, following its recent bank infrastructure contract. This highlights growing trust in Aurionpro’s ability to deliver complex hyperscale data centre solutions.

The project involves designing and upgrading a brownfield facility in Mumbai over the next three quarters, covering engineering, construction, testing, and commissioning, all to global colocation standards. Aurionpro’s expertise in managing end-to-end infrastructure in live operational environments is a key strength. With Mumbai accounting for 53% of India’s operational data centre capacity, this win further strengthens Aurionpro’s presence in the country’s leading data centre hub.

Bhaskar Bhattacharya, EVP & Head – Enterprise Business, Aurionpro, said this strategic win highlights the confidence global players place in Aurionpro. India’s data centre market is at an inflection point, fueled by hyperscaler expansion, AI workloads, and sovereign infrastructure mandates, with government policies and Budget 2026 reinforcing India’s role as a neocloud hub.

He added that Aurionpro’s proven expertise in delivering mission-critical infrastructure in live operational environments, combined with strong governance and deep engineering capabilities, positions the company to capitalize on the growing opportunities in the rapidly expanding data centre ecosystem.

Financials

The company’s revenue rose by 21.21 percent from Rs. 306 crores in December 2024 to Rs. 371 crores in December 2025. Meanwhile, Net profit declined from Rs. 48 crores to Rs. 44 crores in the same period.

The company’s financial structure is robust, with a very low debt-to-equity ratio of 0.02, reflecting minimal leverage and reduced financial risk. Coupled with an attractive PEG ratio of 0.69, the stock appears reasonably valued relative to its growth, making it a compelling investment opportunity for long-term growth-oriented investors.

Over the past five years, the company has demonstrated impressive financial performance, achieving a remarkable 38.3% CAGR in profits. Its strong return metrics, with a ROCE of 18.1% and ROE of 15.3%, highlight efficient use of capital and consistent value creation for shareholders.

Aurionpro Solutions Ltd is a global enterprise technology leader pioneering intuitive-tech through deep-tech IPs and scalable products. With a strong presence across Banking, Payments, Mobility, Insurance, Transit, Data Centres, and Government Sectors, Aurionpro is setting new benchmarks for AI innovation and impact.

Its B2E (Business-to-Ecosystem) approach empowers entire ecosystems – driving growth, transformation, and scale across interconnected value chains. Backed by 3,000+ experts and a global-first mindset, Aurionpro is built to lead the next

It aims to become a vertically integrated player across the value chain and has extensive experience serving multiple customers in the Banking and Fintech sectors across Asia. Additionally, it offers integrated solutions in Transit and Automatic Fare Collection (AFC), supported by a strong order book of over Rs. 1,700 Crores.

The company’s revenue is primarily India-centric, accounting for 66% of total revenue, while the rest of APAC contributes 19%. Revenue from the USA and Europe makes up 13%, and MEA and other regions account for the remaining 2%, reflecting a strong domestic presence with selective international exposure.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post IT Stock Soars 9% After Bagging Huge Data Centre Project in Mumbai appeared first on Trade Brains.

What's Your Reaction?