IT stock under ₹70 jumps 10% after announcing buyback of shares with 21% premium

Known for providing comprehensive market intelligence and startup data, this leading tech firm is making headlines. Shareholders have recently approved a significant financial decision, authorising a substantial capital allocation action. Let’s dive into the specifics of this shareholder-approved move, expected to return significant value directly to eligible investors through a defined tender process. Tracxn Technologies […] The post IT stock under ₹70 jumps 10% after announcing buyback of shares with 21% premium appeared first on Trade Brains.

Known for providing comprehensive market intelligence and startup data, this leading tech firm is making headlines. Shareholders have recently approved a significant financial decision, authorising a substantial capital allocation action. Let’s dive into the specifics of this shareholder-approved move, expected to return significant value directly to eligible investors through a defined tender process.

Tracxn Technologies Limited’s stock, with a market capitalisation of Rs. 671 crores, rose to Rs. 63.89, hitting a high of up to 10 percent from its previous closing price of Rs. 58.08. However, the stock over the past year has given a negative return of 32 percent.

Buyback Details

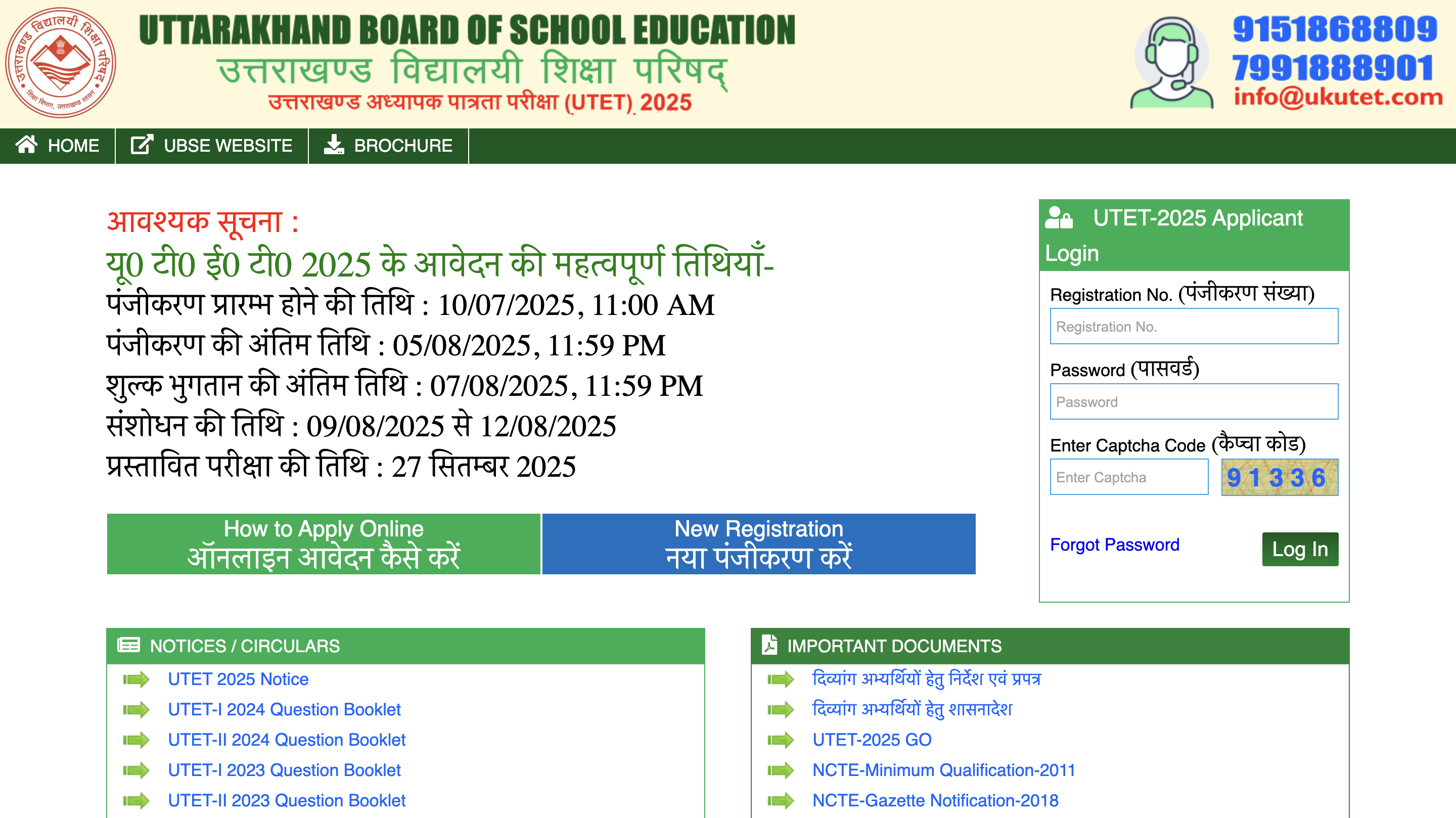

Tracxn Technologies has announced a buyback of its equity shares through the tender offer route. The company’s board approved the proposal in a meeting. Under the buyback, the company will repurchase up to 11,42,857 fully paid-up equity shares at a price of Rs. 70 per share this is a premium of 20.5 percent over yesterday’s closing price. The total buyback size amounts to Rs. 7,99,99,990. This move is in line with Regulation 42 of the SEBI regulations on buyback and disclosure requirements.

The record date to determine the eligibility of shareholders for participating in this buyback is set for Friday, July 18, 2025. Shareholders whose names appear on the company’s register as of the record date will be eligible to tender their shares in the buyback offer. Investors are advised to take note of these details and stay updated through the company’s website for further information.

Also read: Water management stock in focus as JV receives ₹395 Cr order for water treatment project

Q4 Financial Highlight

The company reported revenue of Rs. 21.14 crore in Q4FY25, a marginal decline of 1.2 percent QoQ from Rs. 21.39 crore but up 4 percent YoY from Rs. 20.32 crore. Over the last three years, the company has maintained a steady sales CAGR of 10 percent, reflecting consistent growth despite short-term fluctuations.

However, profitability saw a sharp decline. The company posted a net loss of Rs. 7.58 crore in Q4FY25, compared to a profit of Rs. 1.42 crore in Q3FY25 and Rs. 1.43 crore in Q4FY24, indicating significant margin pressure. Despite this quarterly setback, the company’s 3-year ROE CAGR stands at 14 percent, suggesting long-term value creation.

Tracxn is a SaaS-based platform that provides private market data and analytics to a wide range of global clients, including venture capital and private equity firms, corporates, investment banks, and academic institutions. With a strong international presence generating nearly 60% of its revenue from 50+ countries, its key markets include India, the US, the UK, Singapore, and Germany. Around half of its customers come from the investment industry, while corporates, universities, and government bodies make up the rest. The company operates on a subscription-based, prepaid billing model, recognising revenue over the service period.

Written By Fazal Ul Vahab C H

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post IT stock under ₹70 jumps 10% after announcing buyback of shares with 21% premium appeared first on Trade Brains.

What's Your Reaction?