R R Kabel announces 72% YoY increase in Q3; Check management’s future outlook

Synopsis: R R Kabel Limited reports 42.29% YoY revenue growth and a 72.45% YoY net profit surge in Q3 FY26 results. This small-cap, engaged in manufacturing blow-molded and injection-molded plastic products for industrial packaging, automotive components, healthcare, and infrastructure sectors, jumped 6.31 percent after the company reported December quarterly results with an 85.64 percent YoY […] The post R R Kabel announces 72% YoY increase in Q3; Check management’s future outlook appeared first on Trade Brains.

Synopsis: R R Kabel Limited reports 42.29% YoY revenue growth and a 72.45% YoY net profit surge in Q3 FY26 results.

This small-cap, engaged in manufacturing blow-molded and injection-molded plastic products for industrial packaging, automotive components, healthcare, and infrastructure sectors, jumped 6.31 percent after the company reported December quarterly results with an 85.64 percent YoY increase in net profit.

With a market capitalization of Rs. 16,236.22 crores, the share of R R Kabel Limited has reached an intraday high of Rs. 1,460 per equity share, rising nearly 6.31 percent from its previous day’s close price of Rs. 1,373.30. Since then, the stock has retreated and is currently trading at Rs. 1,435.55 per equity share.

Q3 FY26 Result

Coming into the quarterly results of R R Kabel Limited, the company’s consolidated revenue from operations increased by 42.29 percent YOY, from Rs. 1,782.15 crore in Q3 FY25 to Rs. 2,535.86 crore in Q3 FY26, and grew by 17.20 percent QoQ from Rs. 2,163.77 crore in Q2 FY26.

In Q3 FY26, R R Kabel Limited’s consolidated net profit increased by 72.45 percent YOY, reaching Rs. 118.25 crore compared to Rs. 68.57 crore during the same period last year. As compared to Q2 FY26, the net profit has increased by 1.72 percent, from Rs. 116.25 crore.

The basic earnings per share increased by 72.32 percent and stood at Rs. 10.46 as against Rs. 6.07 recorded in the same quarter in the previous year, FY2025. R R Kabel Limited’s revenue and net profit have grown at a CAGR of 25.17 percent and 20.66 percent, respectively, over the last five years.

In terms of return ratios, the company’s ROCE and ROE stand at 19.8 percent and 15.2 percent, respectively. R R Kabel Limited has an earnings per share (EPS) of Rs. 40.1, and its debt-to-equity ratio is 0.17x.

Revenue Mix for Q3 & 9M FY26

In Q3 FY26, R R Kabel Limited’s revenue mix shows that the business is largely driven by the domestic market. About 74 percent of revenue came from domestic sales, while 26 percent came from exports, showing a stable contribution from overseas markets.

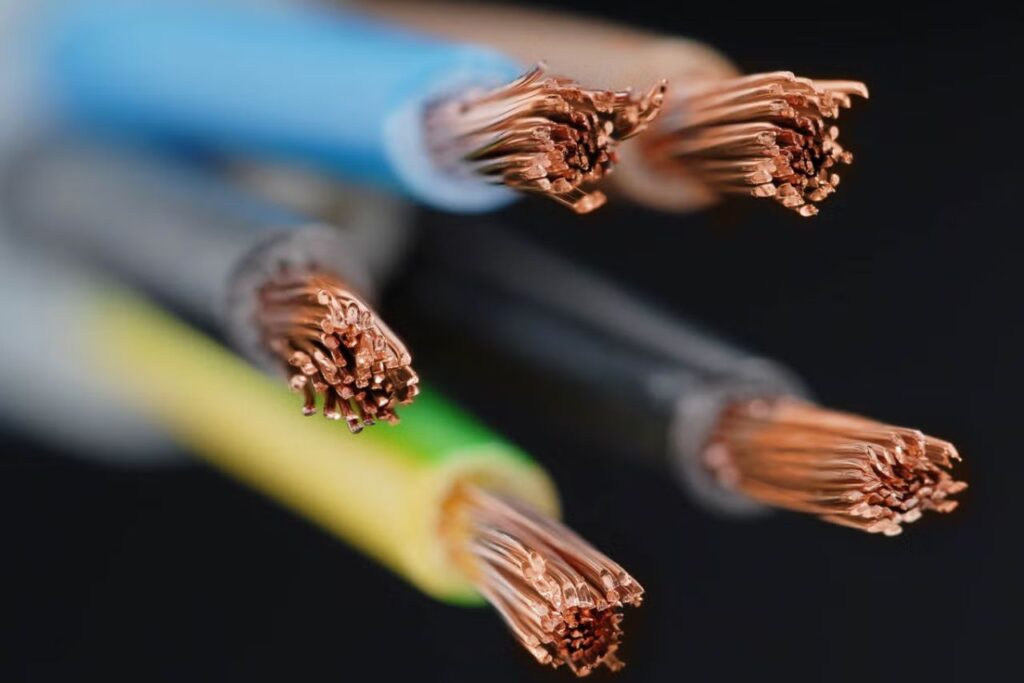

Segment-wise, the company continues to be heavily dependent on its Wires & Cables (W&C) business, which contributed around 90 percent of total revenue. The FMEG segment (fans, lights, and appliances) made up the remaining 10 percent. This indicates that the core strength of the company still lies in wires and cables, with FMEG acting as a growing but smaller support segment.

For 9M FY26, the trend remains very similar and consistent. Domestic revenue contributed about 73 percent, while exports accounted for 27 percent, reflecting steady international demand. Segment-wise, the revenue split again shows 90 percent from W&C and 10 percent from FMEG, highlighting strong reliance on the main electrical cable business.

Management Outlook

R R Kabel Limited’s management is optimistic about the second half of FY26 and expects performance to improve compared to the first half. The company believes seasonal demand and a stronger market environment will support growth.

The company has reiterated its long-term “Project Rise” plan, targeting around 18 percent annual volume growth. The management also aims to maintain a return on equity above 20 percent, showing confidence in profitability and operational efficiency.

Looking ahead, the company continues to focus on strengthening its core wires and cables business. It has reaffirmed its goal of achieving an EBIT margin of 10.5-11 percent in the wires and cable segment by FY28.

To support this growth, R R Kabel plans to invest about Rs. 1,200 crore in expansion, with nearly 80 percent of the capital directed toward the cable segment, highlighting its strategic priority.

R R Kabel Limited, part of the RR Global conglomerate, is engaged in manufacturing and selling wires, cables, and fast-moving electrical goods (FMEG) for residential, commercial, industrial, and infrastructure applications both in India and internationally.

The company’s product portfolio includes house wires, industrial wires, power cables, control cables, solar cables, special cables, along with fans, lighting, modular switches, switchgears, and appliances like room heaters and irons. The company holds a significant 10 percent market share in the branded housing wire segment.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post R R Kabel announces 72% YoY increase in Q3; Check management’s future outlook appeared first on Trade Brains.

What's Your Reaction?

.png)