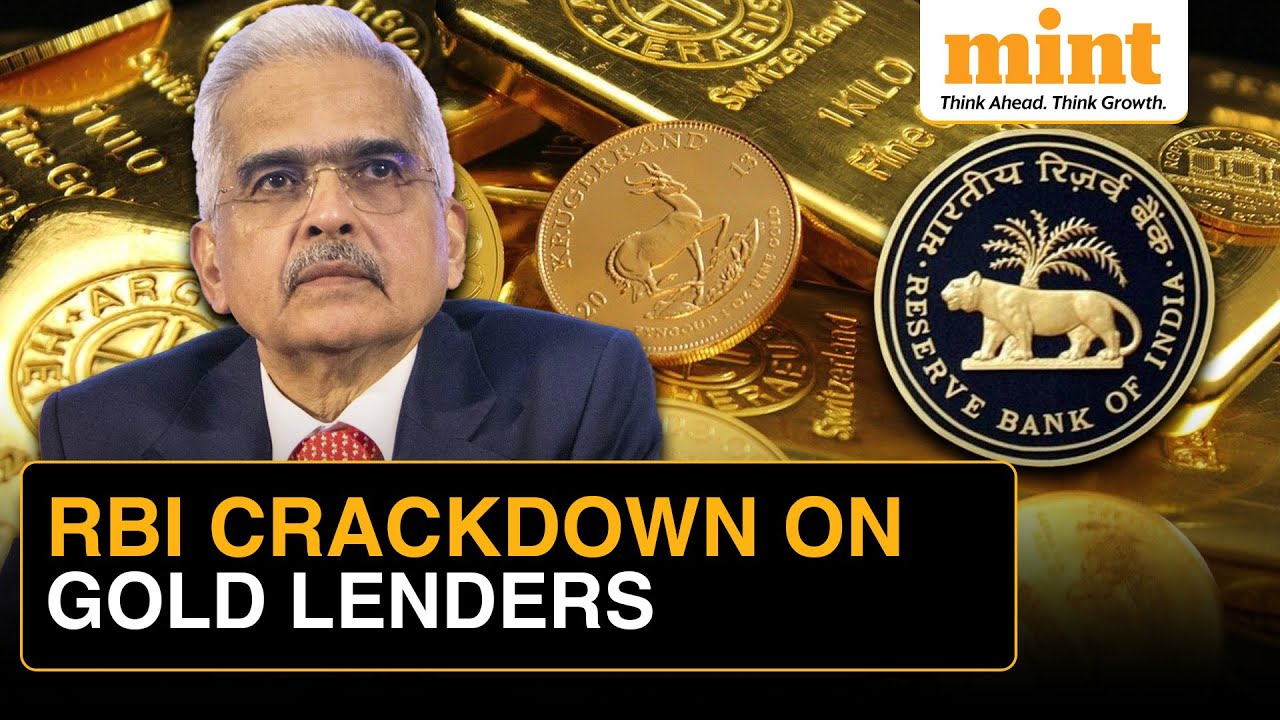

Real Estate Giant Buys 1,000 Bitcoin Worth $102 Million, Plans 3,000 More in 2025

Grant Cardone’s powerhouse real estate firm, Cardone Capital, just made crypto history. The company boldly purchased 1,000 Bitcoin (BTC), valued near $102 million. Following this, Cardone Capital claims a unique title: the first integrated real estate/Bitcoin company. Moreover, CEO Grant Cardone announced ambitious plans immediately. The firm expects to buy another 3,000 BTC before year’s […] The post Real Estate Giant Buys 1,000 Bitcoin Worth $102 Million, Plans 3,000 More in 2025 appeared first on Trade Brains.

Grant Cardone’s powerhouse real estate firm, Cardone Capital, just made crypto history. The company boldly purchased 1,000 Bitcoin (BTC), valued near $102 million. Following this, Cardone Capital claims a unique title: the first integrated real estate/Bitcoin company. Moreover, CEO Grant Cardone announced ambitious plans immediately. The firm expects to buy another 3,000 BTC before year’s end.

Landmark Purchase

Cardone Capital executed this massive Bitcoin buy last week. Significantly, this forms a core part of its new treasury strategy. The firm is deliberately combining physical real estate with digital assets. Cardone publicly declared the move on social media platform X. He called Bitcoin and real estate “the two best-in-class assets”. Furthermore, this $100+ million investment instantly elevates their Bitcoin standing. Indeed, Cardone Capital now holds more BTC than major miners Core Scientific and Cipher Mining.

Leverages Real Estate for Crypto Growth

This isn’t Cardone Capital’s first crypto foray. Previously, in May, they launched the innovative 10X Miami River Bitcoin Fund. That fund uniquely blends a 346-unit apartment building with $15 million in Bitcoin. Cardone explained the strategy clearly. Essentially, rental income from properties actively funds further Bitcoin purchases. Therefore, steady real estate cash flow continuously builds their crypto reserves. The firm manages over 14,000 rental units presently. Additionally, total assets under management exceed $5.1 billion.

Bitcoin Adoption Wave

Cardone Capital is hardly alone in embracing Bitcoin. Japanese investment firm Metaplanet also made headlines recently. They acquired an impressive 1,111 additional Bitcoin just this Monday. Another firm, Metaplanet’s total holdings now reach 11,111 BTC. This stash is worth roughly $1.12 billion today. On the other hand, (Micro) Strategy founder Michael Saylor hinted strongly at more buys. His weekend social media post proclaimed, “Nothing Stops This Orange.”

Aggressive Expansion

Cardone Capital’s vision extends far beyond this initial Bitcoin purchase. Their target is crystal clear: own 4,000 total BTC by December 2025. Achieving this requires securing another 3,000 Bitcoin soon. That potential $300 million+ investment shows deep commitment. Simultaneously, Cardone plans significant real estate growth too. He aims to expand the firm’s property portfolio by 5,000 units. This aggressive dual-track approach blends tangible bricks with digital bits. Analysts noted immediate market ripple effects. Bitcoin trading volume surged 15% following Cardone’s announcement.

Correcting the Record

Some initial reports contained a major error. Certain outlets mistakenly claimed the 1,000 BTC cost $5.1 billion. This figure actually represents Cardone Capital’s total managed assets. Verified sources confirm the correct Bitcoin purchase price. They spent approximately $102 million for the initial 1,000 coins. Cardone Capital pioneers a compelling model for others. They merge reliable real estate income with Bitcoin’s appreciation potential. The world watches as this $5.1 billion firm places a monumental bet on Bitcoin’s future.

Written By Fazal Ul Vahab C H

The post Real Estate Giant Buys 1,000 Bitcoin Worth $102 Million, Plans 3,000 More in 2025 appeared first on Trade Brains.

What's Your Reaction?