Solar stock jumps after it plans to sell 2.4% stake in its subsidiary via OFS

A leading Indian solar panel manufacturer is making a strategic financial move. This company plans to divest a 2.4% stake in a listed solar company. The sale, approximately 10 lakh shares, is expected to occur via an Offer for Sale (OFS). Waaree Energies Limited’s stock, with a market capitalisation of Rs. 90,463 crores, rose to […] The post Solar stock jumps after it plans to sell 2.4% stake in its subsidiary via OFS appeared first on Trade Brains.

A leading Indian solar panel manufacturer is making a strategic financial move. This company plans to divest a 2.4% stake in a listed solar company. The sale, approximately 10 lakh shares, is expected to occur via an Offer for Sale (OFS).

Waaree Energies Limited’s stock, with a market capitalisation of Rs. 90,463 crores, rose to Rs. 3,181, hitting the intraday high of up to 1.97 percent from its previous closing price of Rs. 3,119.50. Furthermore, the stock over the past year has given a return of 34.3 percent.

Promoter Stake Sale

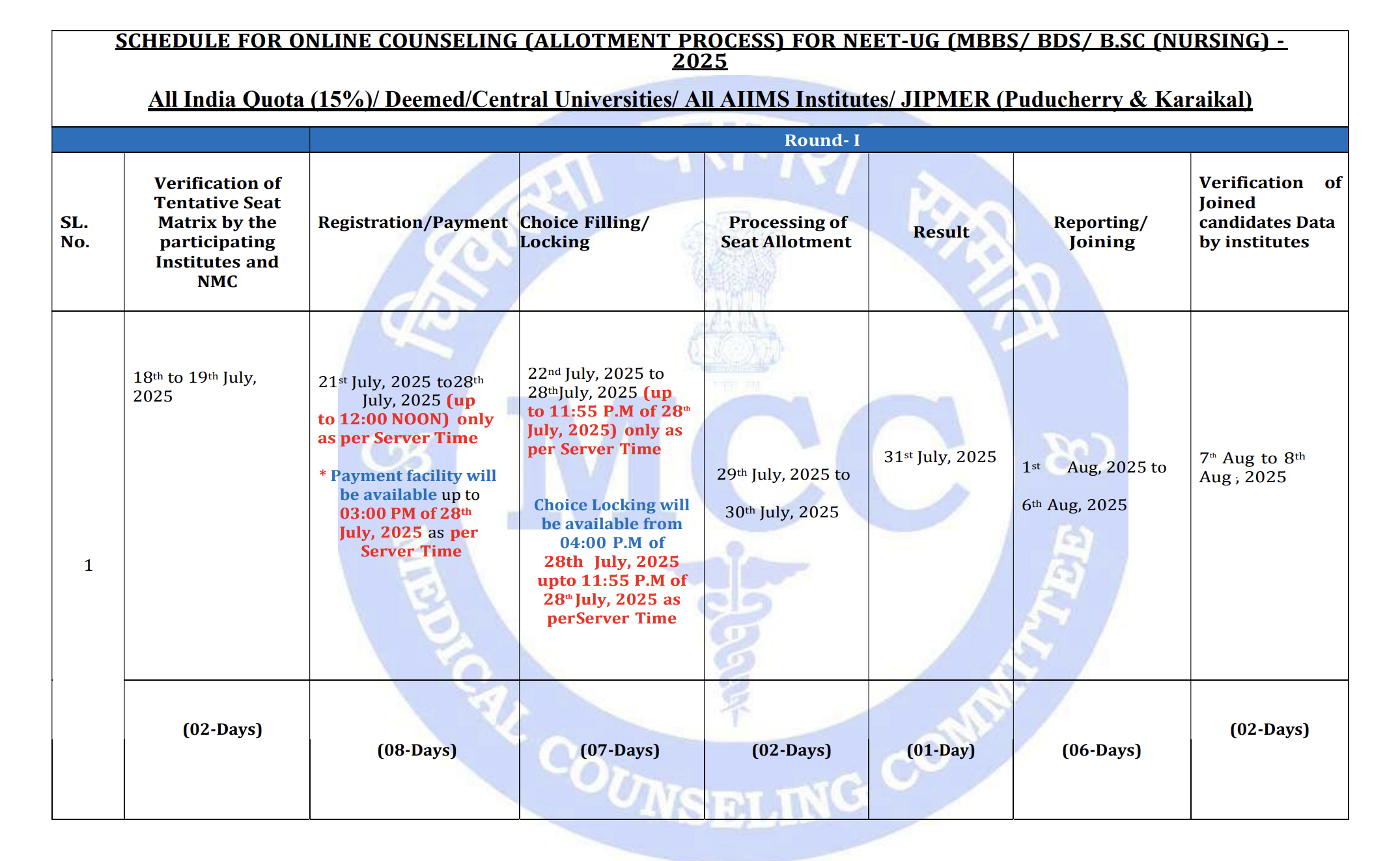

Waaree Energies, the parent company of Indosolar Limited, is planning to offload up to 10 lakh equity shares (2.4% of its total equity) through an Offer for Sale (OFS) to comply with minimum public shareholding rules. The sale will take place on July 10, 2025, for non-retail investors and on July 11, 2025, for retail investors, with a floor price of Rs. 265 per share and no discount for retail buyers. Antique Stock Broking is managing the sale, and the bidding will happen on the BSE and NSE between 9:15 a.m. and 3:30 p.m., with BSE as the lead exchange.

In this OFS, 10% of the shares are reserved for retail investors, and at least 25% are set aside for mutual funds and insurance firms, subject to demand. The final allocation will be based on the highest bids, with retail investors allowed to bid at the cut-off price decided after non-retail bidding.

Also read: Railway stock in focus after receiving order worth ₹17.47 Cr from Chhattisgarh Govt

Waaree History with Indosolar

Indosolar, which faced financial troubles and insolvency proceedings by lenders in October 2018, was later acquired by Waaree Energies under the Insolvency and Bankruptcy Code, 2016. After the takeover, the company turned profitable, reporting a net profit of Rs 55 crore in FY25, compared to a loss of Rs 15.44 crore in FY24. Indosolar shares resumed trading on June 19, 2025, after being temporarily suspended due to procedural issues.

Q4 Financial Highlight

The company reported strong revenue growth in Q4FY25 at Rs. 4,004 crore, up 36 percent YoY from Rs. 2,936 crore in Q4FY24 and 16 percent QoQ from Rs. 3,457 crore in Q3FY25. Profit also saw robust expansion, rising 36 percent YoY to Rs. 644 crore from Rs. 475 crore in Q4FY24 and 27 percent QoQ from Rs. 507 crore in Q3FY25. This reflects healthy operational momentum both on a yearly and sequential basis.

Over a 3-year period, the company has delivered an impressive profit CAGR of 192 percent and a sales CAGR of 72 percent and maintained a strong ROE CAGR of 31 percent, highlighting its consistent financial performance and efficient capital utilisation. The steady QoQ and YoY growth trends, backed by strong long-term metrics, indicate a sustainable growth trajectory.

Written By Fazal Ul Vahab C H

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Solar stock jumps after it plans to sell 2.4% stake in its subsidiary via OFS appeared first on Trade Brains.

What's Your Reaction?