South Korea Reports Record Suspicious Crypto Transactions in 2025

South Korea is facing an unprecedented surge in suspicious cryptocurrency transactions this year. According to recently released data from the Financial Intelligence Unit (FIU), local virtual asset service providers filed 36,684 suspicious transaction reports (STRs) between January and August 2025. This figure surpasses the combined totals from the previous two years, highlighting a significant rise […] The post South Korea Reports Record Suspicious Crypto Transactions in 2025 appeared first on Trade Brains.

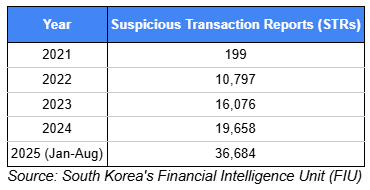

South Korea is facing an unprecedented surge in suspicious cryptocurrency transactions this year. According to recently released data from the Financial Intelligence Unit (FIU), local virtual asset service providers filed 36,684 suspicious transaction reports (STRs) between January and August 2025. This figure surpasses the combined totals from the previous two years, highlighting a significant rise in financial crimes linked to crypto activities.

Record Breaking Numbers in Suspicious Transactions

The number of STRs in 2025 has already doubled those seen in 2023 and 2024, which were 16,076 and 19,658 respectively. Earlier years had far fewer reports: just 199 in 2021 and 10,797 in 2022.

STRs are critical tools used by South Korea’s anti-money laundering framework to flag transactions suspected of involving criminal proceeds, money laundering, or terrorist financing. Under current laws, financial institutions, casinos, and virtual asset service providers must report any suspicious crypto activity to authorities.

Illegal Foreign Remittances

A large share of these flagged cases involve illegal foreign exchange remittances, locally called “hwanchigi.” This method converts illicit funds into digital currencies using offshore platforms, which are then transferred into domestic exchanges and cashed out in Korean won.

From 2021 to August 2025, cases involving crypto-linked crimes referred by the Korea Customs Service (KCS) sum to around $7.1 billion. Notably, 90% of this amount ties back to hwanchigi schemes. In a notable bust in May 2025, officials discovered a broker illicitly moving $42 million in stablecoins between South Korea and Russia via over 6,000 illegal transactions.

Stablecoins as a Double-Edged Sword

Stablecoins like Tether (USDT) have become preferred tools for moving money in these illegal operations. Their price stability makes them ideal for large, rapid cross-border transfers. However, regulators warn that the use of stablecoins increases vulnerability to money laundering and foreign exchange crimes. To combat these risks, lawmakers are urging tighter enforcement, including AI-driven tracking systems, stronger inter-agency cooperation, and stricter regulations on stablecoin issuers.

Global Challenge and Regulatory Responses

South Korea’s surge in suspicious crypto activities echoes a global challenge among financial regulators. While digital currencies and stablecoins streamline payments, they also open new avenues for illicit transactions.

The European Union’s Markets in Crypto-Assets (MiCA) regulation exemplifies a global response by enforcing licensing for stablecoin issuers and capping transaction volumes. Other regulators, like the European Central Bank and the Bank of England, have proposed individual holding limits to curb risks of unchecked digital currency flows. South Korea continues parliamentary discussions on enhancing its regulatory framework to balance innovation with safety and financial integrity.

South Korea’s experience signals a growing tension. With over 10 million crypto investors in the country, over 20% of the population, the booming market is ripe with opportunity and risk. Authorities and lawmakers are determined to strengthen defenses and prevent further criminal exploitation of virtual assets.

This record wave of suspicious crypto transactions underscores the urgent need for systematic countermeasures. South Korea is stepping up efforts to protect its financial system while seeking coherence with international standards in the evolving digital currency landscape.

Written By Fazal Ul Vahab C H

The post South Korea Reports Record Suspicious Crypto Transactions in 2025 appeared first on Trade Brains.

What's Your Reaction?