This Unicorn Startup Launched India’s first UPI-Powered Bank Branch in Bengaluru

Synopsis- The Bengaluru-based fintech startup Slice has launched its first-ever UPI-powered digital branch, modernizing the banking sector. This fully digital, paperless, “phygital” branch lets you do monetary transactions using UPI and digital kiosks, majorly targeting tech-savvy individuals and students. This move sets the beginning of a significant revolution in the banking services industry in India. […] The post This Unicorn Startup Launched India’s first UPI-Powered Bank Branch in Bengaluru appeared first on Trade Brains.

Synopsis- The Bengaluru-based fintech startup Slice has launched its first-ever UPI-powered digital branch, modernizing the banking sector. This fully digital, paperless, “phygital” branch lets you do monetary transactions using UPI and digital kiosks, majorly targeting tech-savvy individuals and students. This move sets the beginning of a significant revolution in the banking services industry in India.

The first-ever digital branch is here, as Bengaluru-based startup Slice has introduced its first UPI-powered branch in the heart of India’s Silicon Valley. This marks a significant achievement and sets the transformation in the financial services provided in India, especially by leveraging the country’s most advanced innovation for payments- UPI (Unified Payment Interface).

The Modern Bank Branch

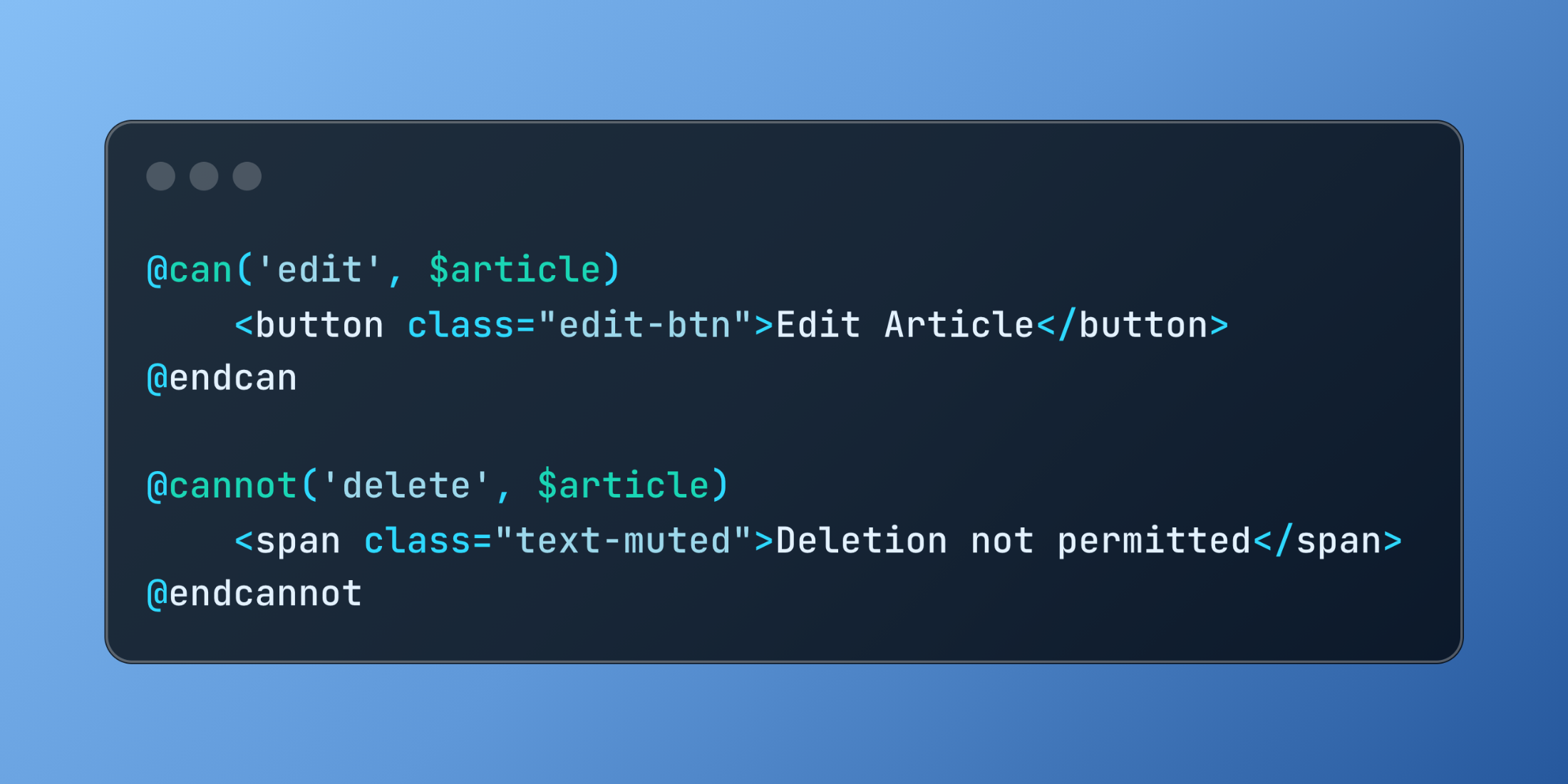

The startup that was always known for its simple yet efficient credit solutions is now back in the limelight with its new-gen branch banking services. After the recent merger of the startup Slice and North East Small Finance Bank (NESFB), the started gained the regulated banking license and access to traditional banking infrastructure, which resulted in Slice expanding into full-fledged banking services. This new gen branch does not have the setup of any other conventional branch, as here you will find digital kiosks, smart tablets, and QR codes instead of counters with lengthy rows.

The “phygital” branch

Unlike traditional banks, this branch has tried its best to completely go paperless, by including features such as

- UPI-based transactions: The services provided here, such as deposit, withdrawal, and transfer of funds, are all done using UPI, either through a smartphone or a kiosk.

- Self-Services: From the most basic services, such as opening a bank account, getting a debit card, or availing of loans or any other financial service, can be executed here using the tablets or the kiosks, including the process of real-time digital KYC too. And it is understandable if some individuals, especially senior citizens, are not able to go through these procedures, hence, there are even Slice representatives present on site to guide you if needed.

- Digital Wallet Services: The slice bank accounts can also be linked to any of the UPI applications such as Google Pay, PhonePe, or Paytm, in order to make fund movements more efficient.

- Paperless Ecosystem: As said before, Slice has most of its services paperless. All documentation, signatures, and communications are digital, which contributes to a sustainable and eco-friendly banking experience.

Why Bengaluru?

The city has always been identified as the” Silicon Valley of India” around the globe, and with a big population of tech-savvy individuals, Bengaluru has always been the best spot to start this type of fintech wave. Additionally, the city has always been open to innovative ideas, especially in the fintech space, making it the best incubator for future-forward ideas.

The strategic location of the branch in Koramangala enhances the beginning of this revolution as being the heart of the city, with the majority of the population being students or tech employees, who are basically the core target audience of Slice. Moreover, the startup plans to use this branch as a pilot in order to gather feedback before opening more branching in other metro cities.

Also read: Fashion Startup Snitch has Partnered with ClickPost to Boost Delivery Efficiency

Riding the Fintech Wave

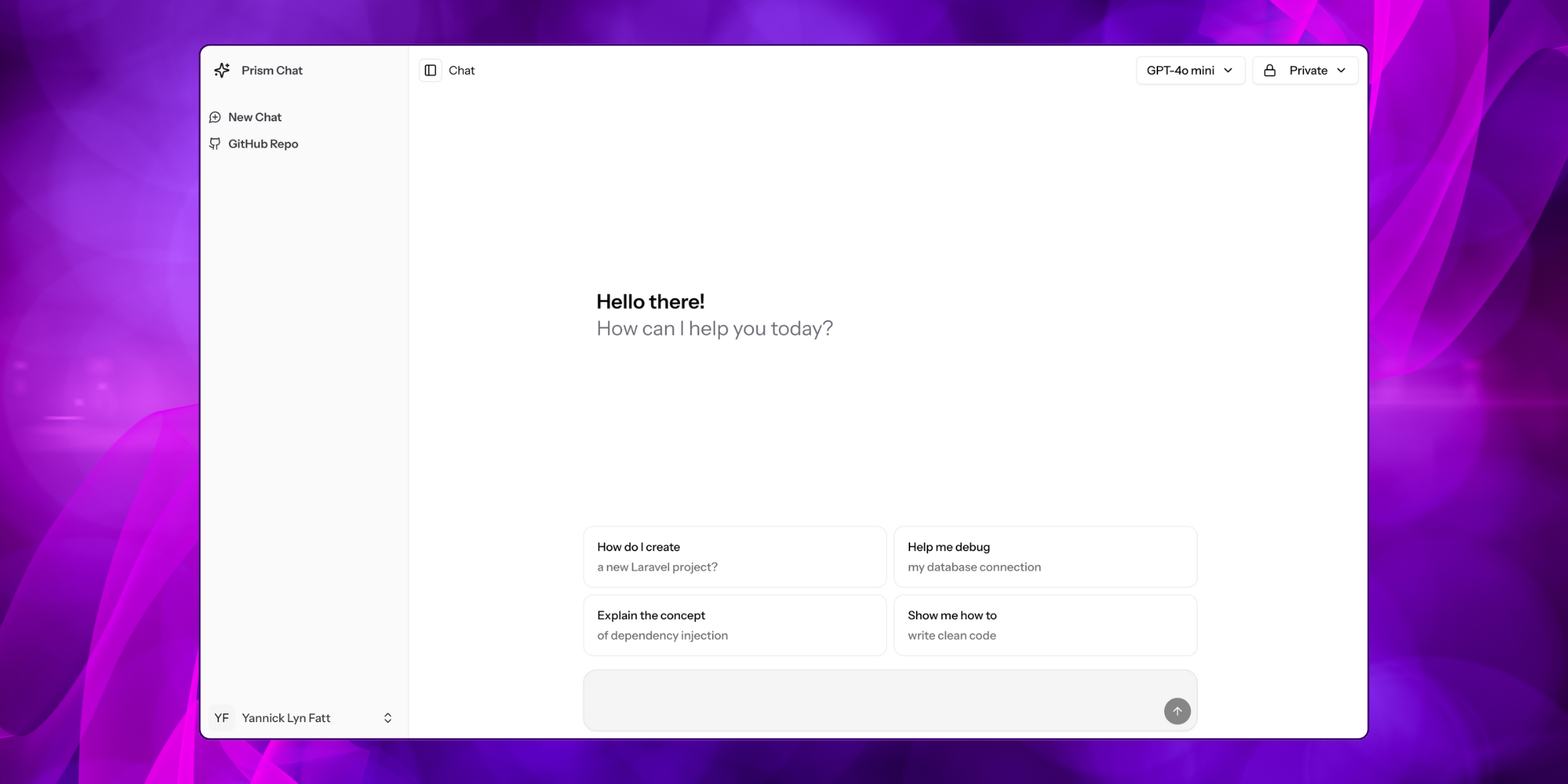

The launch of this new digital bank is adding to the transformation in the fintech revolution, with over 500 million UPI users and the total UPI transaction value crossing ₹17.3 lakh crore in June 2025, India has never seen this level of dependence on digital payments. Incorporating UPI into a branch has helped Slice keep up with the fintech trend, as it is part of the broader mission of the startup to make banking simpler, faster, and accessible to more individuals, especially students and the underserved segment. Additionally, the company is also working on AI-driven customer service bots and gamified savings accounts to attract more customers.

Regulatory Stance

Most of the tech-savvy individuals and students have welcomed the coming of the new gen digital bank, but at the same time, there are also several individuals who have raised questions on its security, compliance, and scalability. The RBI (Reserve Bank of India) has taken a cautious yet supportive stance on Slice Small Finance Bank, and is ready to promote such innovations, and encourages them to work closely with traditional banks in order to ensure stability and data protection. With the acquisition of NESFB, Slice has most of its regulatory concerns sorted out, but operational challenges such as educating first-time users and cyber-fraud still exist.

How is Banking in the Future going to be?

The UPI-powered banking is just a glimpse into the future of financial services in India. In the coming years, we can expect the technology to develop fourfold making allowing several startups to provide banking services, tech and experience-oriented, while traditional banks will stick to providing trust and regulations-oriented services. Additionally, we can also expect other startups to join this wave and establish more UPI-enabled micro-branches or even fully virtual bank branches.

The Bottom Line

The Slice Small Finance Bank has individuals reimagine banking services for the future. Setting the beginning of the transformation in the banking sector, we can see the boundaries between fintech and traditional banking blur. As Slice has come up with its user-first design, seamless digital integration, and deep understanding of young India’s financial behaviour, now we can expect more startups to join in the rising wave of fintech in India.

Written by Adithya Menon

The post This Unicorn Startup Launched India’s first UPI-Powered Bank Branch in Bengaluru appeared first on Trade Brains.

What's Your Reaction?