Waaree Energies and 4 other stocks with bearish MACD crossover to keep on your radar

Several stocks from key sectors such as automotive, insurance, finance, renewable energy, and consumer durables have turned MACD bearish, indicating potential short-term weakness in momentum despite strong fundamentals and long-term growth prospects across industries. MACD bearish stocks are those where the MACD line crosses below the signal line, indicating a potential shift in momentum from […] The post Waaree Energies and 4 other stocks with bearish MACD crossover to keep on your radar appeared first on Trade Brains.

Several stocks from key sectors such as automotive, insurance, finance, renewable energy, and consumer durables have turned MACD bearish, indicating potential short-term weakness in momentum despite strong fundamentals and long-term growth prospects across industries.

MACD bearish stocks are those where the MACD line crosses below the signal line, indicating a potential shift in momentum from bullish to bearish. This suggests that the stock’s upward trend may be losing strength, leading to possible short-term price corrections or consolidation.

The automotive, insurance, NBFC, renewable energy, and consumer durables sector stocks witnessed bearish MACD signals, reflecting short-term selling pressure. While underlying businesses remain fundamentally strong, technical indicators suggest possible consolidation or correction before the next upward move.

Bosch Ltd

Bosch Ltd is a leading supplier of technology and services in mobility solutions, industrial technology, consumer goods, and energy systems. With a strong focus on innovation, automation, and electrification, the company plays a key role in India’s automotive and industrial ecosystem, supported by its strong German engineering legacy.

With market capitalization of Rs. 1,09,746 cr, the shares of Bosch Ltd are closed at Rs. 37,210 per share, from its previous close of Rs. 37,380 per share. This stock has seen a MACD bearish crossover, signaling a potential weakening in bullish momentum and suggesting short-term downside risk.

Star Health & Allied Insurance Company Ltd

Star Health is one of India’s largest standalone health insurance providers, offering a wide range of individual and corporate health insurance products. Backed by a strong distribution network and digital reach, the company continues to benefit from rising health awareness and growing insurance penetration in India.

With market capitalization of Rs. 28,285 cr, the shares of Star Health & Allied Insurance Company Ltd are closed at Rs. 481 per share, from its previous close of Rs. 480.40 per share. This stock has seen a MACD bearish crossover, signaling a potential weakening in bullish momentum and suggesting short-term downside risk.

Bajaj Finance Ltd

Bajaj Finance is a leading non-banking financial company (NBFC) in India, known for its diversified portfolio covering consumer finance, SME lending, and commercial lending. The company has built a strong presence across retail and digital platforms, maintaining robust asset quality and consistent profitability

With market capitalization of Rs. 6,54,574 cr, the shares of Bajaj Finance Ltd are closed at Rs. 1,052.30 per share, from its previous close of Rs. 1,062.95 per share. This stock has seen a MACD bearish crossover, signaling a potential weakening in bullish momentum and suggesting short-term downside risk.

Waaree Energies Ltd

Waaree Energies is India’s largest solar PV module manufacturer and a major player in renewable energy solutions. The company is engaged in solar module manufacturing, EPC services, and solar project development, contributing to India’s clean energy transition and growing global solar exports.

With market capitalization of Rs. 98,697 cr, the shares of Waaree Energies Ltd are closed at Rs. 3,432.20 per share, from its previous close of Rs. 3,477.60 per share. This stock has seen a MACD bearish crossover, signaling a potential weakening in bullish momentum and suggesting short-term downside risk.

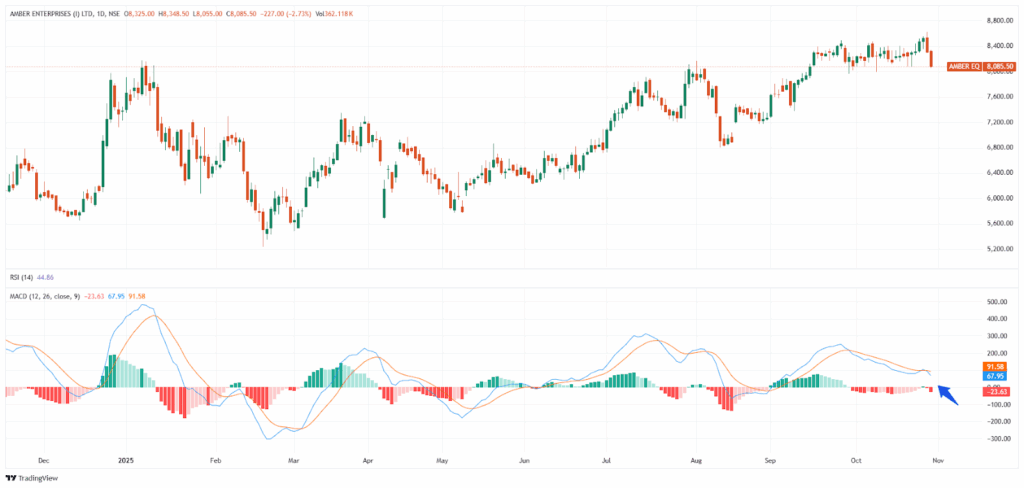

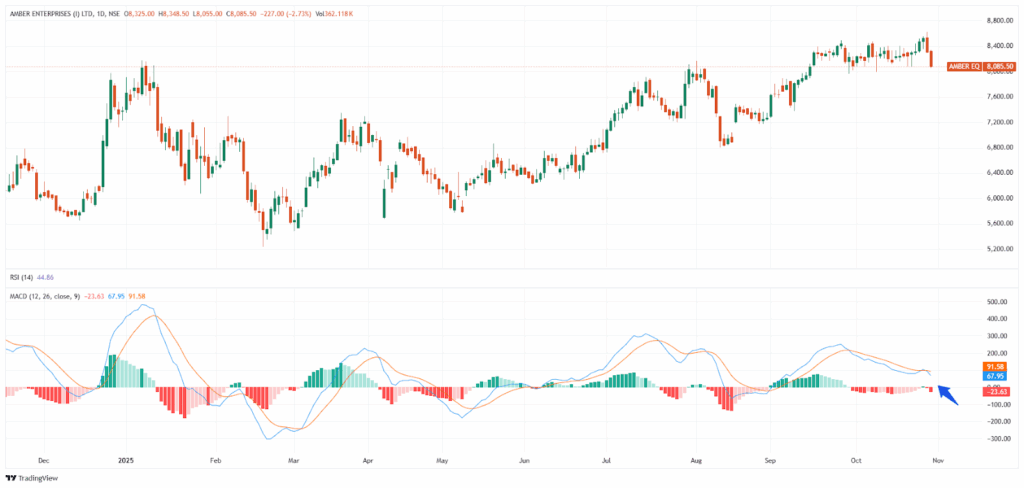

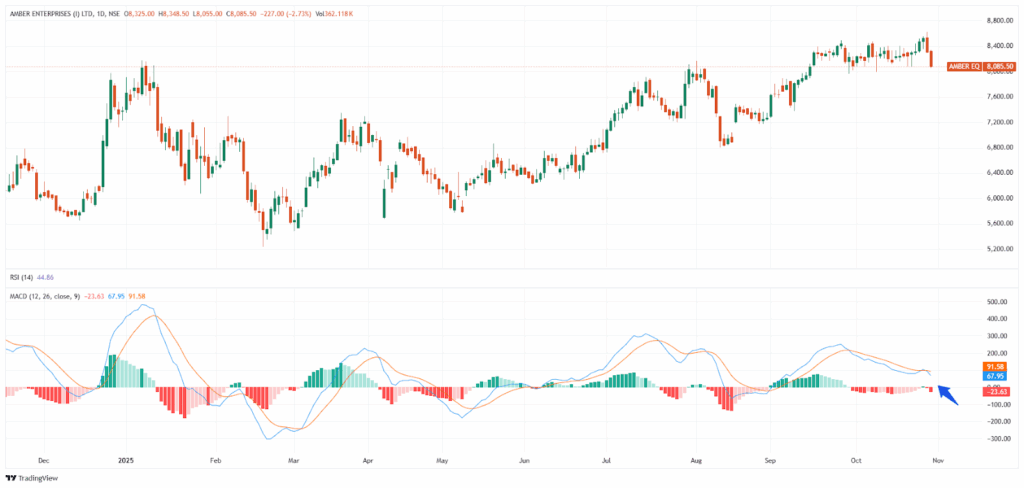

Amber Enterprises India Ltd

Amber Enterprises is a leading manufacturer of room air conditioners and components for major consumer durable brands in India. With a strong focus on design, R&D, and backward integration, the company benefits from rising domestic demand, import substitution, and the government’s Make in India push.

With market capitalization of Rs. 28,552 cr, the shares of Amber Enterprises India Ltd are closed at Rs. 8,085.50 per share, from its previous close of Rs. 8,085.50 per share. This stock has seen a MACD bearish crossover, signaling a potential weakening in bullish momentum and suggesting short-term downside risk.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Waaree Energies and 4 other stocks with bearish MACD crossover to keep on your radar appeared first on Trade Brains.

What's Your Reaction?