What’s the Market Share of IndiGo in Domestic Airlines? Find Out Here!

Synopsis: As of Oct’25, IndiGo Airlines holds the largest market share in India’s civil aviation sector at 65.6%, followed by Air India at 25.7%, according to regulator DGCA. The IndiGo fiasco highlights the dangers of monopoly in an industry. India’s aviation sector has grown massively in the past decade, but one airline continues to dominate […] The post What’s the Market Share of IndiGo in Domestic Airlines? Find Out Here! appeared first on Trade Brains.

Synopsis: As of Oct’25, IndiGo Airlines holds the largest market share in India’s civil aviation sector at 65.6%, followed by Air India at 25.7%, according to regulator DGCA. The IndiGo fiasco highlights the dangers of monopoly in an industry.

India’s aviation sector has grown massively in the past decade, but one airline continues to dominate the skies more than anyone else — IndiGo. Whether you’re a frequent flyer or someone who travels occasionally, chances are high that most of your domestic flights have been on IndiGo. But just how big is its presence? The latest data from the Directorate General of Civil Aviation (DGCA) reveals a clear picture.

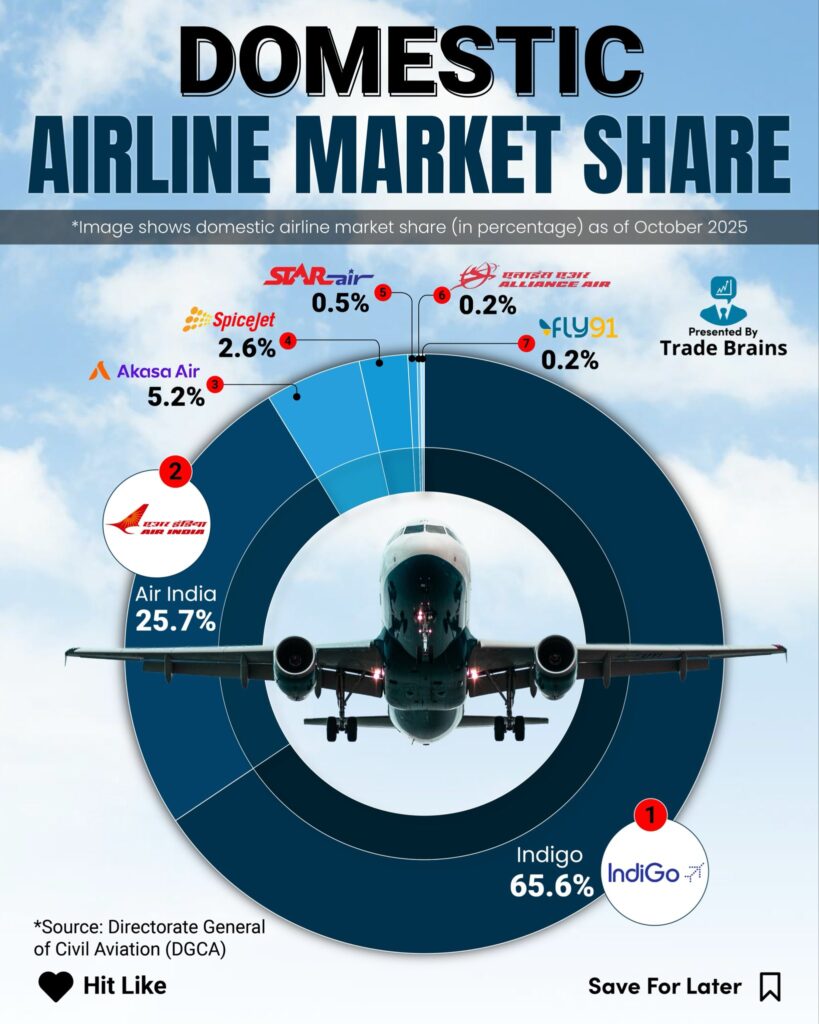

Domestic Airline Market Share (as of October 2025)

IndiGo: 65.6%

Air India: 25.7%

Akasa Air: 5.2%

SpiceJet: 2.6%

Others (Star Air, Alliance Air, Fly91, etc.): 0.9%

With an enormous 65.6% market share, IndiGo is far ahead of its closest competitor, Air India, which stands at 25.7%. To put this into perspective, IndiGo operates nearly two out of every three domestic flights in the country. No other aviation brand has ever held such a large share of the Indian skies at one time.

This dominance, however, has recently highlighted a critical issue — the risks that come with such a heavily concentrated market.

The IndiGo Fiasco: A Wake-Up Call for the Entire Aviation Industry

In late 2025, IndiGo found itself in one of the biggest operational crises in its history. What started as an internal scheduling issue quickly turned into a nationwide aviation setback. Thousands of flights were cancelled or delayed across major cities like Delhi, Bengaluru, Mumbai, Hyderabad, and Kolkata.

The root cause? IndiGo’s inability to adapt to the DGCA’s newly implemented crew-rostering and mandatory rest-period regulations.

These updated norms require pilots to receive longer rest breaks between flights for safety reasons. However, IndiGo — which operates one of the densest flight schedules in India — did not have enough “legally available” crew to keep its operations running smoothly under the new rules. With pilots unable to fly and schedules overloaded, the system began breaking down flight by flight.

Passengers faced last-minute cancellations, long delays, missed connections, and overcrowded airports. As the disruption spread rapidly, it became clear how dependent India had become on one single carrier to keep the domestic aviation network functional.

The Ripple Effect: How One Airline’s Crisis Affected the Entire Country

Because IndiGo handles nearly 66% of all domestic traffic, the chaos wasn’t limited to just its passengers. Other airlines were unable to accommodate the sudden spillover demand, ticket prices shot up temporarily, and airports became crowded with stranded travellers searching for alternative flights.

This incident showed how fragile the aviation ecosystem becomes when one airline holds such massive dominance. Even a small operational disruption at that scale can create nationwide consequences — something India witnessed firsthand.

IndiGo’s Response and Recovery Efforts

Facing mounting pressure from customers, regulators, and the media, IndiGo began offering large-scale refunds and compensation. Refunds of around ₹610 crore were reportedly issued as the airline attempted to manage the financial and customer service fallout. IndiGo has stated that it expects operations to return to near-normal levels by around 10 December, once crew availability stabilises and schedules are restructured to comply with the new rules.

Meanwhile, the DGCA has issued a show-cause notice to IndiGo, asking the airline to explain how such a severe disruption was allowed to escalate without adequate contingency planning. Depending on the findings, further regulatory actions or operational mandates may follow.

What This Means for India’s Aviation Future

The IndiGo crisis has sparked multiple conversations about the structure of the aviation industry in India. Many experts believe that when one airline controls more than half of the domestic market, the overall system becomes vulnerable. A single-point failure can affect lakhs of passengers and disrupt travel plans across the country.

The situation also raises the need for:

• More competition among airlines

• Balanced market share distribution

• Better regulatory monitoring of crew management and scheduling

• Stronger contingency frameworks for major carriers

• Diversification of routes among multiple airlines

Air India, Akasa Air, and other carriers may find opportunities to expand their fleets, add new routes, and increase capacity in the coming years — offering passengers more choice and reducing pressure on a single airline.

Final Thoughts

IndiGo’s 65.6% market share shows its remarkable efficiency, strong brand trust, and large fleet operations. But the recent crisis also underlines the risks of over-reliance on one dominant player. As more Indians take to the skies each year, a healthier balance between airlines will not only improve competition but also make the aviation ecosystem more resilient.

For now, IndiGo is working to bring its operations back on track — but the industry has learned an important lesson: even the biggest airline can face turbulence, and when it does, the entire nation feels the impact.

The post What’s the Market Share of IndiGo in Domestic Airlines? Find Out Here! appeared first on Trade Brains.

What's Your Reaction?