Why Are Easy Trip Planners Shares Up 13% Despite Weak Q3 Results?

Synopsis: Easy Trip Planners surged 13% despite a sharp 90% YoY decline in Q3 profit, as investors focused on sequential recovery, strong international expansion, and growth in high-margin non-air segments. Improved EBITDA margins, Dubai market momentum, and plans to raise Rs 500 crore for expansion boosted market sentiment. The shares of this company, which is the […] The post Why Are Easy Trip Planners Shares Up 13% Despite Weak Q3 Results? appeared first on Trade Brains.

Synopsis: Easy Trip Planners surged 13% despite a sharp 90% YoY decline in Q3 profit, as investors focused on sequential recovery, strong international expansion, and growth in high-margin non-air segments. Improved EBITDA margins, Dubai market momentum, and plans to raise Rs 500 crore for expansion boosted market sentiment.

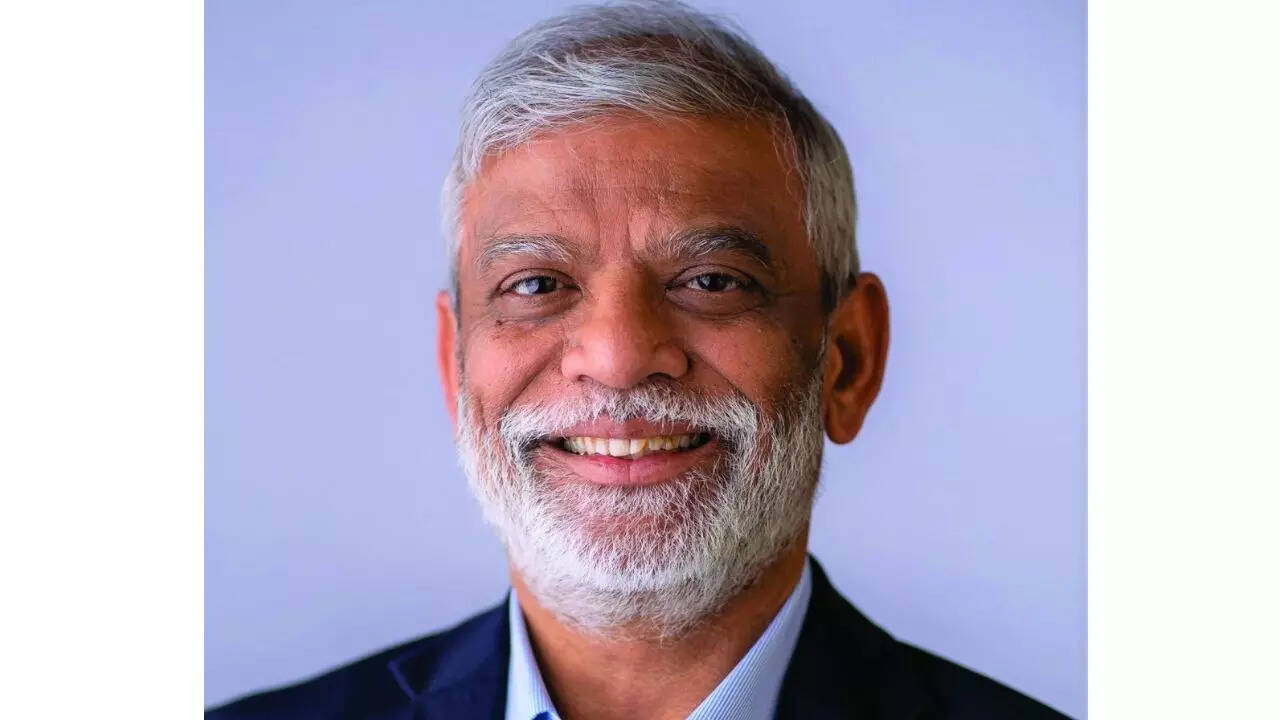

The shares of this company, which is the fastest-growing, 2nd-largest company in the online travel portal in India and offers a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotel and holiday packages, rail tickets, and bus tickets, had its shares in momentum today after the company reported its Q3 results.

With the market cap of Rs 2,702 crore, the shares of Easy Trip Planners Ltd have jumped about 13% and reached a high at Rs 7.45, compared to their previous day’s closing price of Rs 6.61. The shares are trading at a PE of 102, whereas its industry PE is at 44.6.

About the Q3 FY26 Result highlights

The revenue from operations for the company stood at Rs 152 crore when compared to Rs 151 crore in Q3 FY25, growing by about 1 per cent on a YoY basis and, on a QoQ basis, growing by 29 per cent from Rs 118 crore in Q2 FY26.

The PAT fell on a YoY basis when you compare the Q3 FY26 profit at Rs 3.41 crore to the Rs 34.03 crore profit in Q3 FY25. However, on a QoQ basis, it has grown from the Rs 36 crore loss in Q2 FY26.

EaseMyTrip’s Q3 FY26 is a testament to its operational pace, fuelled by international growth and a robust non-air business. The company posted gross booking revenue of Rs 2,213 crore and revenue from operations of Rs 151.7 crore, with EBITDA growth of 15% QoQ to Rs 13.9 crore at an 8.6% margin, while PAT was at Rs 7.5 crore.

The most notable area of growth was Dubai, where Gross Booking Revenue grew a staggering 133% YoY to Rs 397 crore, marking the success of its international business model. The hotel and holiday business also saw an impressive 84% YoY growth, marking a paradigm shift towards more profitable non-air businesses.

In terms of strategy, EaseMyTrip is now focusing on being a well-rounded travel solutions provider rather than a pure air ticketing service. Seasonal offerings, airport food partnerships, religious tourism requirements, and international event collaborations have all contributed to enhanced brand engagement and non-ticketing revenue streams. The improvement in EaseMyTrip’s ESG rating and tourism infrastructure investments also point towards long-term value creation beyond pure growth.

Overall, the release indicates a well-rounded approach to topline growth, margin expansion, and international scalability, although profitability is moderate compared to booking volumes.

EaseMyTrip is set to raise funds of up to Rs 500 crore to further enhance growth and tap high-potential segments such as hotels and holidays The money will be raised through means such as QIP, rights issue, or preferential allotment, among others, subject to approvals. The development is aimed at improving financial flexibility and enabling sustainable growth. All of these, along with the QoQ profitability conversion, fuelled the company shares to gain 13% today.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Why Are Easy Trip Planners Shares Up 13% Despite Weak Q3 Results? appeared first on Trade Brains.

What's Your Reaction?

.jpg)