Bitcoin Doesn’t Get A Macro ‘Bailout’ This Time: Alden Warns Of Gradual QE

Bitcoin investors hoping for a familiar macro rescue may be reading the room wrong. In an interview with Coin Stories host Nathalie Brunell, macro analyst Lyn Alden argued that the next policy turn is more likely to resemble a slow balance-sheet creep than the kind of “nuclear print” that has historically juiced risk assets, leaving bitcoin to compete largely on its own fundamentals and narrative pull. Alden framed the current cycle as unusually underwhelming, not just in price terms but in participation. She noted that sentiment “is worse than 2022,” and attributed the malaise to a missing retail bid, a lack of “alt season,” and a broader crypto market that “kind of run out of narratives.” Bitcoin, she said, topped out at $126,000, below her own bar for a satisfying cycle. “Sometimes they give their time frames so we can just see if it hits that time frame or not,” Alden said, pushing back on the reflexive call that every drawdown forces the Fed’s hand. “Every kind of down tick in stocks or every kind of down tick they say well the […] we’re going to have to print soon. But really the Fed only cares mainly about the liquidity of the treasury market and the interbank lending market […] even stocks going down 10, 20, 30% is not really going to be a catalyst.” Related Reading: Is Jane Street Manipulating Bitcoin? The Viral Theory Explained Brunell pointed to comments she said came from Fed Chair Jerome Powell about “slowly” expanding the balance sheet, with purchases starting around $40 billion in short-end Treasury bills, far from the trillions some bitcoin bulls anchor on. Alden’s response was blunt: the plumbing doesn’t demand a shock-and-awe response right now. “Mainly because the conditions are not such that they would need a big print in the near future,” she said. “There are scenarios that can absolutely result in a big print or a nuclear print […] but when you kind of run the numbers of how much debt is coming out, how levered or unlevered banks are, they just don’t really need a lot of printing. A little printing gets them a long way.” In Alden’s telling, QE1-scale interventions were tied to a very specific setup: an overlevered banking system with low cash ratios and acute private-sector balance sheet stress. Today, she argued, bank cash ratios are “still pretty high,” and absent a COVID-scale disruption or an escalation in war or “financial war”, the base case is incrementalism. Bitcoin Still Has To Win Attention That matters because, in Alden’s framework, gradual balance-sheet expansion is supportive but not decisive for bitcoin. The era where “micro doesn’t matter at all” is reserved for true emergency stimulus and she doesn’t see that as the near-term setup. “Not a ton, I think,” Alden said when asked what gradual QE means for bitcoin. “It’s supportive […] but Bitcoin still has to compete on its own merits for investor attention. So, you know, basically it has to compete with Nvidia […] with everything out there that people can own.” Related Reading: Bitcoin Capitulation Or Buy Zone? What On-Chain Data Shows Right Now She tied the muted cycle to “mediocre” topline demand and a capital-market landscape where AI-linked equities and even precious metals have offered competition for mindshare. Sovereigns “didn’t really show up,” she said, and retail largely stayed sidelined, leaving “the corporate institutional side” and higher-net-worth brokerage buyers, aided by ETFs, as the main marginal bid. Alden also downplayed the idea that derivatives and ETFs are the chief culprit behind a capped upside, even if they can “inflate” synthetic supply for a time. The bigger issue, she argued, is simply that the demand impulse hasn’t been strong enough to overwhelm a now-larger, more liquid market. Looking forward, Alden expects bottoms to form as “fast money gets out” and coins rotate to “strongly held hands,” with price more likely to grind than V-recover. On the upside, she pointed to a potential setup where AI trades eventually peak, bitcoin sits “cheap for a while” in tight hands, and only “a marginal amount of new demand” is needed to restart reflexivity, possibly alongside continued buying from bitcoin treasury companies. For now, her core warning is that this cycle may not be saved by policy theatrics. If bitcoin is going to reassert itself, Alden suggested, it will be less about waiting for a macro bailout and more about whether enough investors still want “self-custodial […] undebasable savings,” even when other assets are stealing the spotlight. At press time, Bitcoin traded at $67,556. Featured image created with DALL.E, chart from TradingView.com

Bitcoin investors hoping for a familiar macro rescue may be reading the room wrong. In an interview with Coin Stories host Nathalie Brunell, macro analyst Lyn Alden argued that the next policy turn is more likely to resemble a slow balance-sheet creep than the kind of “nuclear print” that has historically juiced risk assets, leaving bitcoin to compete largely on its own fundamentals and narrative pull.

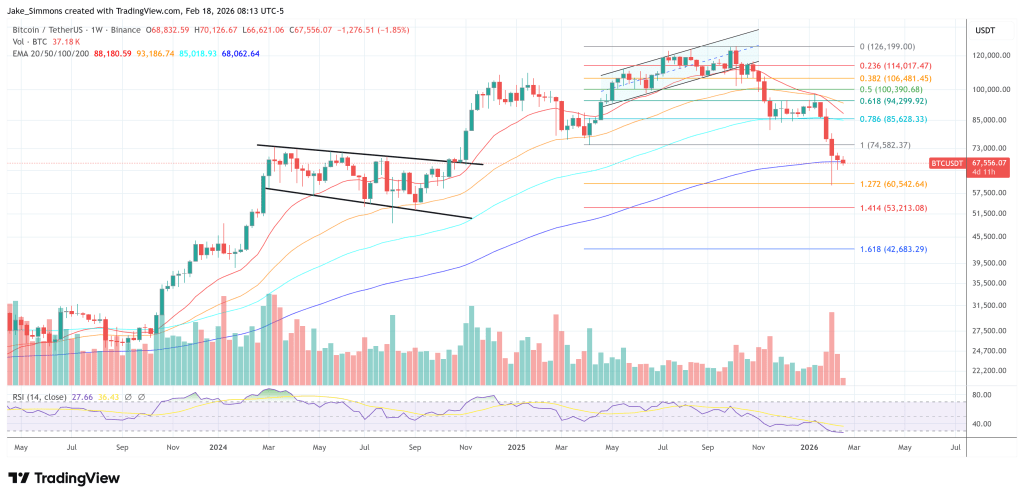

Alden framed the current cycle as unusually underwhelming, not just in price terms but in participation. She noted that sentiment “is worse than 2022,” and attributed the malaise to a missing retail bid, a lack of “alt season,” and a broader crypto market that “kind of run out of narratives.” Bitcoin, she said, topped out at $126,000, below her own bar for a satisfying cycle.

“Sometimes they give their time frames so we can just see if it hits that time frame or not,” Alden said, pushing back on the reflexive call that every drawdown forces the Fed’s hand. “Every kind of down tick in stocks or every kind of down tick they say well the […] we’re going to have to print soon. But really the Fed only cares mainly about the liquidity of the treasury market and the interbank lending market […] even stocks going down 10, 20, 30% is not really going to be a catalyst.”

Brunell pointed to comments she said came from Fed Chair Jerome Powell about “slowly” expanding the balance sheet, with purchases starting around $40 billion in short-end Treasury bills, far from the trillions some bitcoin bulls anchor on. Alden’s response was blunt: the plumbing doesn’t demand a shock-and-awe response right now.

“Mainly because the conditions are not such that they would need a big print in the near future,” she said. “There are scenarios that can absolutely result in a big print or a nuclear print […] but when you kind of run the numbers of how much debt is coming out, how levered or unlevered banks are, they just don’t really need a lot of printing. A little printing gets them a long way.”

In Alden’s telling, QE1-scale interventions were tied to a very specific setup: an overlevered banking system with low cash ratios and acute private-sector balance sheet stress. Today, she argued, bank cash ratios are “still pretty high,” and absent a COVID-scale disruption or an escalation in war or “financial war”, the base case is incrementalism.

Bitcoin Still Has To Win Attention

That matters because, in Alden’s framework, gradual balance-sheet expansion is supportive but not decisive for bitcoin. The era where “micro doesn’t matter at all” is reserved for true emergency stimulus and she doesn’t see that as the near-term setup.

“Not a ton, I think,” Alden said when asked what gradual QE means for bitcoin. “It’s supportive […] but Bitcoin still has to compete on its own merits for investor attention. So, you know, basically it has to compete with Nvidia […] with everything out there that people can own.”

She tied the muted cycle to “mediocre” topline demand and a capital-market landscape where AI-linked equities and even precious metals have offered competition for mindshare. Sovereigns “didn’t really show up,” she said, and retail largely stayed sidelined, leaving “the corporate institutional side” and higher-net-worth brokerage buyers, aided by ETFs, as the main marginal bid.

Alden also downplayed the idea that derivatives and ETFs are the chief culprit behind a capped upside, even if they can “inflate” synthetic supply for a time. The bigger issue, she argued, is simply that the demand impulse hasn’t been strong enough to overwhelm a now-larger, more liquid market.

Looking forward, Alden expects bottoms to form as “fast money gets out” and coins rotate to “strongly held hands,” with price more likely to grind than V-recover. On the upside, she pointed to a potential setup where AI trades eventually peak, bitcoin sits “cheap for a while” in tight hands, and only “a marginal amount of new demand” is needed to restart reflexivity, possibly alongside continued buying from bitcoin treasury companies.

For now, her core warning is that this cycle may not be saved by policy theatrics. If bitcoin is going to reassert itself, Alden suggested, it will be less about waiting for a macro bailout and more about whether enough investors still want “self-custodial […] undebasable savings,” even when other assets are stealing the spotlight.

At press time, Bitcoin traded at $67,556.

What's Your Reaction?