Pharma Stock Skyrockets 11% After Shares Worth ₹216 Cr Exchange Hands via Block Deal

Synopsis: The shares of this pharmaceutical company surged 11.1 percent following a Rs 216.3 crore block transaction, marking a notable change in ownership with a sizable stake exchanged. The share of this company, which offers services to leading global pharmaceutical and fine chemical majors in their NCE development endeavours, gained investor traction after a significant […] The post Pharma Stock Skyrockets 11% After Shares Worth ₹216 Cr Exchange Hands via Block Deal appeared first on Trade Brains.

Synopsis: The shares of this pharmaceutical company surged 11.1 percent following a Rs 216.3 crore block transaction, marking a notable change in ownership with a sizable stake exchanged.

The share of this company, which offers services to leading global pharmaceutical and fine chemical majors in their NCE development endeavours, gained investor traction after a significant stake changed hands.

With a market capitalization of Rs 12,427 crore, Cohance Lifesciences Ltd’s shares on Wednesday made a day high of Rs 307.70 per share, up by 11.1 percent from the previous day’s close price of Rs 307.70 per share. The share of the company trades at a way overvalued P/E of 41.2x compared to the industry P/E of 27.9x.

What Happened

In a significant block deal, about 70 lakh shares of Cohance Lifesciences were traded, accounting for nearly 1.82 percent of the company’s total equity. The transaction was valued at roughly Rs 216.3 crore. However, the market is still unaware of who bought and who sold these shares.

As of December 2025, promoter holding rose to 57.49 percent from 50.10 percent a year earlier. FIIs trimmed their stake to 6.01 percent from 10.70 percent, while DIIs increased theirs to 21.57 percent from 16.67 percent. Government ownership remained steady at 0.015 percent, and public shareholding declined to 14.91 percent from 22.37 percent.

This block deal followed the investor meet, where the Cohance reported FY26 as a transition year, impacted by destocking, patent-led volume recalibration, and regulatory issues at Nacharam. Revenue declined, margins compressed due to mix and operating deleverage. However, Phase 3 pipeline strength, rising RFQs, and API recovery are expected to drive growth in FY27.

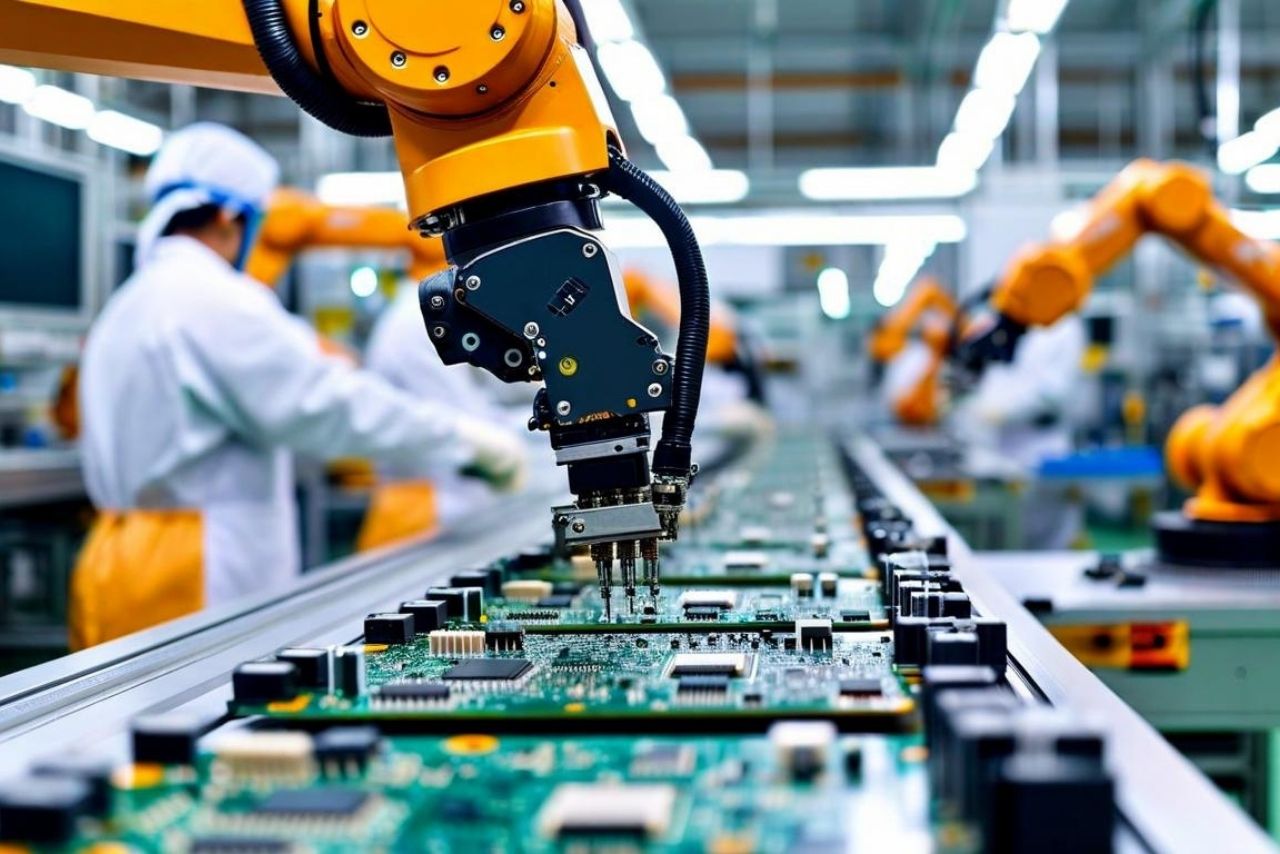

About the Company

Hyderabad-based CDMO company that offers services to leading global pharmaceutical and fine chemical majors in their NCE development endeavours. From process research & development to late-stage clinical and commercial manufacturing, we are committed to providing customers with products fulfilling customer needs and expectations.

Financial Highlights: The revenue from operations declined by 19 percent to Rs 545 crore in Q3 FY26 from Rs 676 crore in Q3 FY25, and EBIDT fell by 60 percent to Rs 95.4 crore in Q3 FY26 from Rs 237 crore in Q3 FY25. Accompanied by a net profit decline of 74 percent to Rs 29.0 crore in Q3 FY26 from Rs 153 crore in Q3 FY25, resulting in an EPS decline of 84 percent to Rs 0.96 per share in Q3 FY26.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Pharma Stock Skyrockets 11% After Shares Worth ₹216 Cr Exchange Hands via Block Deal appeared first on Trade Brains.

What's Your Reaction?