Why Did GE Power Shares Fall 10% Today?

Synopsis: Heavy Electrical Equipment stock engaged in EPC and manufacturing for thermal power plants fell 10% following profit booking after a strong rally, along with its addition to the ASM framework on February 16 and other technical factors. The shares of the Small-Cap company specializing in engineering, procurement, construction (EPC), and manufacturing of key equipment […] The post Why Did GE Power Shares Fall 10% Today? appeared first on Trade Brains.

Synopsis: Heavy Electrical Equipment stock engaged in EPC and manufacturing for thermal power plants fell 10% following profit booking after a strong rally, along with its addition to the ASM framework on February 16 and other technical factors.

The shares of the Small-Cap company specializing in engineering, procurement, construction (EPC), and manufacturing of key equipment for thermal power plants are in focus as they have fallen by 10 percent in a single day following various factors. In this article lets explore the reason for the fall.

With a market capitalization of Rs. 3,340.20 Crores on the Day’s Trade, the shares of GE Power India Ltd hit a 10 percent lower circuit, reaching a low of Rs. 496.85 compared to its previous close of Rs. 552.05.

What Happened

GE Power India Ltd, engaged in engineering, procurement, construction (EPC), and manufacturing of key equipment for thermal power plants have declined by 10 percent in the day’s trade, likely due to the following factors.

Profit Booking After Strong Rally:

The stock had rallied sharply, up ~60‑65% in the last five trading sessions, after strong Q3 results and positive sentiment. This created a high‑return base, so traders booked profits once prices got elevated.

Added to Risk/Surveillance Framework

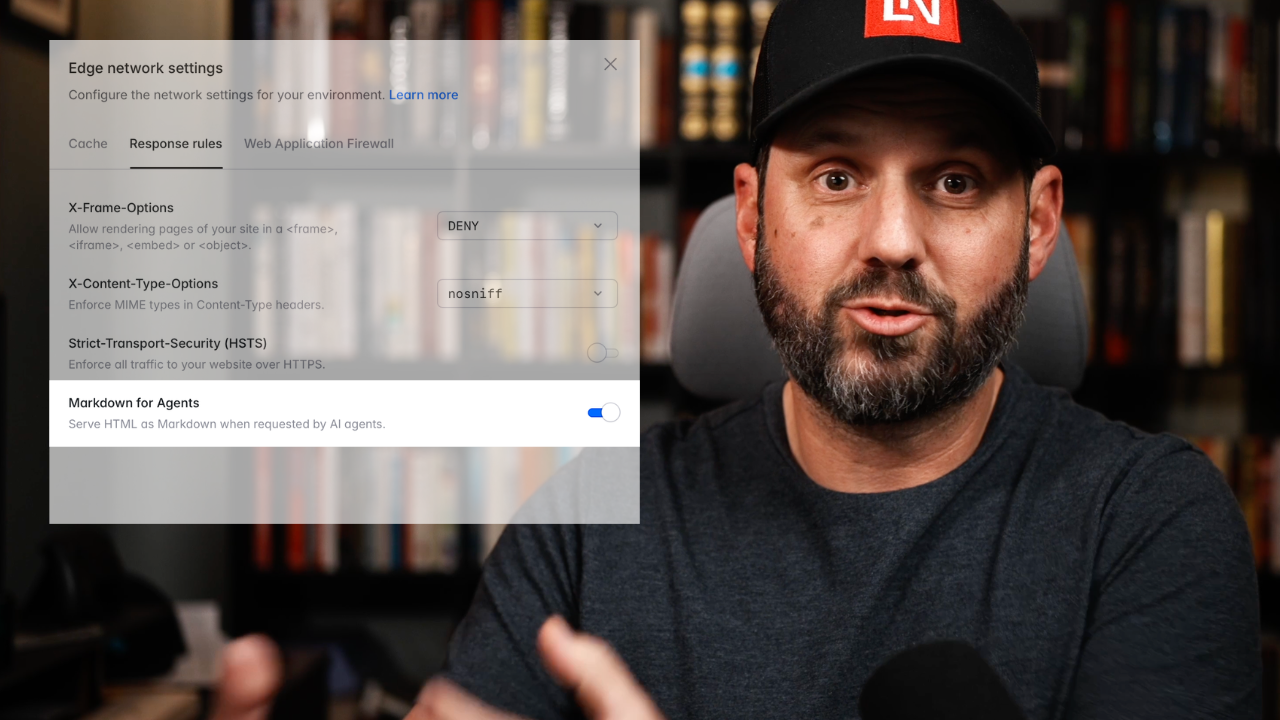

The stock has been recently on 16th february added to the ASM framework. Stocks under such frameworks often face more selling because some institutional and retail traders reduce exposure when volatility flags go up.

Technical Conditions

From a technical perspective, the stock was trading well above key moving averages, including 50‑EMA and 200‑EMA, and had seen strong momentum. RSI (Relative Strength Index) was above 70, signaling overbought conditions. This often leads to overbought conditions, prompting short‑term traders to exit.

Financials & Others

The company’s revenue rose by 21.69 percent from Rs. 317 crores in December 2024 to Rs. 386 crores in December 2025. Meanwhile, Net loss from Rs. 19 crores turned to a profit of Rs. 72 crores in the same period.

The current quarter ended with an order backlog of Rs. 16,706 million, down 38.3% compared to Rs. 27,060 million in the quarter ended 31 December 2024 from continuing operations. The decline was primarily driven by the termination of two FGD EP contracts, Jaypee Bina and Nigrie, amounting to Rs. 775 crore.

GE Power India Limited has strong capabilities in engineering, manufacturing, project management, and the supply of products and solutions for infrastructure. Its operations cover a comprehensive range of activities, including engineering, procurement, manufacturing, construction, and servicing of power plants and power equipment.

The company has engineering centres in Noida and Kolkata, and a manufacturing unit in Durgapur dedicated to boilers. GEPIL (formerly Alstom India) provides turnkey solutions, maintenance, and modernisation for power generation, serving major clients like NTPC and BHEL.

The company demonstrates strong financial health with a decent ROCE of 6.09% and an exceptional ROE of 105%, indicating it is highly efficient at generating returns on shareholders’ equity. Its debt-to-equity ratio of just 0.05 highlights a nearly debt-free balance sheet, suggesting low financial risk and prudent capital management.

In terms of growth, the company has delivered impressive profit expansion, achieving a 24% CAGR over the last five years, reflecting robust operational performance and sustainable earnings momentum. Additionally, a PEG ratio of 0.39 points to an attractive valuation relative to its growth, making it potentially appealing for investors seeking both growth and stability.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Why Did GE Power Shares Fall 10% Today? appeared first on Trade Brains.

What's Your Reaction?