Power stock in focus after company to set up ₹8,175 Cr lithium-ion battery gigafactory

Synopsis: Solar stock came into focus after investing Rs. 8,175 crore to build India’s largest lithium-ion battery gigafactory in Andhra Pradesh, creating 3,000 jobs, covering the full battery value chain, and boosting domestic clean-energy and EV capacity. The shares of this company are engaged in the manufacturing of solar PV modules and has five solar […] The post Power stock in focus after company to set up ₹8,175 Cr lithium-ion battery gigafactory appeared first on Trade Brains.

Synopsis: Solar stock came into focus after investing Rs. 8,175 crore to build India’s largest lithium-ion battery gigafactory in Andhra Pradesh, creating 3,000 jobs, covering the full battery value chain, and boosting domestic clean-energy and EV capacity.

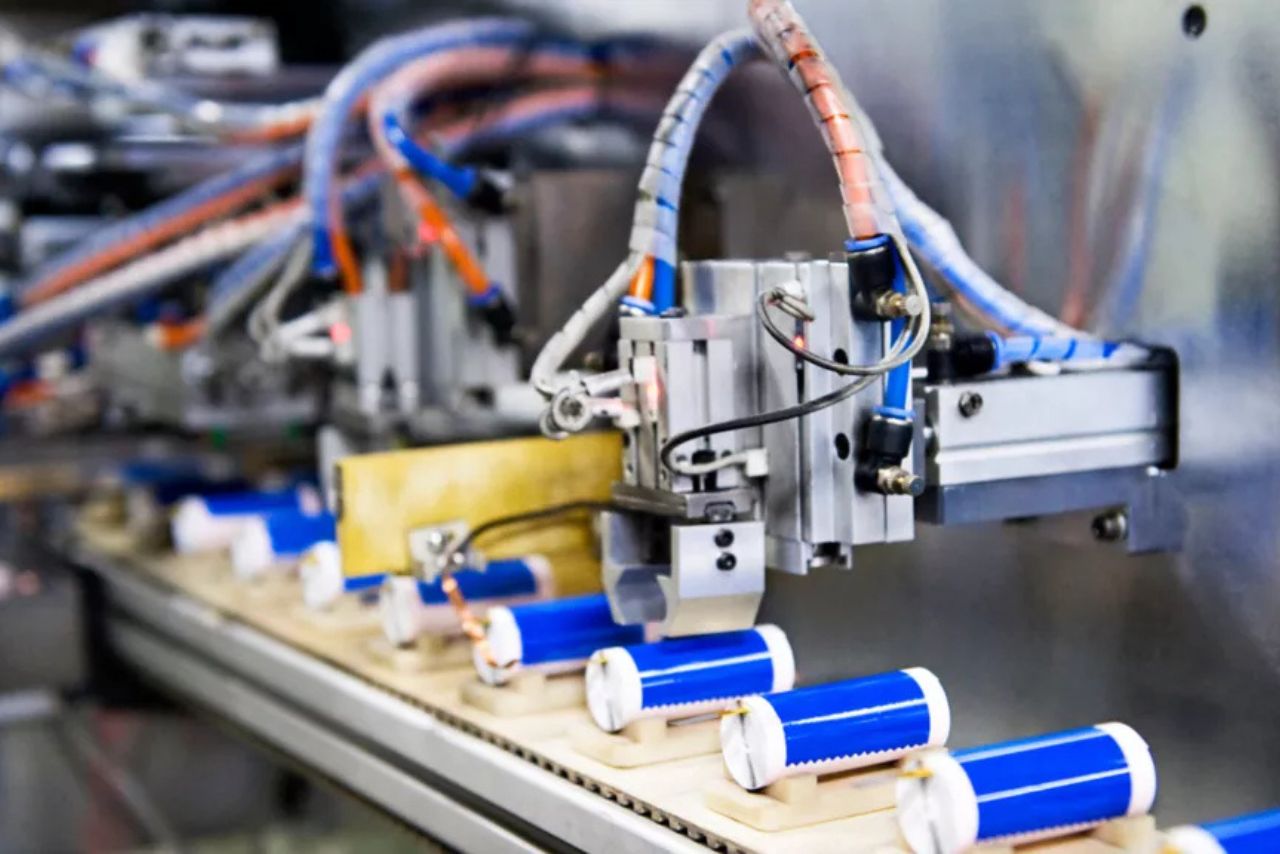

The shares of this company are engaged in the manufacturing of solar PV modules and has five solar module manufacturing facilities in India, with international presence are in focus after investing Rs. 8,175 crore to build India’s largest integrated lithium-ion battery gigafactory in Andhra Pradesh.

With a market capitalisation of Rs. 83,667 cr, the shares of Waaree Energies Ltd were trading at Rs. 2,908.75 per share, decreasing 1.9% from its previous close of Rs. 2,964.10 per share. The stock has gained 31% over the past year, declined 2% year-to-date, fallen 4% over the last six months, and risen 13.5% in the past month.

Major Clean-Energy Investment

Waaree Energies is investing Rs. 8,175 crore to build India’s largest integrated lithium-ion battery gigafactory in Rambilli, Anakapalli district, Andhra Pradesh. This greenfield facility marks a major step for the company, expanding from solar manufacturing into advanced energy storage which is a key sector for electrification and grid stability.

The gigafactory will have an initial 16 GWh capacity, making it one of the highest-capacity battery plants in India. The facility will cover the entire battery value chain, including cell manufacturing, battery pack assembly, and large-scale Battery Energy Storage Systems (BESS). This integration will reduce India’s dependence on imports for critical battery components needed in renewable energy and electric vehicle systems.

The project is expected to generate around 3,000 direct jobs, along with numerous indirect opportunities in ancillary industries, logistics, and services. This employment boost supports broader economic development in the region and strengthens advanced manufacturing capabilities in Andhra Pradesh.

The project has received in-principle approval from the Andhra Pradesh State Investment Promotion Board, chaired by Chief Minister N. Chandrababu Naidu. The government’s support highlights its focus on promoting clean-energy investments and attracting large-scale private projects that advance sustainable development.

The gigafactory is part of India’s strategy to build domestic capacity in lithium-ion batteries, which are critical for the growth of renewable energy, electric vehicles, and grid storage solutions.

Waaree Energies Ltd is a leading Indian solar company, headquartered in Mumbai, specialising in manufacturing solar panels and providing complete solar energy solutions for residential, commercial, and utility-scale projects.

For Q3FY26, the company reported sales of Rs. 7,565 crore, up 119% from Rs. 3,457 crore in Q3FY25. EBITDA surged 167% to Rs. 1,928 crore from Rs. 722 crore, while net profit rose 118% to Rs. 1,107 crore from Rs. 507 cr. EPS of Rs. 36.94, a 111% increase from Rs. 17.15 a year earlier.

The company has demonstrated a strong operational momentum with a significant ramp-up in production and a robust order book. Module production nearly doubled from 1.8 GW in Q3FY25 to 3.5 GW in Q3FY26, while cell production grew 35% to 0.8 GW. During this period, the company sold 3.6 GW of modules.

Its order book has strengthened to approximately Rs. 60,000 crore, up from ~Rs. 50,000 crore in Q3FY25 and ~Rs. 47,000 crore in Q2FY26, with a total pipeline exceeding 100 GW.

The company’s revenue is well-diversified, with 38.1% coming from Utility/IPP/C&I projects, 32.6% from overseas markets, 18.6% from retail, and 10.7% from EPC, reflecting both domestic and international growth opportunities.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Power stock in focus after company to set up ₹8,175 Cr lithium-ion battery gigafactory appeared first on Trade Brains.

What's Your Reaction?