Sterlite Technologies: Should You Buy or Sell This Cable Stock After Q3 Results?

Synopsis: Sterlite Technologies shares surged 8 percent after Nuvama reaffirmed a Buy with a Rs. 200 target of 40 percent upside, citing strong Q3 revenue growth, easing US tariffs, and robust North America and data centre demand, driving bullish sentiment. The shares of this company manufacture and sell telecom products in India and internationally like […] The post Sterlite Technologies: Should You Buy or Sell This Cable Stock After Q3 Results? appeared first on Trade Brains.

Synopsis: Sterlite Technologies shares surged 8 percent after Nuvama reaffirmed a Buy with a Rs. 200 target of 40 percent upside, citing strong Q3 revenue growth, easing US tariffs, and robust North America and data centre demand, driving bullish sentiment.

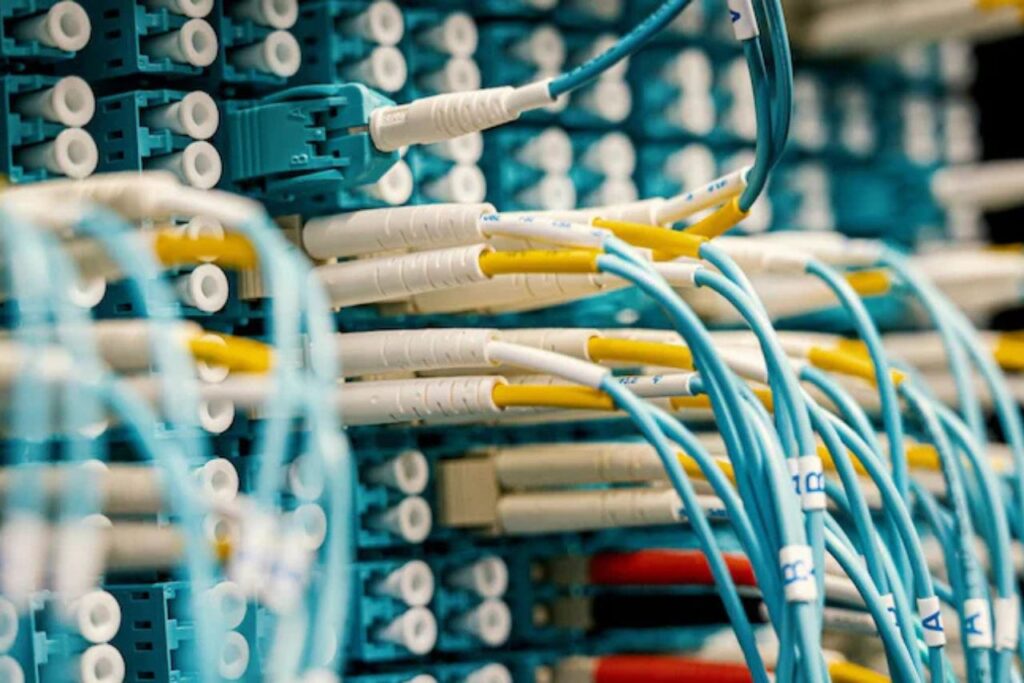

The shares of this company manufacture and sell telecom products in India and internationally like optical fibres, optical fibre and specialty cables, and optical connectivity products are now in focus after it rose by 8 percent in today’s session following Nuvama’s BUY target of 40 percent upside.

With a market capitalisation of Rs. 6,884 cr, the shares of Sterlite Technologies Ltd were trading at Rs. 141 per share, increasing 8 percent in today’s market session, making a high of Rs. 143.60, up from its previous close of Rs. 132.45 per share. The stock has delivered an 86 percent return over the past year, is up 38 percent year-to-date, gained 11 percent in the last six months, and surged 51 percent in the past month.

Brokerage Coverage

Shares of Sterlite Technologies surged by over 8 percent after the company was reaffirmed by Nuvama as a ‘buy’ with a target of Rs. 200. There were two primary reasons cited for this optimistic outlook. The brokerage cited improving revenue growth and easing trade tariffs as key reasons for optimism.

Growth and Margins Expected to Improve

Sterlite Tech saw a sharp rise in Q3 revenue, although profits were slightly hit due to tariffs. With the US lowering tariffs on Indian exports from 25 percent to 18 percent and removing additional punitive duties, analysts expect margins to improve, making the company more profitable.

Strong Demand in North America And Data Centre Markets

Analysts predict strong continued growth for the company, especially within North America as demand continues for products and services from both telecommunications providers and cloud-based data service providers.

This demand is expected to improve as trade barriers reduce further, and manufacturing moves closer to customers through local facilities and increased attention is paid to providing solutions to data centres.

Of the analysts surveyed on Bloomberg, 67 percent recommend buying, with the rest of the analysts suggesting holding. The respective estimate for the 12-month share price has a consensus of Rs. 155.50, with approximately 10 percent upside potential.

Nuvama’s price target is Rs. 200, which is the highest target among brokers with 40 percent upside from current levels. Maybank at Rs. 215 and Equirus Securities at Rs. 226, both displaying strong bullish outlooks for the share.

Sterlite Technologies Ltd is a leading telecom infrastructure company that designs, manufactures, and sells products such as optical fibres, specialty cables, and optical connectivity solutions. The company serves telecom operators, data centres, and hyperscalers globally, with a strong presence in India and North America, and focuses on enabling high-speed data networks and digital infrastructure.

The company reported strong year-on-year growth in Q3 FY26, with sales rising 26 percent to Rs. 1,257 crore from Rs. 998 crore, and EBITDA up 13 percent to Rs. 120 crore from Rs. 106 crore. The company swung to a net loss of Rs. 17 crore versus a Rs. 24 crore loss last year, while EPS improved to Rs. -0.35 from Rs. -0.49, reflecting a notable recovery in profitability.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Sterlite Technologies: Should You Buy or Sell This Cable Stock After Q3 Results? appeared first on Trade Brains.

What's Your Reaction?