Cupid Stock: Why Has the Company Issued a Strong Advisory on “Multibagger” Messages?

Synopsis: Cupid Limited warned investors about fake “multibagger” messages misusing its name and clarified that it does not provide stock tips and urged reliance on official sources and SEBI-registered advisors only. This Small-Cap Stock, engaged in manufacturing male and female condoms, lubricant jelly, and diagnostic test kits for sexual health, STI prevention, and disease testing, […] The post Cupid Stock: Why Has the Company Issued a Strong Advisory on “Multibagger” Messages? appeared first on Trade Brains.

Synopsis: Cupid Limited warned investors about fake “multibagger” messages misusing its name and clarified that it does not provide stock tips and urged reliance on official sources and SEBI-registered advisors only.

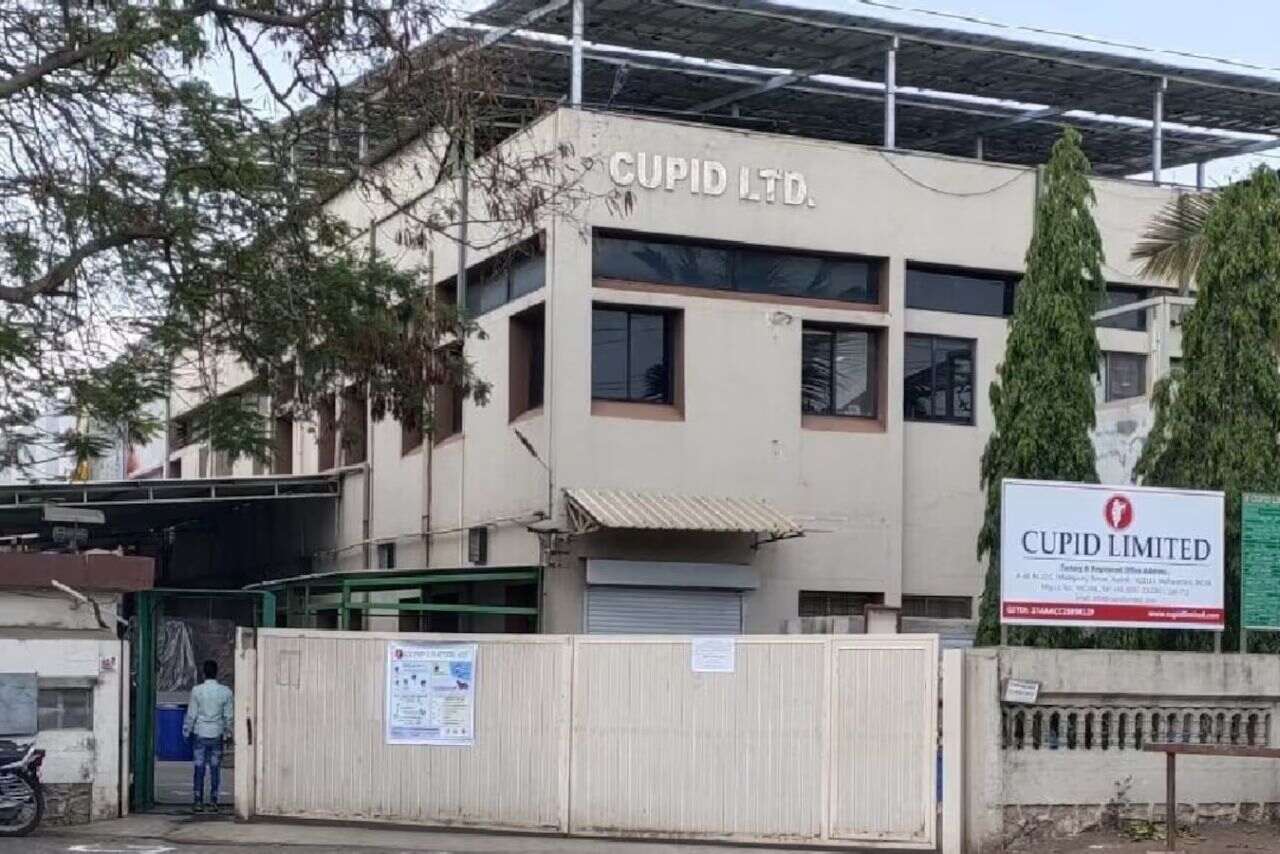

This Small-Cap Stock, engaged in manufacturing male and female condoms, lubricant jelly, and diagnostic test kits for sexual health, STI prevention, and disease testing, is in focus after the company issued a strong public advisory warning investors about fake and unauthorized “multibagger” promotional messages misusing its name on social media platforms.

With a market capitalization of Rs. 11,226.57 crore, the shares of Cupid Limited were currently trading at Rs. 417.45 per equity share, down nearly 1.28 percent from its previous day’s close price of Rs. 422.85.

Over the past five years, the stock has provided impressive returns of more than 3,804.61 percent. The stock is currently trading at a 20.85 percent discount from its 52-week high of Rs. 527.40.

What is the News?

Cupid Limited has issued a public advisory warning investors about fake promotional messages being circulated on SMS, WhatsApp, and Telegram. These messages misuse the company’s name and refer to its past share price performance to promote so-called “next multibagger” stock opportunities. The company has clearly stated that these messages are false, unauthorized, and not connected to Cupid Limited in any way.

The company believes that some third parties with vested interests are trying to misuse Cupid’s name and market reputation to mislead investors into unrelated schemes for their own benefit. Cupid Limited has emphasized that it does not send stock tips or investment recommendations through such platforms.

Investors are advised to rely only on official information shared through BSE, NSE filings, the company’s official website, and press releases. They should consult only SEBI-registered advisors, avoid suspicious links, and verify registration details on SEBI’s website before making any investment decisions.

Company Overview:

Cupid Limited was established in 1993 and designs, manufactures, and markets male and female condoms alongside water-based lubricant jelly to promote sexual wellness and prevent STIs or unplanned pregnancies.

The company supplies these products globally to governments, NGOs like WHO/UNFPA, and healthcare providers, leveraging advanced facilities for quality and innovation in latex-based prophylactics. Cupid Limited also produces in vitro diagnostic (IVD) test kits for pregnancy, HIV, dengue, malaria, COVID-19, and other infectious diseases.

Cupid Limited has provided a strong growth outlook for FY26. The company expects FY26 to be the strongest year in its history, with revenue projected to exceed Rs. 335 crore. Net profit is anticipated to surpass Rs. 100 crore. Additionally, H2 FY26 is expected to be stronger than H1, supported by a healthy order book and improved execution.

Cupid Limited has built a strong distribution backbone to support its nationwide growth. The company operates with more than 58 super stockists, over 1,050 distributors across India, and a sales force of more than 325 members. Its products have achieved placement in more than 1.5 lakh retail outlets nationwide, reflecting extensive market penetration and a well-established supply network.

Cupid Limited is expanding its domestic manufacturing capabilities through a new facility at Palava, Maharashtra (MIDC). The project spans a total built-up area of approximately 170,000 sq. ft. The expansion will add incremental annual capacity of around 770 million male condoms and 75 million female condoms.

Post-expansion, total annual capacity is expected to reach approximately 1.25 billion male condoms and 125 million female condoms per year, strengthening the company’s production scale and growth potential.

Coming into financial highlights, Cupid Limited’s revenue has increased from Rs. 46 crore in Q3 FY25 to Rs. 94 crore in Q3 FY26, which has grown by 104.35 percent. The net profit has also grown by 200 percent from Rs. 11 crore in Q3 FY25 to Rs. 33 crore in Q3 FY26.

Cupid Limited’s standalone revenue and net profit have grown at a CAGR of 11.22 percent and 34.11 percent, respectively, over the last three years.

In terms of return ratios, the company’s ROCE and ROE stand at 12 percent and 12.9 percent, respectively. Cupid Limited has an earnings per share (EPS) of Rs. 3.11, and its debt-to-equity ratio is 0.07x.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Cupid Stock: Why Has the Company Issued a Strong Advisory on “Multibagger” Messages? appeared first on Trade Brains.

What's Your Reaction?