How eMACH.ai from Intellect Design Arena is Set to Transform Indian Banks; Check details

Synopsis: Shares of this Fintech firm jumped 6% after unveiling eMACH.ai AI-First Banking. The platform, powered by 550 AI agents and multilingual NLX, aims to transform Indian banks with automation, hyper-personalisation, and compliance-led innovation. The shares of this company engaged in Financial Technology for Banking, Insurance, and other Financial Services, including a portfolio of products […] The post How eMACH.ai from Intellect Design Arena is Set to Transform Indian Banks; Check details appeared first on Trade Brains.

Synopsis: Shares of this Fintech firm jumped 6% after unveiling eMACH.ai AI-First Banking. The platform, powered by 550 AI agents and multilingual NLX, aims to transform Indian banks with automation, hyper-personalisation, and compliance-led innovation.

The shares of this company engaged in Financial Technology for Banking, Insurance, and other Financial Services, including a portfolio of products across Global Consumer Banking, Central Banking, Risk & Treasury Management etc are in the spotlight after it rose by 6% following the announcement of the launch of its eMACH.ai AI-First banking.

With a market capitalisation of Rs. 10,260 cr, the shares of Intellect Design Arena Ltd were trading at Rs. 736 per share, increasing 6% in today’s market session, making a high of Rs. 740.10, up from its previous close of Rs. 697.25 per share.

Intellect Unveils eMACH.ai AI-First Banking

Intellect Design Arena Ltd. has announced the launch of its eMACH.ai AI-First Banking platform at the India AI Impact Summit 2026 held in New Delhi on February 18, 2026.

The launch marks a significant step toward transforming banking into a more inclusive, intelligent, and seamlessly integrated experience. Designed specifically for Indian banks, the AI-First Banking ecosystem aims to make banking “invisible, intelligent, and inseparable” from the daily lives of customers.

550 Domain-Aware Agents and NLX Foundation

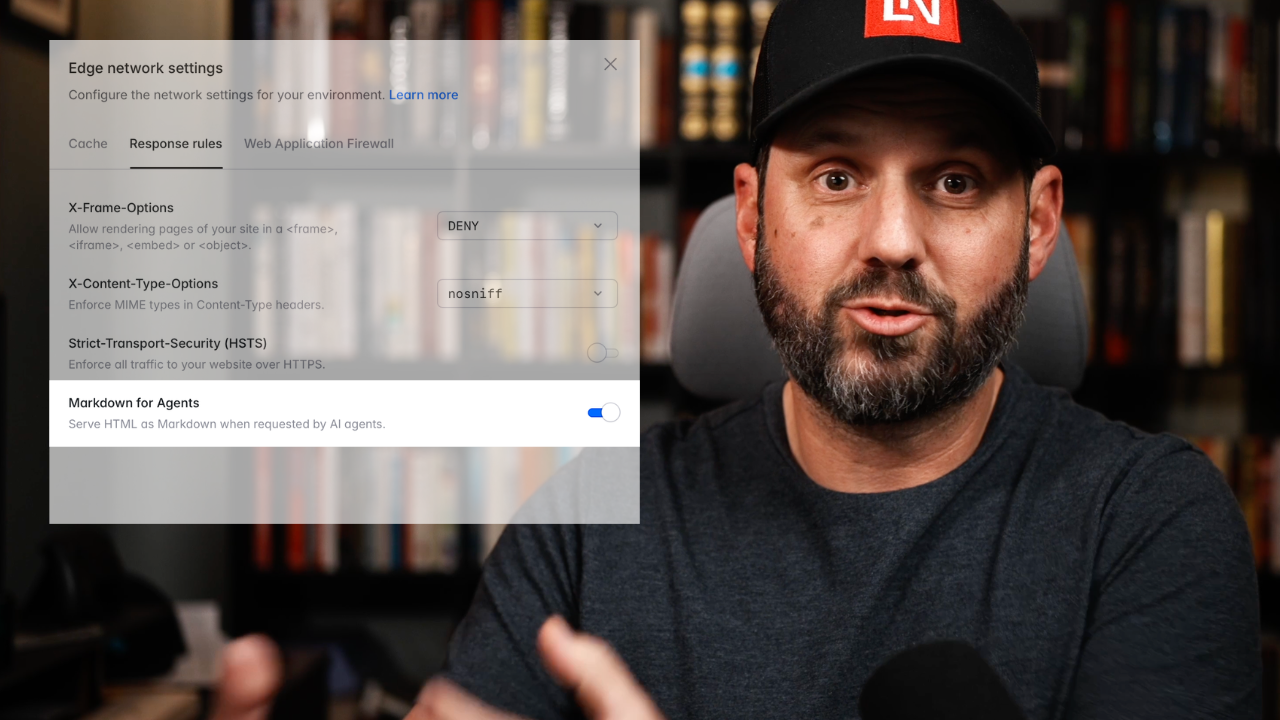

The eMACH.ai AI-First Banking platform is powered by 550 domain-aware AI agents spanning critical banking functions such as lending, trade finance, payments, treasury, wealth management, bank operations, customer servicing, and complaint management.

At its core is a Natural Language Experience (NLX) foundation that enables users to interact with banking systems through everyday spoken or written language rather than complex menus or technical interfaces. This removes barriers related to language, literacy, and technology, allowing retail and SME customers to access financial services in their own language via voice or text, across devices.

Five Strategic Foundations

The ecosystem is built on five strategic pillars such as hyper-personalisation, embedded finance, autonomous operating models, continuous LLM learning and optimisation, and enterprise governance and security. These foundations allow banks to anticipate customer needs, deliver contextual recommendations, automate operations intelligently, and ensure compliance through role-based data access and real-time audit trails. The platform emphasises regulatory alignment and safeguards to prevent AI inaccuracies or underperformance.

Among its key offerings is Bank GPT, which aims to reduce customer queries on transactional items by up to 35% through automated resolution and instant servicing. The solution also includes over 65 pre-trained “Digital Experts” built on the Purple Fabric Open Business Impact AI platform, enabling deployment of agentic AI systems that operate collaboratively while remaining compliant with banking policies and regulations.

AI-Driven Journeys Transform Lending, Trade, Retail and SME Banking

The platform delivers ready-to-deploy AI-driven user journeys across multiple banking segments. In lending, it accelerates loan onboarding up to ten times faster and helps reduce non-performing asset risks by 30%.

In trade finance, it reduces manual document checking efforts by 50% while achieving over 90% accuracy in extraction and classification. For retail customers, it enables automated savings optimisation, debt management suggestions, and tax planning nudges.

For SMEs, it automates over 90% of payment reconciliation, provides 45-day liquidity projections, and connects businesses to invoice discounting opportunities through the OCEN network.

Management Commentary

Arun Jain, Chairman & Managing Director of Intellect Design Arena Ltd, said the launch of AI-First Banking marks the beginning of a new era of inclusive and intelligent banking. He emphasised that multilingual, natural language-based capabilities remove barriers of language, access, and exposure, enabling “boundaryless banking” for customers across geographies.

He added that, inspired by India’s pioneering financial innovations such as Unified Payments Interface and Aadhaar-enabled Payment System, Intellect’s AI-first ecosystem is designed to democratize banking innovation. By embedding compliance and governance into its core, the platform helps banks reduce costs while delivering human-centric, secure, and scalable AI-driven outcomes.

Intellect Design Arena Ltd is one of the global leaders in AI-First, enterprise-grade financial technology, architected from first principles to deliver measurable business impact at scale. With three decades of domain expertise, Intellect delivers composable, intelligent platforms across Wholesale Banking, Consumer Banking, Central Banking, Wealth, Capital Markets, Treasury, Insurance and Digital Technology for Commerce.

In Q3FY26, sales rose 20% YoY to Rs. 731 crore from Rs. 610 crore in Q3FY25, but profitability declined, with EBITDA at Rs. 100 crore from Rs. 119 crore, down 16% YoY. Net profit at Rs. 27.4 crore from Rs. 70.8 crore, down 61% YoY. EPS dropped to Rs. 2.04 from Rs. 5.06 last year.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post How eMACH.ai from Intellect Design Arena is Set to Transform Indian Banks; Check details appeared first on Trade Brains.

What's Your Reaction?